Greece Is (Not) the Word

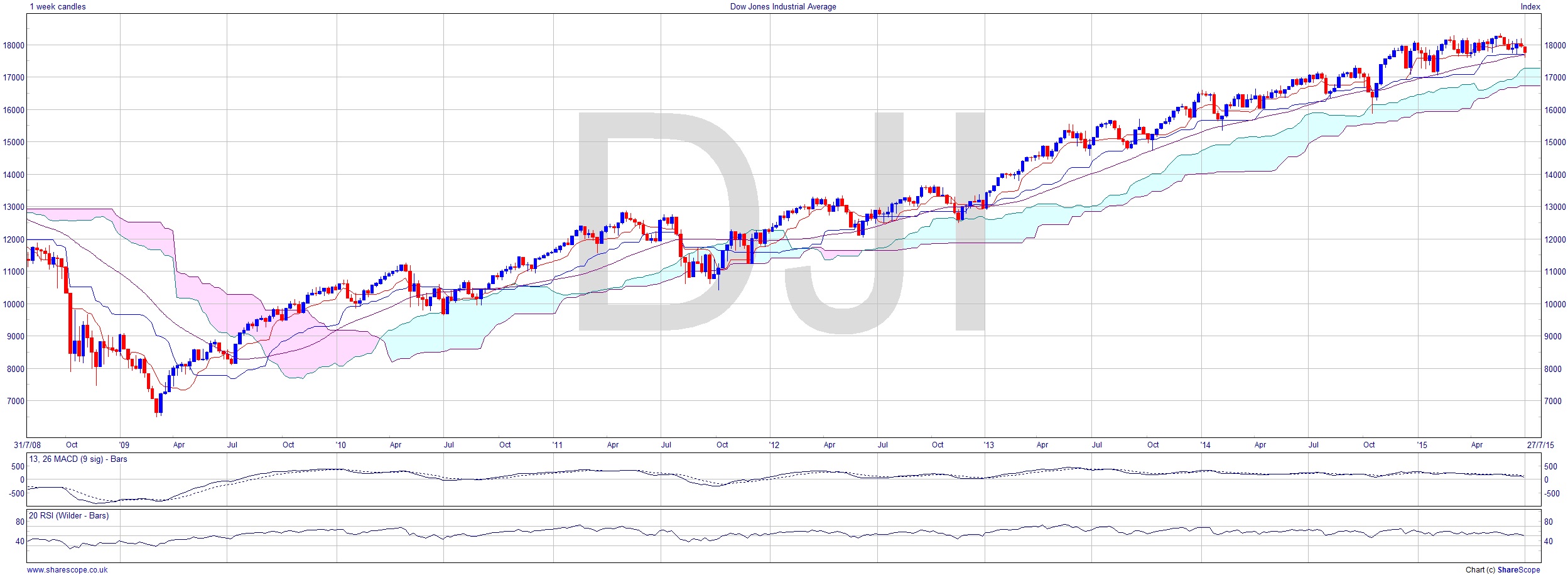

Just a few weeks ago I wrote a piece about the likely effect of the General Election on the FTSE 100 (MI Mag issue 2 pp.84-86). Looking back over the last 18 elections, I discovered that in a vast majority of the 18 post-war elections, the markets just resumed the path they were on before the discounting due to uncertainty in the days leading up to the election. This is true of most events. I doubt the Greek referendum will be any different, certainly for the US markets. The Dow is riding high at the moment, and if there is a correction I suspect it won’t have a lot to do with Greece, rather more that it’s been in an intact uptrend for 6 years. That is one great looking chart as you can see.

Closer to the Eurozone, the FTSE 100 has been underperforming the DAX for years. In fact, it almost always underperforms the DAX. That it’s traded off around 500 points during the last few weeks might have an awful lot to do with the fake economy that’s under-pinning it. And that’s not the fault of the Eurozone. The FTSE 100 still flounders in the 6000’s, never having convincingly pushed past its ATH from 15 years ago. A complete contrast to the Dow Jones chart, the FTSE 100 over the last couple of years is a pretty trendless one. If the trend is your friend then the FTSE 100 is not your friend.

