Apple’s recovery lacks solid foundations

Not good enough

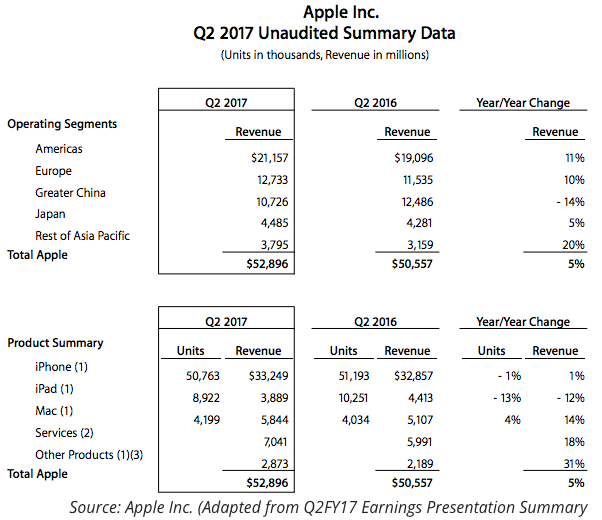

Apple has just released its earnings for the quarter ending 1 April, reporting revenues of $52.9 billion, earnings per share of $2.10, a profit margin of 38.9% and an enviable accumulated cash balance of more than a quarter trillion dollars! The company increased its quarterly dividend payments by 10.5% to 63c per share and boosted its share repurchase plan by $35 billion to $210 billion to disburse its pile of accumulated cash. Management expects revenues to come between $43.5 – $45.5 billion next quarter and the gross margin to remain inside 37.5% – 38.5%, while Tim Cook commented that he expects iPhone sales to recover upon the iPhone 8 release.

While the reported revenue has been higher for the second consecutive quarter, leaving behind a turbulent period of declines, the reported figures didn’t impress investors, leading shares towards a small decline. At a time when Apple has already sold more than 1 billion iPhones in a saturated market (from which Apple reaps 91% of operating profits), the margin for continued growth seems limited, forcing the company to new ventures. While valuations are still okay, there are a few points that are worth taking a look at, because Apple is no longer operating in a high-flying market.

Me against the world…

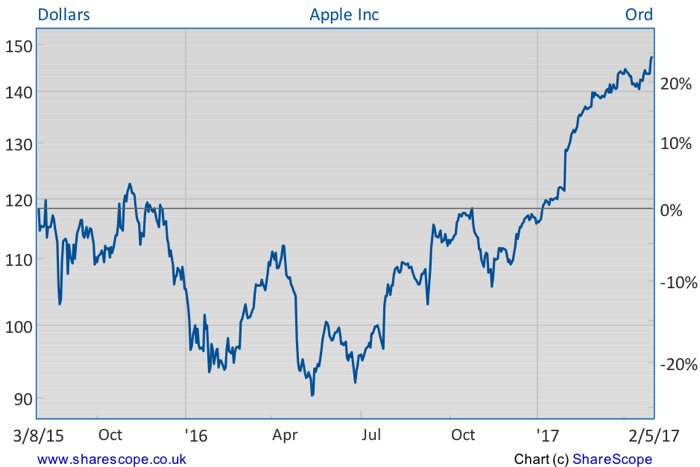

It seems I have the world against me on Apple, as while everyone has been enthusiastically filling their portfolios with these shares, I have been expounding my arguments against the company’s near-term prospects. The truth is that, when last October I mentioned Apple as a sell candidate, I was wrong because the stock has been trading higher and higher. Apple turned into a fashionable company, providing glamorous products to the world, which everyone (except the Chinese) seems to be willing to pay for whatever the cost. At the same time, with a market capitalisation north of $750 billion, Apple is under the radar of every fund manager in the world (including Warren Buffett), all of whom are willing to compete hard for the company’s shares.

While the above is great, it may also come to an end. My goal here is to highlight the risks, instead of going with the herd. Phones, computer brands, search engines, social websites, and other technology don’t last forever and are exposed to severe trends. I remember Blackberry being a kind of iPhone once. And I also remember it disappearing as quickly as day follows night. Apple itself ran into trouble in the past. Many of those rushing to buy Apple shares at whatever cost may not remember the dot.com crash, but I can still recall 28 September 2000. At the time, everyone was disregarding metrics when valuing companies and making optimistic future predictions. Apple’s stock had enjoyed a 150% rise in the previous year and was trading mostly flat in 2000. But then, on 28 September, after the close, Apple issued a profit warning stating it would earn $110 million instead of $165 million in the quarter ending 30 September. Whoever purchased the stock the next day got a 50% discount. If that happened today, in a three-quarter trillion dollar company owned by everyone, it would be disastrous.

Digging into the data

Well, let’s put aside dramatic predictions, and look into Apple’s earnings in a little more detail. First of all, the company is earning a lot of money. Second, it is not growing as fast as it has done in the past. Third, iPhone sales have stalled. Fourth, the company is looking into services as a new source of future revenue.

While revenues have been reported at $52.9 billion, they came slightly below Thomson Reuters’ call of $53.02 billion. The reverse happened with the bottom line results, which came in at $2.10 per share instead of the $2.02 expected (even though much of this comes from accounting subtleties like the effective tax rate etc). Apple was able to keep a very high operating margin of 38.9%, mainly because services are increasing their share in revenues. The average selling price for the iPhone has also increased due to the introduction of a more expensive iPhone with a bigger screen. But iPhone units sold declined by 1%. While CEO Tim Cook claims consumers are delaying purchases because of the rumour that a new revamped iPhone will be released this year, it seems clear that the market is a little saturated too. A completely new iPhone may well boost sales temporarily, but the effect of replacements for old products will be ever more limited.

