The fund manager telling investors not to buy his trust

The investment industry is often criticised for its sharp practices and lack of transparency, so it makes a nice change to be able to report on a welcome bout of honesty. This is particularly the case when the disclosure is entirely voluntary and made for the long-term benefit of investors.

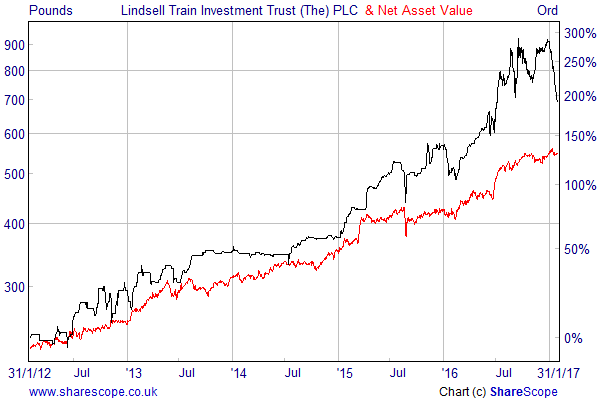

It concerns the £140m Lindsell Train Investment Trust (LON:LTI), which has the best long-term record of all the funds operating in the Global sector. Between the launch in January 2001 and the end of 2016 its share price increased by over 1,000% (one thousand per cent), well ahead of the 128.5% returned by the MSCI World Index.

Last year was another fantastic one for the fund with the shares up over 60%, but Nick Train, the manager, felt it was important to spell out the risks for investors. These related to the exceptional increase in the carrying value of Lindsell Train Limited, the unlisted investment management company through which Train and his colleagues conduct their business.

Writing in the fund’s December update he said: “We urge shareholders to think hard about the sources of 2016’s performance. The biggest contribution by far was yet another uplift in the value of the just over 24% stake the Company holds in Lindsell Train Limited (LTL), our investment management company.”

Lindsell Train Limited is unquoted and is valued monthly based on a formula agreed by LTI’s non-executive directors. The value of this holding rose by more than 50% in 2016, from about £27m to £41.5m. If it had been excluded, the NAV of the remaining assets would only have returned about 12% during the year rather than the 31% as reported.

Excessive premium

By the end of 2016 the fund’s stake in Lindsell Train Limited had become by far and away the single biggest holding and accounted for a massive 37.9% of the portfolio. As a result its huge return completely dominated the fund’s performance.

The massive contribution was due to the growth in assets under management that rose from £6.2bn at the start of the year to £8.9bn at the end. This creates significant value for shareholders and reflects the successful long-term performance of the Lindsell Train funds.

It appears that investors had got used to these sorts of growth rates and assumed that they would continue. The upshot was that they had bid up the value of LTI shares well beyond their underlying NAV.

“The implications for LTI shares, still trading at a meaningful premium to the NAV, are clear.”

In 2016 the shares appreciated by 60%, whereas the NAV rose by just 31%, largely due to the increase in the value of Lindsell Train Limited. This trend had been going on for some time as the 1,000% gain in the shares since launch was well ahead of the 587% uplift in the NAV, which meant that by the start of 2017 the shares were trading on an incredible premium of 66.3%.

It was this that prompted Train to remind LTI investors that “just as the performance delivered by our investment approach cannot be guaranteed to outperform every year, so there is no law that says Lindsell Train Limited’s business must keep growing every year either. The implications for LTI shares, still trading at a meaningful premium to the NAV, are clear.”

A risk that’s worth taking at the right price

I like the fact that investment trusts can hold associated unlisted securities like Lindsell Train Limited as it gives them the potential to add considerable value. It was one of the reasons why I invested in the fund years ago, although I sold my holding in 2015 because I was concerned about the fact that it had become such a dominant part of the fund and had driven the premium to dangerous levels.

Another issue is that it compounds the risks. Train’s investment approach has been remarkably successful over the last few years, but if it starts to underperform there would be every chance that the assets under management would tail off and the value of the unlisted holding would decline at the same time that the rest of the portfolio – which is very similar to his other funds – was also losing ground.

Train’s comments seem to have had the desired effect and made investors more cautious. Since the start of the year the shares have fallen from £900 to £700, although they are still well above the last quoted NAV of £550.

I think it is definitely worth keeping an eye on once the valuation comes back to more reasonable levels, especially in view of the relevance of the mandate, which was one of the things that drew me to it in the first place.

The aim of the fund is to maximise long-term total return subject to the avoidance of loss of absolute value and with a minimum objective to maintain the real purchasing power of sterling capital, as measured by the annual average running yield on the longest-dated UK government fixed rate bond.

LTI mainly invests in the sort of high quality blue chip stocks with strong franchises that characterise Train’s other funds, with the major holdings including the likes of Diageo, London Stock Exchange and Unilever.

It also has 11.2% invested in three of their funds: the LT Japanese equity fund, LT Global Equity and the Finsbury Growth and Income Trust. Despite this extra diversification it is an incredibly concentrated portfolio with just 13 holdings.

Train ends his update on a more upbeat note: “I would like to conclude by assuring you that we remain optimistic for global stock markets, optimistic that our investments will generate competitive returns over time and optimistic, therefore about the long term prospects of both Lindsell Train Limited and LTI.”

I wholeheartedly applaud Train for spelling out the valuation risks as clearly as he did and even though it has hurt investors in the short term, it has stopped things getting completely out of hand. The fund is well worth keeping an eye on, although I think it is still too risky to invest with the premium close to 30%.

As you have determined that the current premium to NAV of 30% makes this fund to risky to invest in, you must have determined an approximate value for Lindsell Train Limited (a private company), as this is the investment which makes the premium so large. I assume your valuation shows that the 30% premium is higher than is warranted and I would be very interested to find out what you reckon the valuation of LindsellTrain Limited is as I find it quite hard to determine.

It would be very difficult to put an accurate valuation on Lindsell Train Limited, but if the 30% premium was a reflection of its true worth it would imply that it is almost double the carrying value. The monthly valuation methodology looks a bit rough and ready, but it has been agreed by the non-exec directors so I think we have to assume that it is a fairly prudent estimate. If you accept that then it seems to me that there is a lot of growth of AUM baked into the current share price.