Glencore recovery in play?

I was commenting positively on a friend’s picture they’d posted on Facebook the other day. They thanked me and said it was taken when they were younger. I replied, “I think you’ll find all photographs were taken when you were younger”. When you’re analysing charts and creating a watchlist it’s a really good idea to take a picture of the chart and either annotate it with your notes or make separate ones. That way when you go back to it in the future you can quickly see what you were thinking and expecting.

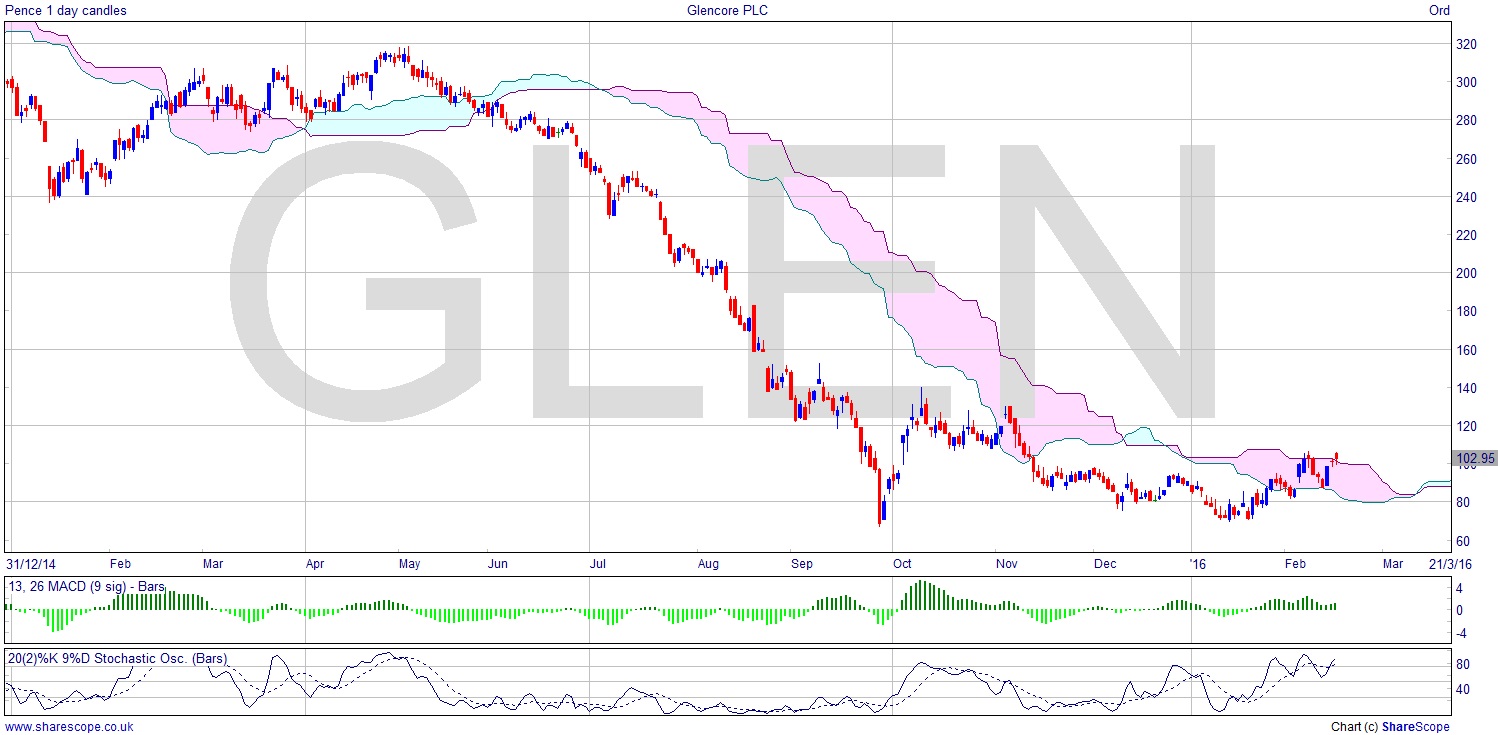

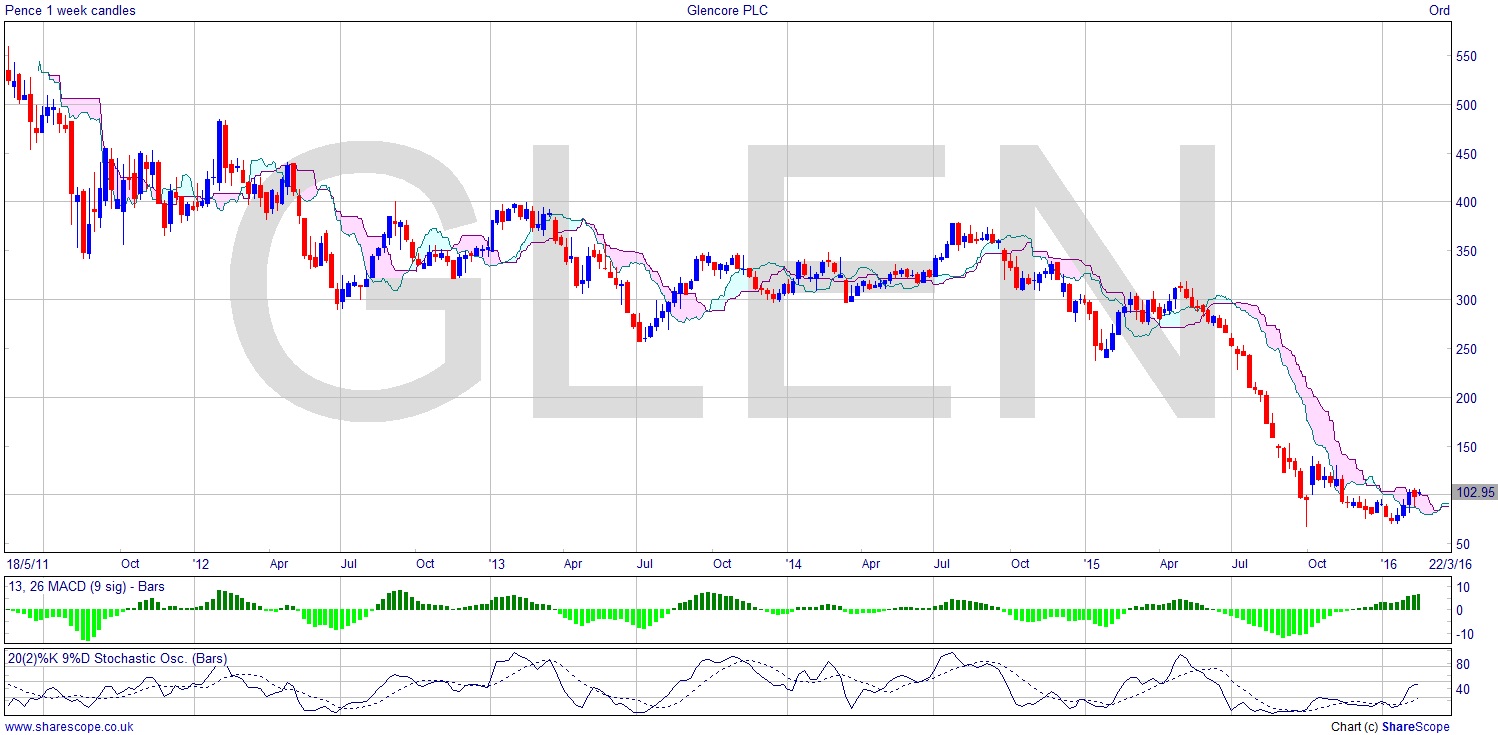

I wrote about Glencore (GLEN) back in late September and I said that the price had already reached as low as 10% of the ATH and bounced, which could be an interesting sign if we’re looking at it as a recovery play. I was waiting to see a higher low on the daily and confirmation on the weekly, and we now have that. I’ve shown the daily Ichimoku on both the weekly and the daily chart here as that’s our entry control.

We’re testing resistance at the top of the cloud on the daily, and the weekly has made a decent higher low following suit with the daily. There’s a great deal of upside here. Apparently they’ve sorted out – or at least the general perception is they’ve sorted out – their financing problems. I like this as a trade and as a punt. The trade is sound because there is upside and plenty of technical support for the trade, especially in the very important basic elements – Dow Theory in terms of Higher Lows, Support & Resistance, and then at the more artistic end, the cloud. The cloud is going to fall away from this price level meaning the price chart can become bullish by simply going sideways, or even down a little. That’s a very powerful position to be in.

