Zak’s Daily Round-Up: AZN, MNDI, PREM and UTW

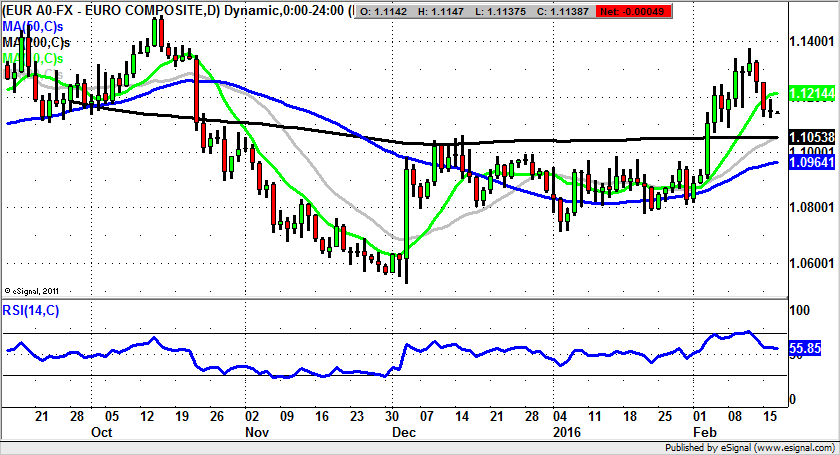

Market Position: Euro / Dollar Test of $1.1050 Zone Due

AstraZeneca (AZN): Bear Trap Back to 4,600p

It is in the very nature of the game that drugs companies of all shapes and sizes have a rather rough ride in general, as they attempt to trial and then deliver new drugs. Luckily for the big players such as AstraZeneca, the uncertainty of new products is mitigated by the existing portfolio and pipeline, which is by definition not present in the one hit wonder biotech companies. What is interesting as far as the blue chips like AstraZeneca are concerned, is when a breakthrough is made on a particular treatment, there is usually a decent mark up in share price terms – on many occasions rather larger than the overall profits the new source of income might be able to deliver. Nevertheless, this is the way that the stock market works, and it would appear that this is the way it will operate for quite some time. As for AstraZeneca, we are looking at a situation where the U.S. Food and Drug Administration (FDA) has granted new treatment for bladder cancer drug, durvalumab, the title of a breakthrough therapy. It works by boosting the response of the immune system, a line of attack against cancer which looks as though it may prove to be the winning formula after a decades long battle. Perhaps as much as anything else, we shall be waiting to see whether other forms of cancer are proven to be conquerable by this approach. In terms of the technical position of the drugs stock on its daily chart is concerned, it can be seen how we have a bear trap gap reversal from below the former October 3,831p floor. The likelihood over the near term is that, provided there is no end of day close back below the floor of the latest gap to the upside at 3.979p, we shall be treated to a top of 2015 range target as high as 4,600p over the next 1-2 months. In the meantime any dips towards the 10 day moving average currently at 4,070p can be regarded as buying opportunities.

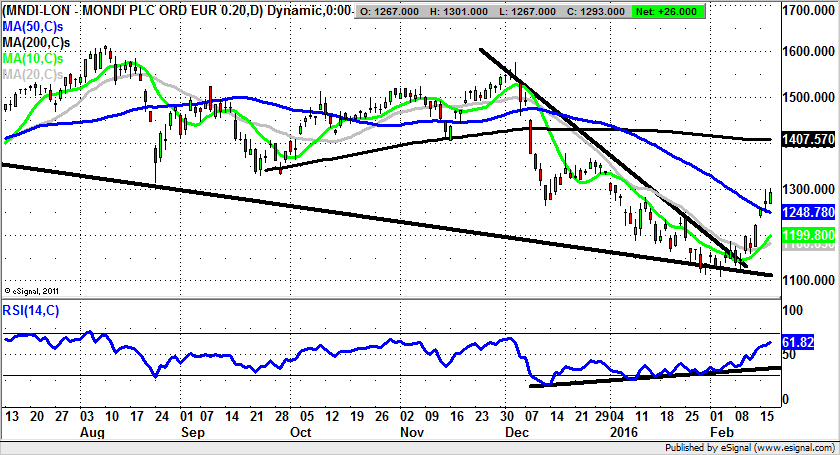

Mondi (MNDI): Break of 50 Day Line Targets 1,500p Plus

It has to be admitted that even though this is a FTSE 100 company, spun off from mining giant Anglo American (AAL), paper and packaging group Mondi has not perhaps been as high profile as its blue chip status perhaps deserves. However, given the way that the shares have negotiated the early 2016 bear run for the stock market relatively unscathed, it could very well be the case that we should look to this play on a more regular basis. This is particularly the case on a charting basis where it can be seen how the stock has managed a decent bullish breakthrough. This has taken the form of a falling June triangle breakout. The resistance line of the triangle was conquered earlier this month at the 1,150p level, with the follow on action easily clearing the 50 day moving average at 1,248p. The idea now would be that, provided there is no end of day close back below the 50 day line, we should be on the receiving end of a push to as high as the main post December resistance zone at 1,500p plus. The timeframe on such a move is regarded as being as soon as the next 4-6 weeks at the present rate of progress. At this stage only cautious traders would wait on an end of day close back above the initial February resistance at 1,298p before pressing the buy button.

Small Caps Focus

Premier African Minerals (PREM): Broadening Triangle Points to 1p Target

It may be worth noting that despite the extended breakdown that is evident on the daily chart of Premier African Minerals, we have seen the company remain quite a favourite amongst private investors, even as this mining prospect undoubtedly caused no little damage to the value of their respective portfolios. Nevertheless, it may be the case that the stock will finally atone for recent sins by a decent turnaround in the share price. This idea is backed by the way that over the post October period we have seen Premier African Minerals find extended support off the floor of a post October broadening triangle. Its floor has been towards the 0.3p level, with the message at the moment being that we are viewing the latest break back above the 50 day moving average at 0.38p very positively. Indeed, while there is no end of day close back below this key feature the likelihood is that a journey towards the top of the broadening triangle at 1p plus could be seen over the next 1-2 months.

Utilitywise (UTW): Price Channel Target at 230p

What is interesting about the present daily chart configuration at Utilitywise is the way that we appear to have been treated to a slow, but sure, turnaround on a technical basis. This is said in the aftermath of the higher support points served up since a December probe below 120p. What is also key is the way it is possible to draw a rising trend channel in place from as long ago as August. The floor of the channel runs at 160p, just below the present level of the 50 day moving average at 168p. This suggests that technical traders can look to buy into shares of Utilitywise in the wake of the latest trading update for the full year in which the group has hailed significant progress. On this basis one would be looking to a fresh rally over the next 1-2 months for the energy cost management business. The favoured destination in this respect is seen as being the top of the rising August price channel at 230p. Indeed, only cautious traders would wait on a momentum trigger such as a clearance of the initial February intraday resistance. Before taking the plunge on the upside.

Comments (0)