Euro’s gains against the Pound could be short-lived

As is typical, the first week of the month has been dominated by the release of the latest US Non-Farm Payrolls report. July data came in roughly in line with expectations with a gain of 215k compared to expectations of 222k. The accompanying unemployment data came in mostly in line with expectations.

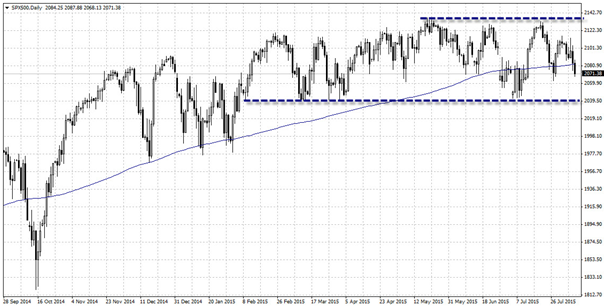

Yet, judging by the reaction of the S&P 500 alone, you would think the numbers were dreadful. The S&P 500 sold off for the second day in a row to close below the 200 period moving average.

So what gives?

Once again, stock markets are throwing the proverbial rattle out of the pram as the July numbers were not good news for equities. They did not overshoot expectations enough to send the champagne corks popping, but neither were they bad enough to delay a forthcoming interest rate hike.

In-line jobs data for July has been interpreted as removing the remaining obstacles for a rate hike as early as September. The prospect of this rate hike has been keeping a lid on stock market gains throughout 2015, with the S&P 500 trading in a tight range supported by the 200 period moving average for now.

S&P 500 Daily Chart

Away from the US, Europe has had a mixed week, while enjoying a positive second half. This comes despite soft German industrial output on Friday, with a trade balance that widened more than expected.

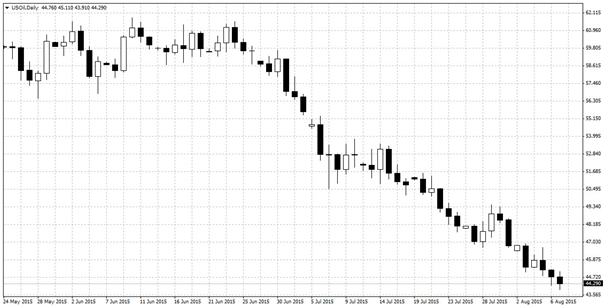

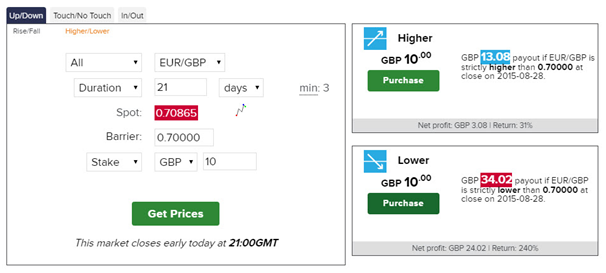

The EUR/GBP enjoyed sizeable gains on Thursday & Friday, but this shouldn’t automatically be seen as a sign of inherent strength in the euro. Friday’s euro gains primarily came due to a weaker US dollar, while a weaker pound helped lift the EUR/GBP specifically.

EUR/GBP Daily Chart

The pound’s weakness came on the back of Thursday’s MPC meeting, which went slightly against expectations in revealing a voting pattern of just one member in favour of a rate hike compared to expectations for two.

Despite all this, there is still a widening gap in both interest expectations and economic forecasts for the Eurozone and the UK. UK rate expectations might have been knocked back a month or so, but euro rate increases are still not even on the horizon yet.

As such, the EUR/GBP’s recent gains could be a good opportunity to sell rather than buy.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)