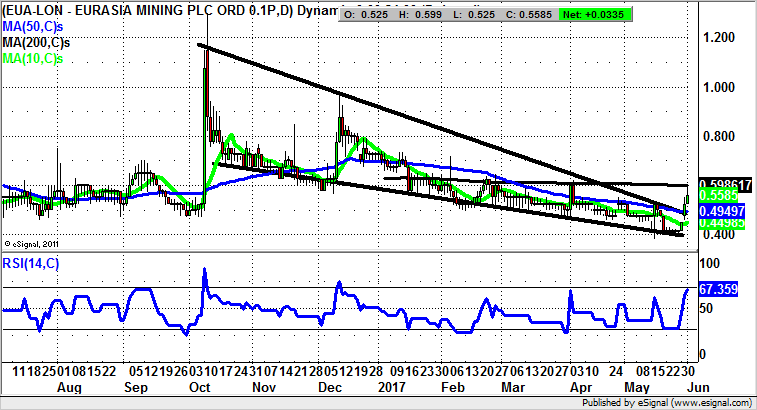

Eurasia Mining: Wedge breakout targets return to 1p zone

After a rather long gestation period, shares of Eurasia Mining (EUA) may finally be set to deliver on the hopes of shareholders.

It really has been quite a wait as far as bulls of Eurasia Mining have been concerned in the recent past. Indeed, we have seen the shares drift to three year lows over the course of May. However, recovery appears to be in the air, on the basis of the latest unfilled chart gap to the upside. This has punched through not only the 50 day moving average at 0.49p to deliver one of my preferred positive reversal signals, it has also snapped a bullish falling wedge formation. This has its resistance line level with the 50 day line, and has been in force since as long ago as October, meaning that the break is highly significant.

It is also not surprising. Yesterday the company announced its reserve approval for Monchetundra, something which echoes the technical breakthrough. Therefore, we look to a push for the stock back up to the main post autumn 2016 resistance zone at 1p plus over the next 2-3 months, especially while the 50 day line is held. The message: look to buy into any dips towards the 50 day line over the next few sessions, with only cautious traders waiting on a clearance of the 200 day moving average at 0.6p before taking the plunge on the long side.

Comments (0)