The only reason we in London and the South haven’t noticed the recession – which in a technical sense I’m saying is still with us – is because lots of money has come to park itself here thanks to the UK being a de facto tax haven, a little truth we should just admit. I say we’re still in a technical recession because anyone experiencing very low inflation, or even deflation, must be living in a different city than I’ve been in for the last 6 years. Interest rates were on track to rise but have been perverted. Inflation too should be much higher than it is or has been, and back in 2008 I predicted 8-10% for around 2012-13. If you use public transport, buy meat, pay rent, etc. then your personal inflation will have been of that order – especially if you consider the number of products sneaking inflation in under the radar, where smaller quantities are sold in ostensibly identical packaging rather than apply a price increase. Anyway, that considered, GDP less inflation, i.e. Real GDP, would definitely have been less than zero for every quarter since the credit crisis – i.e. recession.

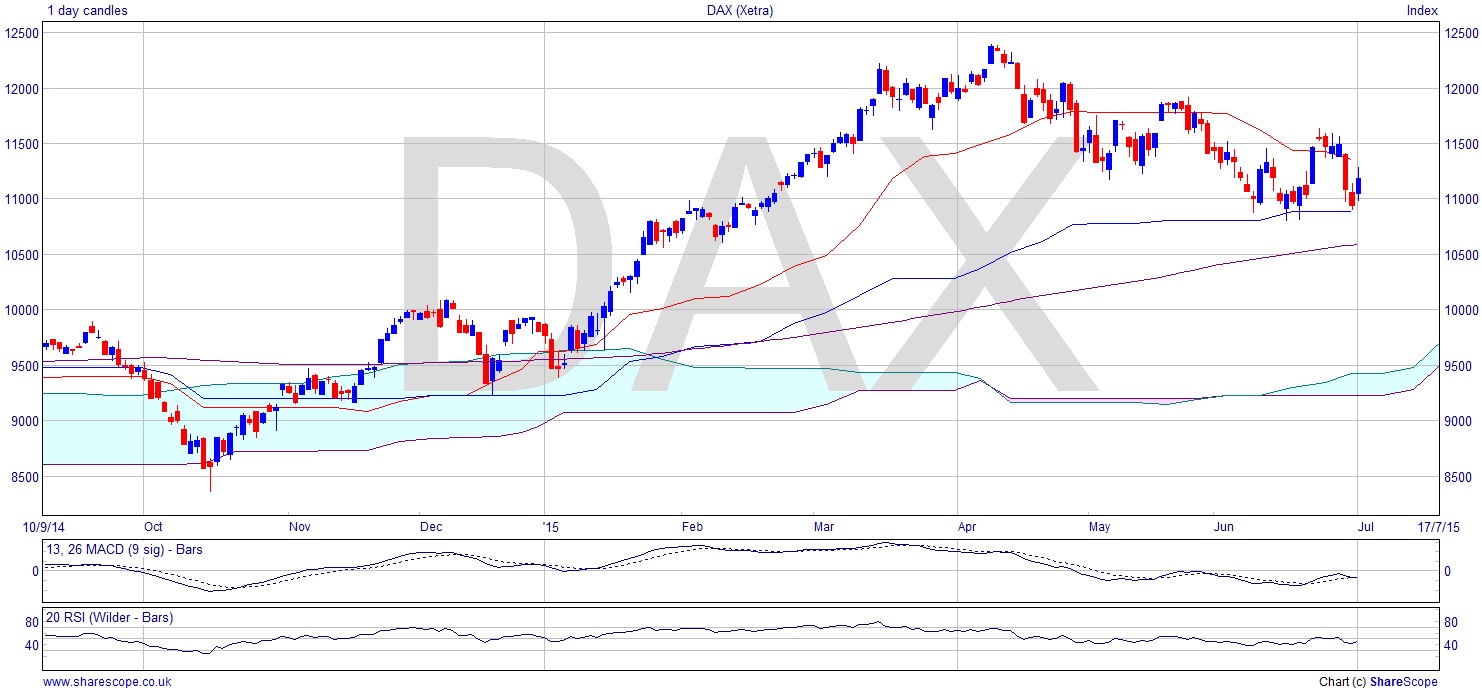

The DAX (and the CAC for that matter) had an excellent rally from around the beginning of the year, moving more than 25%. That’s a huge gain for an index in a short time. Again, a correction at this point can’t be seen as a reaction caused only by the Greek situation. Markets are often underperformers, or at least uninteresting, during the summer months. In any case, had you been riding the wave up to 12,000 on the DAX, why would you still be in now it’s around 11,000? A series of gentle lower highs on the DAX isn’t what you’d generally be buying into, and that sideways movement is a bit too big to be a bull flag now.

If Greece does exit a recalibration between the DAX/CAC and the Dow, leaving the latter relatively stronger, wouldn’t be a surprise.

Meanwhile, there are probably some really good holiday deals to be had in Greece, if you don’t think it’s hot enough in London…

Comments (0)