Zak’s Weekend Charts Round-Up

FTSE 350 Stocks

Antofagasta (ANTO): June Price Channel to 600p

While some of the other mining sector giants such as Randgold Resources (RRS) seemed to head for the upper reaches of the stratosphere with relative ease, it can be seen on the daily chart of Antofagasta that there has been a crawl higher over recent months. But at least there is a rising trend channel from early June up which the stock has rebounded, with last month helping the bulls as there was a smooth clearance of the 200 day moving average, now at 460p. For the near term the big plus point is the way the shares have found support at the floor of the rising 2016 price channel / 20 day moving average at 529p. At least while there is no end of day close back below the 20 day line one would be happy to call the stock up to the top of the June channel at 600p. The timeframe on such a move is regarded as being as soon as the end of next month. Those who wish to wait on a fresh buy trigger should hold back until a clearance of the 10 day moving average at 544p, just above Friday’s close.

BAE Systems (BA.): One Month Target at 580p

While it may be stretching things to say that over the past couple of months we have seen an ideal set up on the daily chart of BAE Systems, it does certainly appear to be very encouraging from a bullish perspective. The vehicle for the recovery since the narrow late June bear trap rebound has been the overall rising trend channel in place since as long ago as April. Indeed, that month’s trend channel has its resistance line pointing as high as 580p. Given the latest consolidation by the shares the likelihood is that provided there is no end of day close back below the 50 day moving average at 525p the notional upside should be hit as soon as the end of next month.

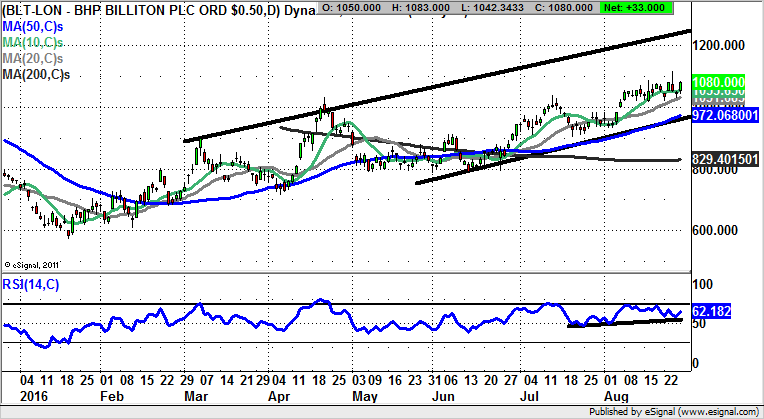

BHP Billiton (BLT): 1,250p Price Channel Destination

The stock market has taken the recently reported $6.4bn loss reported by BHP Billiton in its stride. From a charting perspective it is interesting to see how the stock has remained above the August gap floor at 984p, even after the big news. On this basis one would be suggesting that at least while there is no break back below the floor of the gap we could still see significant upside here at BHP Billiton, after the recent consolidation within an extended flag is complete. This could drag the shares up to the top of a rising March trend channel at 1,250p.

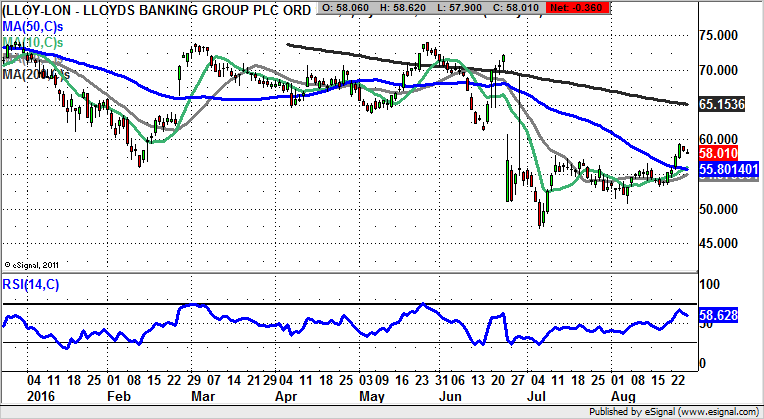

Lloyds Banking (LLOY): 200 Day Line Target

In the wake of the alleged extra-banking activities of the CEO of Lloyds, it has been questioned by some whether Antonio Horta Osorio has damaged the reputation of the part state owned group. Fortunately, the answer to such concerned is that banks and bankers are held in such poor regard that there is very little that could lower perceptions further. As for the charting position of the Black Horse share price, it can be seen how there has been a tentative recovery of the 50 day moving average at 55.8p. Ordinarily, one would be happy to call the stock up to the 200 day moving average at 65p. But it may be that cautious traders wish to see the shares clear the bottom of the June gap at 60.74p on an end of day close basis before targeting the 200 day line.

