Value Opportunity: The Middlefield Canadian Income Trust

It has been a difficult time for natural resources stocks and energy companies with the slump in commodity prices hitting their profits. The decline has been of such severity that it has had a significant impact on the economies that are dependent on these sectors of the market.

One example is Canada, where the fall in the oil price has reduced economic growth and put pressure on the stock market. Energy companies make up about a fifth of the main S&P/TSX Composite Index and this has affected the performance with the benchmark down by about 11% in the last 12 months.

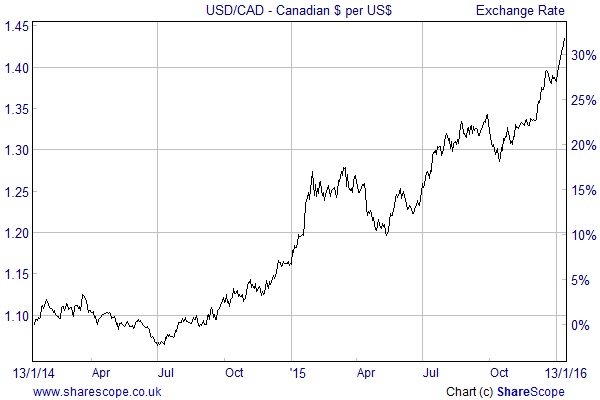

Another casualty has been the exchange rate with the Canadian dollar falling by more than 30% against the US dollar in the last two years. This is partly due to the strength of the greenback ahead of the rise in interest rates, but also reflects the weakness of all the petro currencies.

The fall in the Canadian dollar and the strength of the US economy has provided a massive boost to Canada’s non-energy exports and will help to stabilise both the economy and stock market. It should also be beneficial for an unusual fund that looks like it has been oversold.

The Middlefield Canadian Income Trust (MCT) invests in a portfolio of US and Canadian shares with the aim of providing shareholders with a high level of dividends as well as capital growth over the longer term.

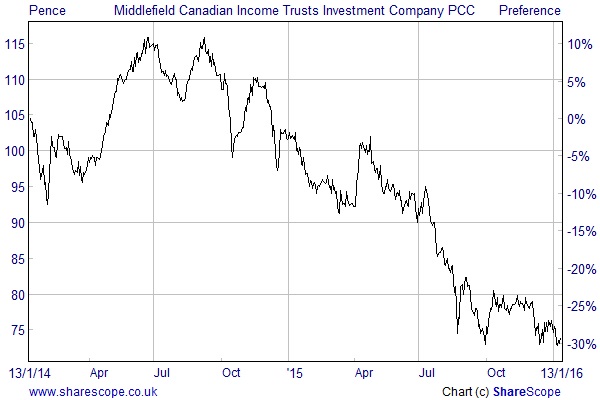

Its association with a commodity rich country has meant that it has been out of favour with investors with the share price falling 30% in the last two years. The shares are now trading on more than a 10% discount to the underlying net asset value (NAV) and yielding over 6.8% with the dividends of 1.25 pence per share paid on a quarterly basis.

This sort of performance would suggest that the managers are heavily exposed to energy stocks, whereas in reality they only make up 8.1% of the portfolio, with the largest exposure being the 24.6% weighting in financials.

In their latest monthly update the managers said that the weak Canadian dollar has begun to support economic activity, while the lower interest rates have helped the housing market to remain resilient. The Canadian government has also announced a significant fiscal stimulus package in the form of higher spending on infrastructure that should improve the prospects for local businesses.

It is the currency exposure that is hardest to assess. The US dollar has strengthened against the pound, thereby adding to the fund’s returns, but the Canadian dollar has fallen and has had the opposite effect. In all probability these will continue to offset each other, although it is a difficult area to predict.

MCT has 56.6% of its assets invested in Canadian stocks, with a further 31.6% in the US stock market. This puts it in a great position to benefit both directly and indirectly from the strength of the American economy, and even a small recovery in the oil price could provide a major catalyst for a re-rating.

Comments (0)