Binary Corner – When the Fed Errs, it’s Time to Buy Gold

In the UK, the Budget took centre stage and garnered all the front page headlines, but in reality this was a mere sideshow to last month’s US FOMC statement.

The US dollar plunged on the back of the statement, propelling most other currencies higher. Why? The Federal Reserve removed the word “patient” from its statement with regard to the timing of interest rate hikes, but at the same time hinted at a slower path thereafter.

Why so much attention on a single word? Fed Chair Yellen and her predecessor Ben Bernanke have been keen to stress that it’s not the timing of a rate hike that’s important per se, but the expected momentum from that point forward. In what has been described as a “good cop, bad cop” routine, the Fed balanced the dropping of “patient” with warnings about a more gradual pace going forward amid slowing export gains.

The upshot is that an interest rate hike might well arrive in June, but there will be no race back up to the historically typical levels of around 5%.

After months of certainty that the Fed was not only going to hike rates soon, but then keep up a measured pace, markets are no longer sure what to think.

S&P 500

The chart above shows the S&P 500 depicted with its 100 and 200 day moving averages. Aside from a brief dip in October, both these lines have acted as continual support during the rally and the reversal on Wednesday only cemented the latest rebound off the 100 day average to put equities back within striking distance of their all-time highs.

US Dollar Index Weekly

The dollar index has moved in line with the S&P 500 throughout its rally by and large, but we have seen some dislocation of this trend of late. Higher rates are not on the stock market’s wish list, but the prospect of further and imminent rate hikes has been the primary driver behind the dollar rally since mid 2014.

However, there are some clear indications that the dollar index has been running too hot.

The chart above plots the dollar index alongside the Parabolic Stop and Reverse Indicator (PSAR). The bottom panel is a bespoke indicator that measures the size of the gap between the price and the PSAR as compared to the last 50 periods. Extreme moves are normalised between a bounded range of 0-100.

The upshot is that large red spikes indicate that the dollar to PSAR spread is significantly bigger than it has been in the past on the upside and that a pull back is due. A large green spike indicates that the PSAR spread is significantly bigger than it has been in the past on the downside and that a rally is overdue.

At extreme levels, this PSAR stretch indicator has consistently spotted the times when the dollar is running too hot. These pullbacks have been relatively shallow, but they were still good for at least two weeks of negative activity before the relentless uptrend started again.

Selling the dollar since June has not been a successful strategy, but waiting for the extreme situations will have reduced risk-rewards on counter trend trades considerably.

Gold Weekly Chart

A similar chart for gold shows the PSAR spread indicator with less extreme levels since 2012 due to the lack of any sort of trend since mid-2013. The red line spiked recently at the turn of 2014, setting up a golden sell opportunity, just as it did back in 2012.

However, now the PSAR spread has its highest green level for over three years.

Gold has traditionally been seen as a safe harbour in troubled waters, but as the precious metal is primarily denominated in US dollars, it has been a terrible asset to hold since 2002. As the dollar rises, it makes it harder for goldbugs to justify holding their favourite asset.

However, now we have a unique intersection where US rate expectations are uncertain, an overbought US dollar and an undervalued precious metal.

This presents three strong hints that gold could have a renaissance in store, at least in the short term.

However, there’s one more reason to buy gold right now:

Greece and the spirit of mutual trust

Greece has never been far from the headlines in 2015 and this week has seen further tough negotiations between Greece and its creditors.

A four month extension of the country’s bailout was agreed last month, but many billions of euros have not yet been released. The truth is that the recent Greece agreement was merely the first step in a long process of Greek reforms.

The negotiations are riven by divisions within divisions, with the European Commission urging a more collective approach “in the spirit of mutual trust”, and Angela Merkel pushing a more hard-line approach. On the Greek side, Greek Prime Minister Tsipras appears to have taken a conciliatory tone, but still there is no firm agreement that has been made.

As Michael Cartine of Thomson Reuters noted recently, “Given the situation, one almost gets the feeling that if Europe’s leaders feel a need to publicly assert a “spirit of mutual trust”, then distrust and discord between the two sides must run very deep indeed.”

With many economists including former Fed Chairman Alan Greenspan pointing out the fairly obvious – namely, that Greece will never repay its bailout loans – the prospect of a Greek exit remains higher than ever. A ‘Grexit’ is supposedly more contained than it has been in the past, but this is still likely to cause significant market volatility as traders are likely to get out of the water just in case.

Four reasons to buy gold

The upshot is that there are now four good reasons to bet on a gold rally over the next couple of weeks at least.

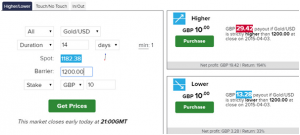

A good way to play this is a HIGHER trade predicting that gold will close HIGHER than $1200 in 14 days time could return 198% if successful. Or put another way, betting that gold will rise and close above $1200 on April 3rd 2015 could return £29.63 from every £10 put at risk.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)