EVR Holdings: Trend channel target still towards 14p

EVR Holdings (LON:EVR) was supposed to be one of my stocks for 2017. It would appear that even as the first month is over the virtual reality group has lived up to the bullish promise.

December was the big month for virtual reality content provider EVR, with the transformational Warner Music/WEA International deal being reflected in the share price. The best thing about the reaction to this positive news is that there has been a steady climb for the stock, something which implies an orderly re-rating, rather than too much irrational exuberance.

Clearly, VR is on the zeitgeist, and perhaps it may not live up to the greatest of expectations. However, there can be little argument that EVR is a leader in this new field, and is set to benefit considerably. What may be worth looking out for next is what happens during the first part of 2017. I am sure many private investors are sitting on the edge of their seats looking for the next milestone to be taken out…

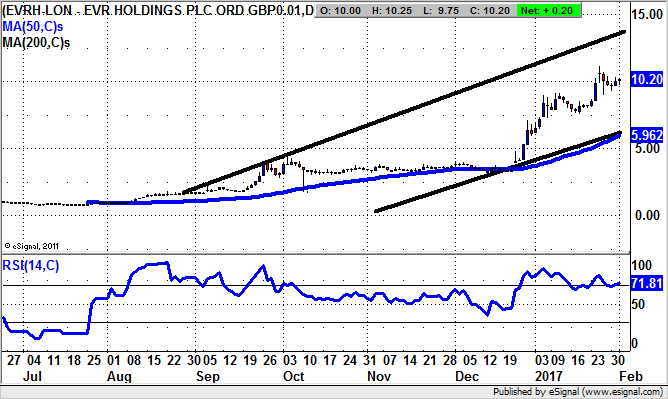

It is perhaps best at this time to refer to the daily chart, which has in many ways been something of a textbook example of how a minnow can progress. Here the start of the fun began as long ago as August with the clearance of the 50 day moving average now at 5.95p.

This is now acting as the trailing stop loss on the extended rally – at the floor of a rising trend channel from last summer. The notional upside here is the 2016 resistance line at 14p over the next 1-2 months, especially while the recent bull flag range between 8p and 9p acts as support.

Comments (0)