The punt part comes from the fact that if they really have sorted out their problems, then why wouldn’t some suitor or even suitors come calling from M&A Town? This is the kind of trade where I would split the trade notionally into several parts, and on one part have a crazy limit order. Perhaps 350p or even higher, anticipating a high bid. A limit order that doesn’t get hit because it’s very high is not risking anything at all. In any case we’ve got price targets all over the place. A 50% retracement, which is a quite plausible occurrence from these very low levels when stocks do recover, would give a target of 200p-220p from the current price of around 103p.

I’d be careful at weekends to ‘insure’ this position – perhaps with a guaranteed stop, which I wouldn’t necessarily use during the trading week. You have to base that sort of trade management on your own risk profile. Glencore are in mining, too, and following my report on Commodities last week we may also expect some help from recovering commodity prices over the coming months.

This is the sort of thinking behind a proposed trade. You’re really interested in how it can go wrong as well as how it can go right. There are lots of compelling reasons it can work and far fewer on the negative side, because external factors should support the price move we are expecting to see. Note I used the word ‘expecting’, not ‘hoping’, as we have evidence here, not just whim. If you’re ‘hoping’ about any of your positions, then perhaps they shouldn’t be on. I like American philosopher Peter Boghossian’s definition of faith: “faith is pretending to know things you don’t know”. We shouldn’t be pretending to know anything in trading. We should know plenty and act on evidence only.

Comments (0)