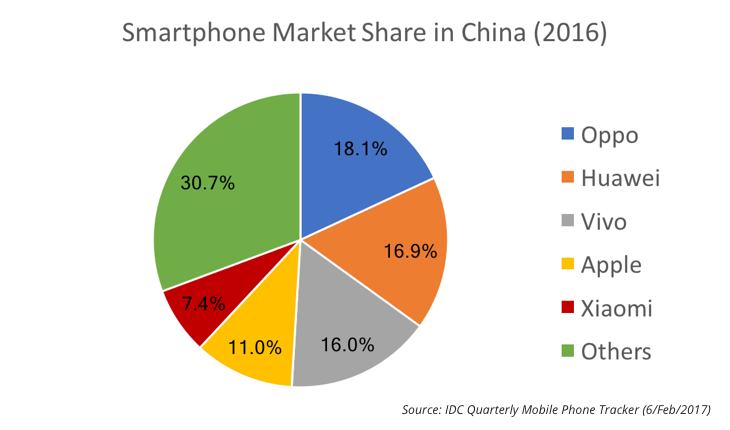

The Achilles’ heel for Apple is China. In the past, I mentioned that China was a key market for the company because of its size and the low market share Apple has there. But Apple is completely failing to convince the Chinese, who seem to have learned how to make cheaper iPhones and still be happy with the result. Analysts expect sales to pick up in this market with the introduction of the iPhone 8. I would trade on that expectation very carefully, in a market that has seen Apple going down from a market share of 15% in 2015 to 11% in 2016. That market is sensitive to price. Unless Apple reinvents the iPhone with its iPhone 8 or cuts its price, I believe the Chinese will continue looking at Oppo (18.1% market share), Huawei (16.9%) and Vivo (16%), for the best mix of features and price.

Coming back to the iPhone sales, as I mentioned earlier, units sold declined by 1%. For now, sales are holding up, but in the future Apple will find it difficult to keep sales and the operating margin both at the same levels of the present. To maintain revenues, Apple will have to find a replacement for the iPhone. Certainly, it is not the iPad because sales are declining rapidly. Unit sales declined by 13% year-on-year while revenues declined by 12%. Mac products were brought to life again, mainly because Apple introduced new cheaper models and released a new Macbook pro (after more than one year without upgrades). Still, the impact on revenues is low.

Then comes services, the big new bet. Apple is looking forward to growing app store revenues, where marginal costs are zero and the company takes 30% of sales revenues. This market has been growing as the consequence of the one trillion iPhone devices spread across the world, spending money at the app store. Revenues from this market came in at $7,041 million (but also including revenues from other services like music), up from $5,991 million. While growth has been great lately, I’m afraid the numbers may still be too weak to replace any iPhone declines and maintain Apple’s three-quarters of a trillion dollars market cap. Besides, we should never forget that if iPhone sales decline, the number of devices buying from the app store would also decline, which may dent services sales. Unlike the android app store, which is shared among several different computer, tablet and phone brands, the app store is more proprietary.

Putting it all together

By now the reader is probably thinking I’m a big opponent of Apple, but I am not. As I mentioned in past articles, I’ve always been a consumer of the Macbook and iPad due to their functionality and elegance. I still am. But, when I put aside sentiment and look at the numbers and recent events, I see a company that is losing its previous shine. One of the reasons Louis Vuitton is able to charge a few thousand dollars for the simplest of bags is because the company built a recognition and awareness that elevated the brand through the roof, above anything else. Only some wealthy people have access to it and these few are willing to pay for it because owning those bags is a sign of the highest social status. For some time Apple enjoyed a similar recognition. But I wonder what happens when 9 out of 10 people own an iPhone. How much is the distinguishing factor worth then?

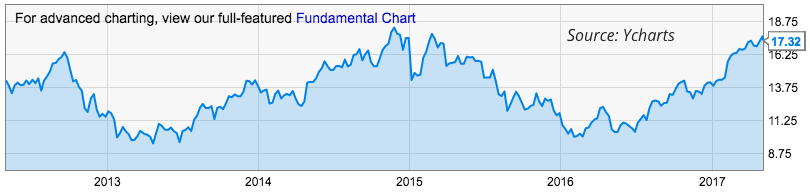

At the current price of $147, Apple shares offer a dividend yield of around 1.7%, which is fair but not great for a company with $250 billion to disburse. The price-to-earnings ratio is around 16.9x, which is way below other tech giants like Alphabet and Google and very reasonable for the industry. But, by historical levels, it is high. The average price-to-earnings for the last five years for Apple has been around 13.6x. But, with the boost the market has received from Trump, the shares have risen significantly. There’s no doubt that prices are rising faster than earnings. If the iPhone 8 doesn’t provide the boost everyone is looking for, we may witness a blood bath.

While I can’t say that Apple is way overvalued, I still believe it is above the most reasonable valuation, which should come in nearer $115, in my opinion. For those who own the shares, it may be time to rethink their view and reduce exposure. For those who do not, selling short is a possibility, even though I wouldn’t expect any extreme movement. Another option would be to purchase a put option with a maturity date several months from now. At a time when market volatility is really low, options are cheaper. Investors may benefit from a decline in share price and from any increase in volatility (which will happen because volatility is a mean reverting process). A suggestion is the June/2018 put with a $145 strike, which currently trades at $12.70.

Comments (0)