Zak’s Daily Round-Up: RBS, SPD, SMIN, EKF, PCGE and PROX

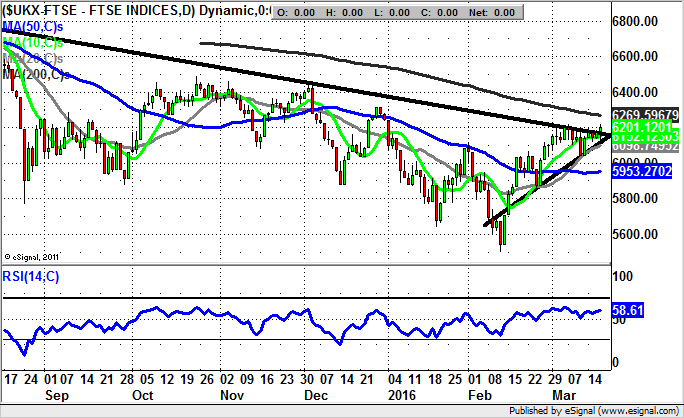

Market Direction: FTSE 100 above 6,100 Targets 6,400

RBS (RBS): Wedge Breakout Back To 260p

Rather against the odds the market has welcomed the RBS initiative to add robots to the payroll, or at least use them in order to cut costs and perhaps offer a better service without the vagaries of the human condition. What will be interesting to see is when the first issue of potential negligence comes into play, with the SFO coming in to censure the latter-day counterparts of R2-D2 or K9?

Nevertheless, since the stock was last written up here, it can be seen how we have been treated to a wedge break out, one of the more reliable set-ups in the charting catalogue. The view now given the way that we have seen a break of the December resistance line at 235p is that we should at least be treated to a push to the 50 day moving average at 243p. Above the 50 day line on an end of day close basis should be enough to deliver a return to the main post February resistance at 260p over the next four to six weeks, even if the overall bear trend here resumes after that.

Sports Direct (SPD): Sharp 50 Day Line Recovery

What can be seen on the daily chart of Sports Direct is the way that we have been looking at an extended base in place since the start of this year. The big plus point over the near term has been the way that after an extended test of the former rising January trend channel, and backed by an uptrend line in the oscillator window, we have seen a decent end of week break above the 50 day moving average at 401p. All of this goes to suggest that while there is no end of day close back below the 50 day moving average, we should be treated to at least a decent intermediate rally. The favoured destination at this point is the top of the rising January trend channel with its resistance line projection currently heading as high as 500p. The timeframe on such a move is the next two to four weeks. In the meantime any dips towards the 50 day line are regarded as buying opportunities.

Smiths Group (SMIN): Bull Flag Breakout

I may not be alone in regarding Smiths Group as a rather decent M&A situation, although it has to be admitted that there may not be that much evidence as far as this company is concerned that really backs the idea of a full takeover. This is despite the way some aspects of the business such as the security screening unit may be attractive to potential purchasers at the moment. From a technical perspective we can see the way that for March the shares have broken up and then developed support at and above the 200 day moving average still falling at 1,029p. This is a decent line in the sand as far as the argument between the bulls and bears are concerned, with the message at the moment being that provided there is no end of day close back below the 200 day line, one would expect further significant gains. The favoured destination at this point is as high as the top of the rising trend channel in place on the daily chart from a long ago as August. In the meantime any dips towards the 10 day moving average of 1,061p can be regarded as a buying opportunity given the way that the stock is headed towards overbought territory in the RSI window. Otherwise the target here is as high as 1,250p over the next four to six weeks, especially in the wake of the break above the initial sub 1,100p February resistance for the shares.

Small Caps Focus

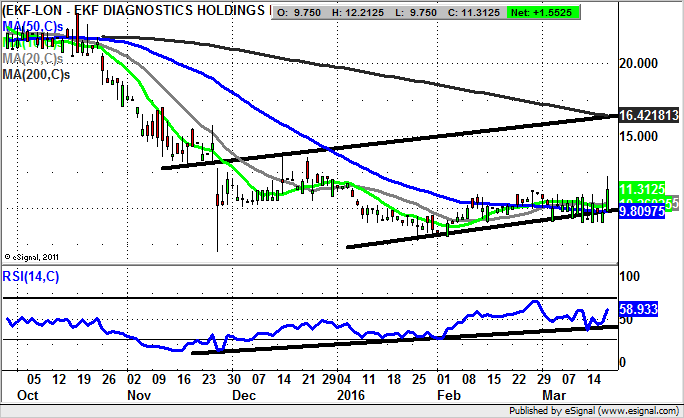

EKF Diagnostics (EKF): Good Initial Progress

EKF Diagnostics was covered here quite recently and it can be seen that in the wake of today’s jump for the share price we are looking at quite an intriguing recovery play. The expectation now is that there will be continued progress within a rising trend channel which can be drawn from as long ago as November, with the floor of the channel currently running level with the 50 day moving average at 9.8p. The implication is that provided there is no weekly close back below the combination of the 50 day line and the post-autumn uptrend line, we shall see decent upside. Just how high the stock could stretch is suggested by the November resistance line projection currently getting as high as 16.42p, the present level of the 200 day moving average. All of this would suggest that within the next one to two months we shall have decent outside here for EKF Diagnostics shares. This is especially the case given the way that the recovery to date has been backed by an extended uptrend line in the oscillator window in place from the time of the November selling climax on the stock.

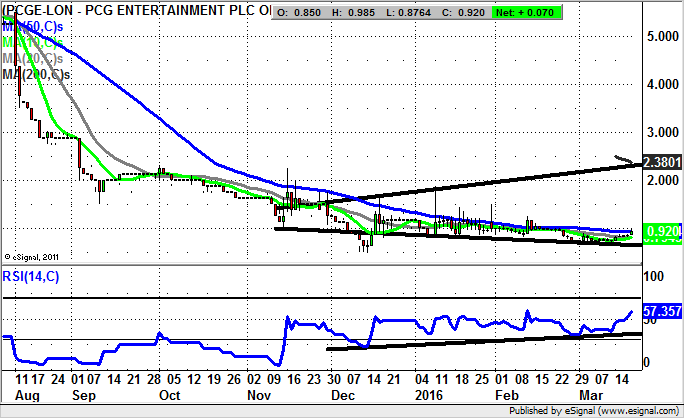

PCG Enertainment (PCGE): Broadening Triangle Breakout

PCG Entertainment may have been brewing for quite some time as a potential recovery situation, but it can be seen how in the wake of the latest consolidation for the stock one can regard potential upside as being back much nearer than at any time over the last six months. The reason for the relative optimism is the way that it is possible to draw a broadening triangle in place on the daily chart from as long ago as November. The resistance line projection of the triangle is currently heading up to the 200 day moving average at 2.38p, and this is regarded as being the two to three months timeframe destination for the stock. Indeed, at this stage only sustained price action back below the recent 0.8p support for the shares is regarded as delaying the upside scenario.

Proxama (PROX): Solid 0.8p Support

Although it has been a rather rough ride in the recent past for shares of Proxama, the overall impression here is that of an improving situation. On this basis one would regard the stock as having made a lasting base above the 0.8p post February support zone, with the implication being that provided there is no sustained price action back below this area, decent upside should be forthcoming. Indeed, the favoured target for Proxama is as high as the December price channel top at 2.1p. Only cautious traders would wait on a clearance of the 200 day moving average at 1.15p before taking the plunge on the upside.

Comments (0)