Small Caps

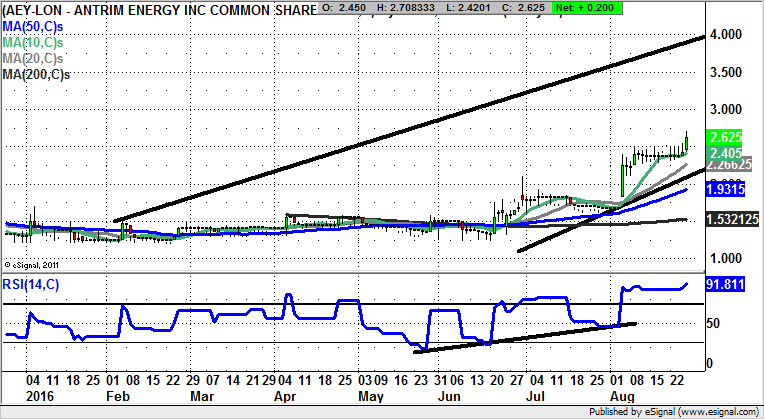

Antrim Energy (AEY): Bull Flag Breakout towards 4p

Although Antrim Energy is clearly not a very liquid situation, it can be seen on the daily chart how this has been a dynamic example of price action over the course of August. This is said in the wake of the unfilled gap to the upside and the bull flag breakout above the 50 day moving average at 1.93p. There has also been a rebound off the floor of a rising trend channel from February. The floor of the channel currently runs just above the 50 day line, with the hope being that while above this feature the upside for Antrim Energy will be the 2016 resistance line projection pointing at 4p over the next 4-6 weeks.

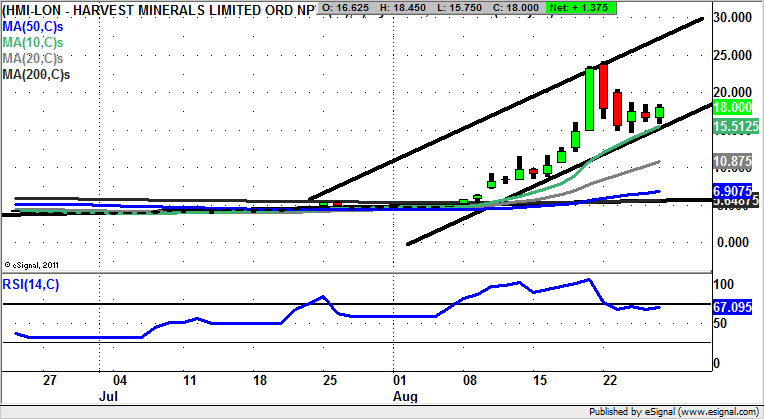

Harvest Minerals (HMI): 30p Price Channel Target

It is worth updating the charting position of Harvest Minerals in the wake of the big break to the upside this month. The giveaway that something significant could happen was the as yet unfilled gap to the upside above the near-term moving averages. This certainly worked for the bulls, with the likelihood currently being that the stock is in a mid-move consolidation which could deliver a fresh leg to the upside. The anticipated level is the top of last month’s rising trend channel at 30p during September. Only back below the 10 day moving average at 15.5p questions the idea of further prompt gains.

Sirius Minerals (SXX): 55p June Price Channel Target

What can be seen on the daily chart of Sirius Minerals is what a phenomenal run the shares have had over the past couple of months. Perhaps just as importantly it would appear that there is still some gas left in the tank as far as this bull run is concerned. This is because it is possible to draw a rising trend channel in place from June, with the resistance line projection of the channel heading to 55p. The anticipated destination could be hit over the next 2-4 weeks, especially while there is no end of day close back below the 10 day moving average at 41p.

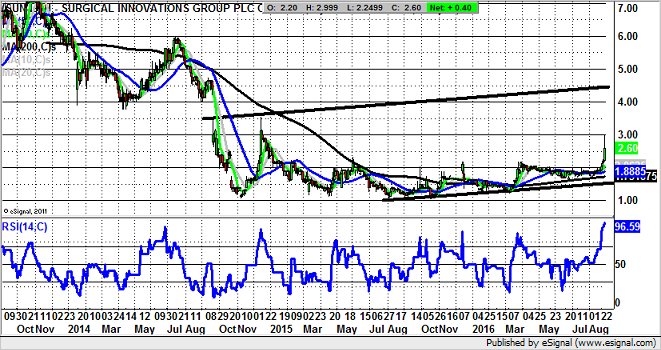

Surgical Innovations (SUN): 2015 Price Channel Heading For 4.5p

Vertical moves through the 200 day moving average are normally significant events in charting, with this happening for Surgical Innovations in March. Since then we have been treated to a sideways shuffle at and above the 200 day moving average now at 1.73p. The hope now is that while the shares above former June 2015 resistance at 2.32p we should be heading as high as the top of last month’s price channel top at 4.5p over the next 1-2 months.

Comments (0)