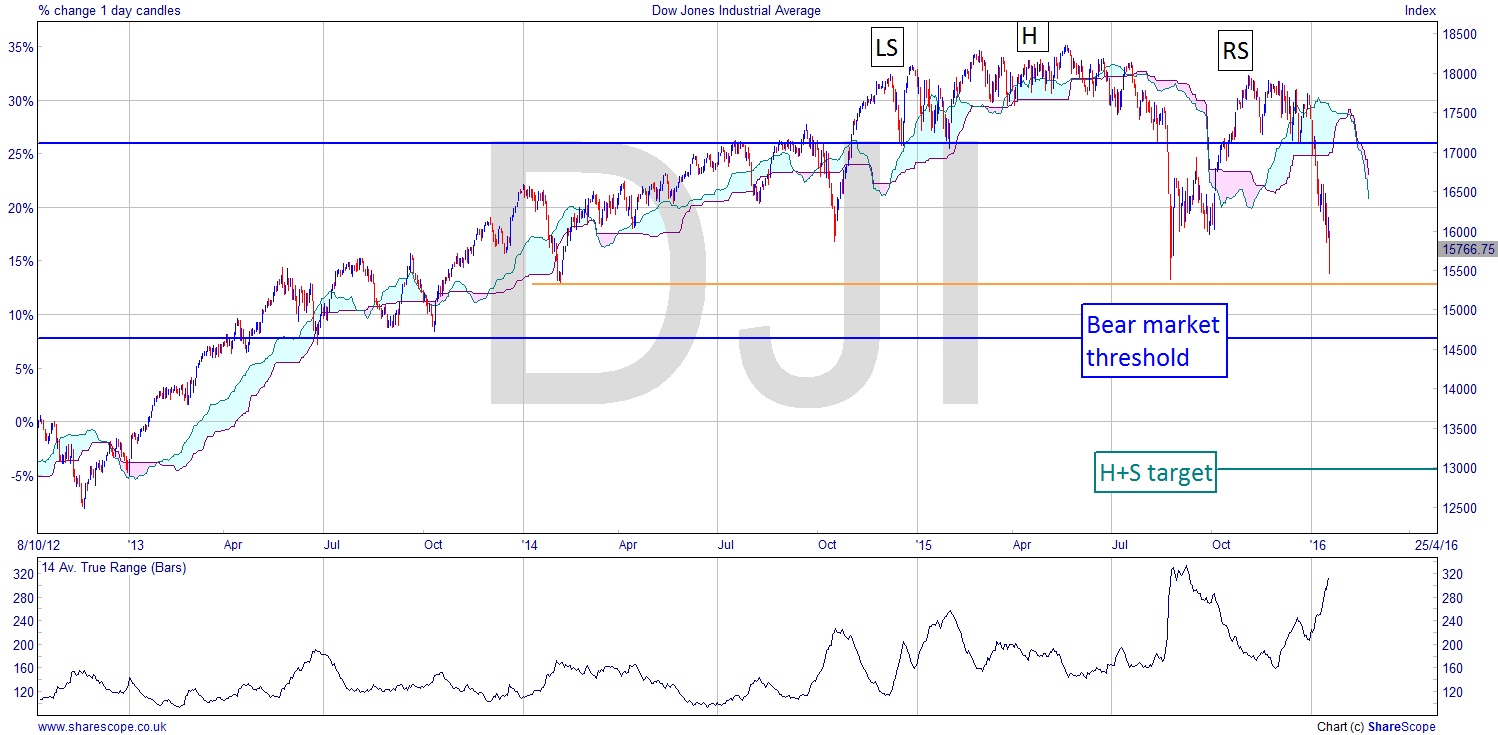

Dow H+S shoulders complete

It is so easy to fall into the trap of getting it right a few times, and then thinking you can tell the markets what to do. Well, in the short term, if you have the luxury of piles of money, you can influence the markets, but it’s always going to be short-lived for any liquid global instrument. Everyone’s been having a go at the markets and oil lately, usually with as much of a scientific approach as a doomsday religion: the end is nigh, and it’ll be on the 30th of whatever at 5pm. It won’t.

We deal in the observable evidence. The H+S is now complete on the Dow. Still a way above being in bear territory, but it’s certainly at a critical point. If you adopted my approach for H+S set-ups and got in early, you will be laughing now and no doubt planning your summer holiday, or possibly retirement if you really pushed the boat out. You might easily have taken the three Lower Highs leading into that blue cloud at the end of ’15 as an entry signal, at least a starter position and then full once it’s in the cloud. That would have been a comfortable 17,000 entry and now you’d be around 1,500 points to the good with a fairly tight stop and staring down a possible measured move.

H+S patterns are a classic for measured moves. It’s what they’re all about. And here we can expect a move based on the depth of the pattern. Well that’s a good 2,500, maybe even 3,000. But let’s not be greedy – greed is an expensive commodity – and say 2,500. So, assuming you’re in already, then you may reasonably expect to see either a rally and bank your profits, or a nice move down in the order of 2,500. The interesting thing about a move of that size is it gives you a target of 13,000 (the current level less the depth of the H+S pattern).

A few things underpin a decent fall. Firstly the orange support level I’ve marked is now being tested for the third time. A fall below it shows weakness in the index. And our target of 13,000 is well into bear territory. That means we can expect a move even lower should it reach 13,000, as a fall of only 10% in a bear market is not that impressive. In a bear market we might expect 50% off the peak the bear market is based on, in this case the Head of the H+S around 18,300. As 50% is around 9k, a bear market might easily give us 10k as a realistic target.

It’s a very exciting set-up. As we know from my January magazine article ‘Can The Markets Be Terrorised?’, basically there is no evidence to suggest they can be, which means it’s pretty much a technical set-up. Wars and terrorism are not market fundamentals. Read the article if you don’t believe me.

The main reason markets fall is because people have been paying too much for things. This growth cycle has been particularly flimsy, and much of the market value has been based on QE money chasing prices, coupled with low returns elsewhere due to near-zero interest rates. It’s basically market inflation, not actual growth, in a large part. It’s just bored money dumped in stocks, and in many cases companies prepared to borrow money at low rates to maintain dividends, which is a very bad idea indeed.

There will at some point be a blood bath of companies that have got it wrong with their borrowing, and become too comfortable with the low interest rate landscape to the point where they thought it would never end. Good luck with that you little corporate executives, you! There will be some spectacular failures over the coming years. And we’ll be waiting to cash in on their hubris.

Comments (0)