Defined Benefits Become Indefinable Liabilities

As seen in the February edition of Master Investor Magazine.

If you’ve been paying attention over the last 50 years (or for as many of them as you were around), then it can’t have escaped your attention that there is a bit of a problem in the pensions department. I wrote about how The Baby Boomers Stole My Pension in my Final Word column in the November 2015 issue of Master Investor Magazine. The problem is basically a demographic one: a larger than average generation retiring while fewer of us are working to support the ridiculous gold-plated having-a-laugh final salary pension schemes of people who already lucked out by actually living through, if not remembering, the ‘60s.

We now face (well they don’t, but the rest of us still working do) the problem of companies which, in the same way successive governments ignored the well-known demographic time-bomb, have not dealt with the problem of funding these Rolls Royce Cash Cows. This is akin to a successful accumulator bet for which the rest of us are on the wrong side.

Putting actual numbers on these sorts of things is notoriously difficult, but estimates by various pension expert groups make for dismal reading. The fact that there are still defined benefits schemes live today is shocking to me; but either way, their legacy is a very big black hole.

When the financial crisis of 2007 was coming it was seen in investment bank circles as better to get it wrong with everyone else as a trader, than to get it right and be at odds with the majority. So anyone inside the major investment banks who took a stance similar to John Paulson, who masterminded the biggest trade in history by anticipating the sub-prime disaster, became persona non grata. Something like that appears to be happening here. The Pensions Regulator thinks everything will be OK. And that alone should ring alarm bells.

The problem may be in the region of £1.1 trillion across a thousand companies. To give that number some perspective, all the residential housing in the UK amounts to £5.75 trillion. It’s a pretty big deal.

Given the regulator is not that bothered, I thought I’d have a look at the numbers and see how right they’re getting it, and what the future may likely hold.

Not surprisingly we are at a crossroads. What I’ve done here is to take the data going back to March 2006 published by the Pension Protection Fund. As the total number of pensions reported varies from month to month, I’ve created an index based on the overall surplus, or deficit, divided by the number of companies. It was last published to include figures to the end of 2015.

