Is a ‘Bed & Brexit’ Strategy the Way to Go?

Financial institutions and think tanks are making sure they’ve issued a completely unhelpful and non-committal statement about Brexit. They should stay silent rather than publish superficial comments. This is like that ‘double dip recession’ rubbish many came out with. There is no double dip recession: it’s the same recession, but saying double dip is a way of hedging your bets in case calling the end is a bit premature. Smoke and mirrors. ‘Brexit may cause a blow to the economy’, I hear. Oh well done Sherlock. Is it possible that it might equally do the exact opposite? Well, that’s so helpful, matey. I’m really glad we had this chat. It’s pathetic.

The plain fact is we don’t really know what will happen because, broadly speaking, nobody knows, as there is no precedent, and it’s hard to predict how the players involved will react in either scenario.

Alongside that, the general public are of course deciding which of their favourite celebrities to vote with (or against). How could that go wrong?! Now we just have to wait for the ‘apolitical’ monarch to pipe up, like before the Scottish Independence referendum.

So the question is: if your investments are based in the UK isn’t the EU Referendum a potentially devastating hazard to your portfolio? In a word: yes.

The question you have to ask is whether you’re more worried about losing money on existing investments or the potential for gain. It’s certainly a time to think about guaranteed stops, but then if volatility is high all that achieves is to decide how much money you’re definitely going to lose. Don’t forget that once you place a stop order the market knows it’s there. If enough volume is there then it’s not outside the realms of possibility that some of the market players could move the market to your price in the face of uncertainty and then hit all the stop loss orders before rallying back upwards. It’s often better to just sell out and buy back than be exposed to that risk.

Hence: Bed & Brexiting. In the old days people used to make use of their Capital Gains allowance by selling their stocks on 5th April in order to buy them back on the 6th, thus taking any gain into the tax year concerned. That’s perfectly legitimate in this case since you are not seeking to limit taxes, but risk. It doesn’t need to be done the day before either. And how long you’ve held a position, and where the position now stands, will be important in evaluating what to do. For example, if you have a position that is not performing then you may not wish to risk anything on it, and simply close the position. On the other hand if you have a profitable position then perhaps a hedge using a spread bet might be a cheap insurance policy. In the next post I’ll have a look at hedging a position like this with a spread bet.

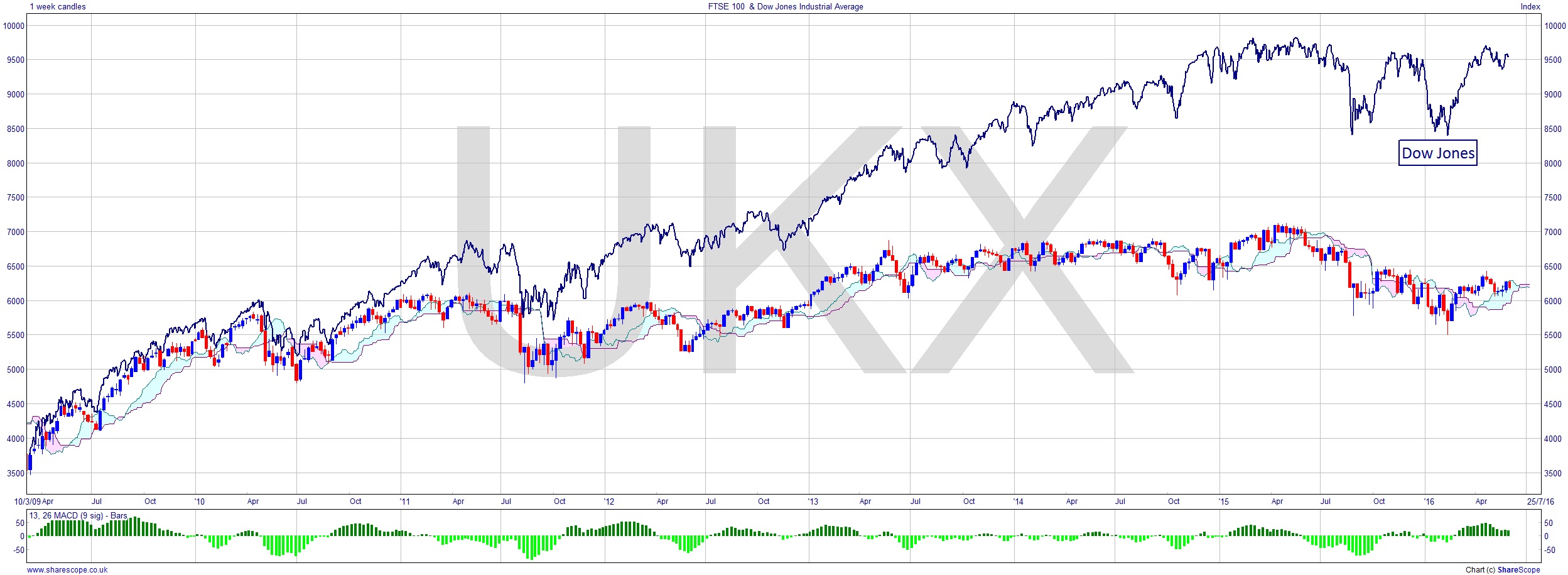

Meanwhile, the FTSE 100 continues to underperform the Dow. More divergence as I predicted some time ago. The Dow is presently knocking on ‘heaven’s door’ again, whilst the FTSE is rewarding loyalty with poor returns and a bleak outlook. You might want to consider that.

Comments (0)