School Corner – Refusing to Crystallise Losses

This is the sixth in a series of educational articles on the best habits of winning traders and investors, the most common mistakes traders make and the best ways to avoid them.

Today, we are looking at refusing to crystallize trading losses, the irreparable damage this can cause to your trading account (let alone to your soul), and how you can avoid this.

This subject is actually related to two of my previous articles, namely ‘’How to Efficiently Set Stop Loss Orders’’, and the more recent ‘’Arrogance IS a Sin’’. Let’s explore why.

As I hope all of you realize, when one trades or invests, one should always accept the risk of incurring losses. Not every trade will be a winning trade; some trades are going to be unsuccessful and they will come at a monetary cost. This, as any successful trader can testify, is just part of the game, and has not “killed” them in monetary terms or otherwise.

So what’s the problem with refusing to crystallise losses?

I refer to this as the ‘’It WILL come back’’ syndrome. This is the belief that any losing trading position or any losing medium/long-term investment you currently hold, will eventually turn into a winning one. It may be down now, you tell yourself, but if I hold on to it for long enough, and take enough pain watching it move against me, I will eventually be proved right, it will make me money… eventually.

Now I am not here to dispute the basis of the theory of ‘’mean reversion’’. As you may know, according to mean reversion theory, financial assets like bonds or stocks tend to trade within a price range for relatively long periods of time, and as such, do eventually return to the mean.

However, there are a few problems with taking the above assumption too much to heart.

Problem 1

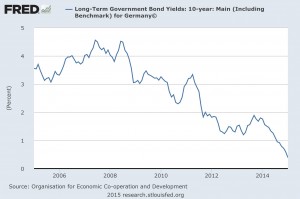

Financial assets do NOT always mean revert within a reasonable period of time. Take for example the German Government 10 year Bonds (German Bunds). Below is a chart of their Yield over the last 10 years. As many of you know, a bond’s yield moves inversely to its price. In simple terms, when a bond’s yield is falling, its price is rising, and vice versa.

As can been seen from the chart, the 10-year German bond yield has been falling since 2008 (late 2007 to an extent). All this time, its price has been rising, not in a straight line (nothing does in markets) but nevertheless indisputably in this case, price has been moving up for the last eight years now.

This means that you could have shorted the 10 year Government Bond (or as would be the case its related Futures) at any point over the last 7 years, and still be waiting in vain for its rising price to mean revert. As you can see, to this day, it has NOT reverted back to its pre-2008 levels. Of course, it may do… eventually, but even if you had the financial resources of a large institution, it is rather unlikely that you could or should have stayed with this trade.

Just to spice things up a bit, let me add a short personal story. There was a time when I used to trade German bond futures of different maturities. I will not bore you with the specifics of how I used to trade them, but I will confess that I was sometimes too ‘creative’. Unfortunately, this led to my finding myself short a considerable amount of German Bund Futures on the morning that Ireland asked the European Union for a bailout, and guess what? The Bund Futures rallied.

Now, I could have waited to this day for the price to come back to my entry, but I can ensure you that it would have been in vain. Luckily, instead I just took a loss on that same day, and moved on. And this is exactly what you should do too when a trade really does not work.

Problem 2

Any financial asset can take longer to mean revert (assuming it one day does) than you can remain liquid for. You may have heard the saying that “the markets can remain irrational for longer than you can stay solvent”. It IS true. So even if you are determined to be proved right via holding your current lossmaking positions into the future, there is a huge probability that after some point you will no longer be liquid enough to hold on to anything.

Problem 3

Even if you are liquid enough to hold on to bad positions for prolonged periods of time, doing so is definitely not the best use of your available trading capital. No one has unlimited resources. So why waste yours by tying up your money in loss-making positions? You are much better off crystallizing your losses at the right time, and using your capital in order to make money elsewhere.

Problem 4

Some financial assets never revert to the price at which you bought them. A good example of this is the stocks of ‘’junior’’ oil explorers. Some of these companies never discover oil, or at least not enough oil, and one day go bankrupt.

So to conclude, next time you refuse to crystallize a loss despite your trading system’s clear indication that you should, do please try to remember the above, and ask yourself whether or not the real reason that you refuse to take this loss is just to protect your ego. If it is, may I please remind you that the markets hardly ever stay merciful for long enough with any trader or investor that does not control his or her ego?!

Until next month,

Happy trading everyone!

Comments (0)