Heavy oil drags Canadian dollar lower

This week’s trading has been dominated by the People’s Bank of China allowing the yuan to devalue by dropping the peg against the US dollar on consecutive days. To add to the drama, the PBOC then declared in a press conference that it sees no reason for the yuan to fall further. The conflicting messages produced a predictable level of volatility as stock markets dropped to overnight lows then recovered on the day.

The dollar has had a curious week as a result, with many now believing that the yuan’s devaluation could push a rate hike further into the future. As a stronger dollar makes US exports more expensive (especially into Asia), the Chinese devaluation could be acting as an effective rate hike to the US economy, with a rate hike now posing further danger on top of the current status quo.

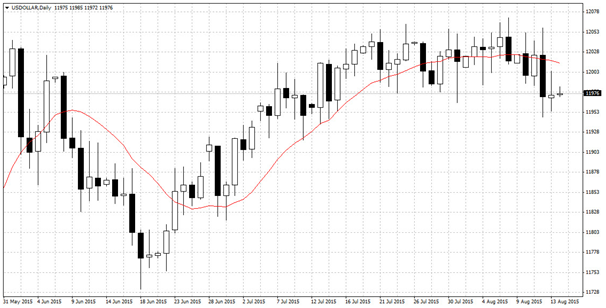

The US dollar index has been stuck in an ugly trading range as a result, with a negative bias towards the end of the week. While a weaker yen ostensibly should mean a stronger dollar, the prospect of a later rate hike has a greater effect on the dollar index.

US Dollar Index

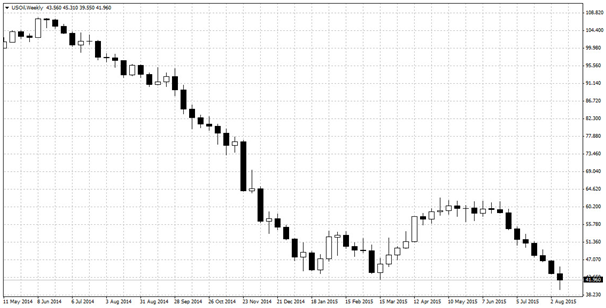

This moves comes at a time when oil prices continue to leak. Crude oil prices are now back to 2009 levels as OPEC plays a dangerous game of brinkmanship against abundant US shale gas. Oil producing nations are attempting to make Western oil and shale projects uneconomic, resulting in a delay to infrastructure projects that could ultimately drive up oil prices in the future. Oil briefly dropped below $40 on Friday.

Crude Oil Spot weekly

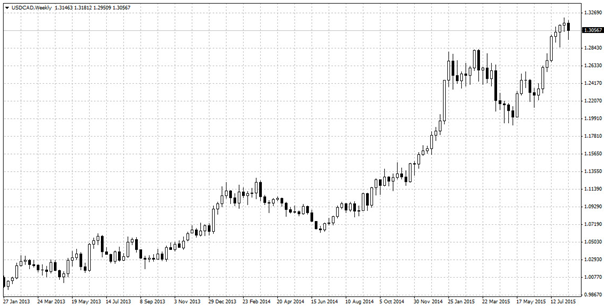

The consequences of China’s activities have been felt keenly by most dollar pairs as the likes of the EUR/USD took advantage of dollar weakness to rise this week. One currency struggling to make any traction is the oil heavy Canadian dollar.

USD/CAD

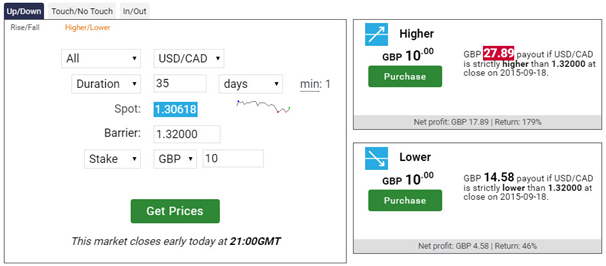

The USD/CAD is experiencing its first negative week in many sessions (as of Friday morning), but support for the Canadian dollar still lags other dollar pairs such as the EUR/USD and GBP/USD. Indeed, Friday saw another rally for the USD/CAD as oil prices drifted lower.

Perhaps more than any Western economy, Canada is feeling the bite of lower oil prices. The Canadian oil sands are an expensive way to extract black gold and only make economic sense when oil prices are sustained at levels more than double current levels.

While the US dollar has been hit by yuan volatility and a rate hike possibly delayed, a Canadian rate hike is still nowhere on the horizon.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)