Pension surplus index

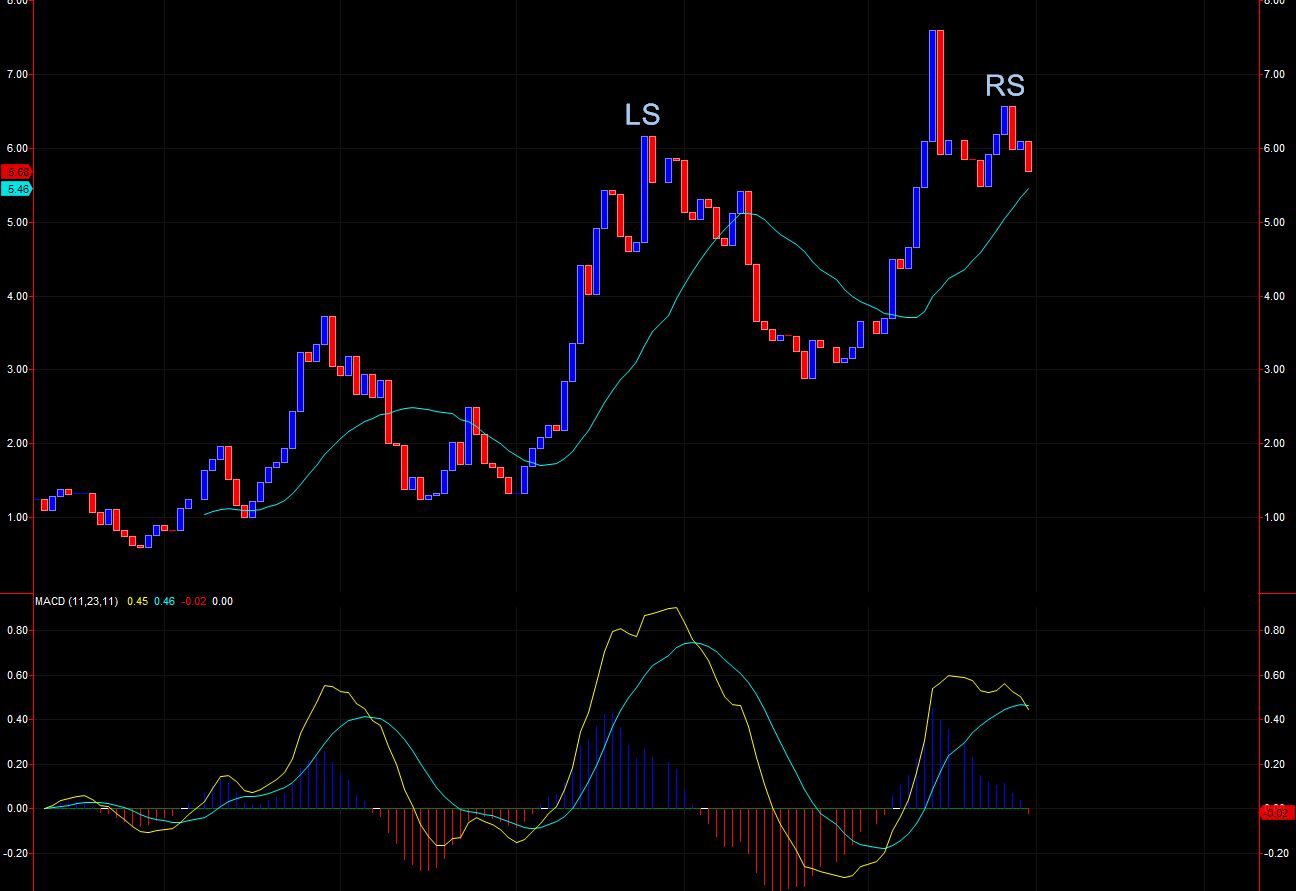

Pension deficit index

Looking at the Surplus Index first, we can see that it is rather weakly trying to break up above that resistance level. It’s falling shy of it though so it’s not that encouraging. If we look on the other hand at the Deficit Index then we find a clearer picture, although also incomplete at this time. That looks like a Head + Shoulders to me. That said it would be stronger if the right shoulder was a bit lower, but in fact it’s higher than the left shoulder. The MACD is nicely crossing over downwards though, which would support a move down.

If the H+S plays out it will mean the break out on the Surplus chart also works. That being the case, disaster will have been narrowly averted, at least for a few years. It’s a fairly trending chart, too, so we might expect the MACD to work here, as it has in the past, supporting the move where the crossover takes place. As far as the Surplus Index goes, the Higher Lows are encouraging. However, the MACD is not so convincing here.

As with all these things you can find people who will say that some companies could be brought down by this toxic pension debt. More than a few companies in the FTSE 100 have pension liabilities which exceed their market value! Bizarrely 23 companies in the FTSE 100 still offer defined benefits schemes to employees. In spite of the confidence of the regulator, JLT Employee Benefits’ research suggests that as many as 25 of the largest UK companies are “highly unlikely” to honour their pension commitments adequately. Yikes!

The companies affected by shortfalls equivalent to their market value include BAE (BA.), BT (BT.A) and IAG (IAG). Not much of a surprise there, I suppose, because they were once government corporations, and no doubt the pensions from that era are very generous indeed.

I would be very surprised if only a few companies went to the wall as a result of this. It only takes a perfect storm for those companies to deteriorate, and almost whatever happens is likely to be a perfect storm for one company or another. Imagine Sainsbury (SBRY) or BT being up for grabs in a pension debt fire sale. The government may well end up having to step in to sweeten the deal and guarantee those pension benefits themselves, by which I mean, of course, ourselves, the tax payers.

Given that most of these companies will likely see smaller, more efficient workforces over time, there will be lower and lower contributions to those schemes that remain open. Lower contributions are one of the problem factors – and it’s not restricted to the UK. There are systemic problems in the US, too, where public pension plans have $1 trillion of unfunded liabilities. Over half of all states fail the test level of fiscal soundness, which means a funded ratio of less than 70%.

Low interest rates mean that those already retired are seeing their pension income not being eroded by inflation, and their bricks and mortar earning far more than they probably ever did. I guess they don’t have to worry which of those bubbles bursts first unless they’ve leveraged their property.

Either way we should know in the next six to nine months if the H+S has held up on the Deficit Index and pension liabilities are decreasing or not. It really is a mine field for every employee now. It is becoming more and more an imperative to manage your own destiny, and therefore pension fund.

You should have seen in my articles over the months that I will use TA on about anything. I correctly predicted a mild winter back in October using TA on the weather. I’ve used it to analyse company directors, Corporation Tax and so on. The point is that it is a very useful tool that is by no means limited to the share price alone. Of course, it takes a bit of leg work in the sense that these figures have to be modelled into data sets that can be manipulated using TA. But it can be done if you’re prepared to put a bit of time and effort in. Think outside the box.

Charts created using TradeStation

Comments (0)