Zak’s Daily Round-Up: PSN, STAN, COMS and NRRP

Market Position: FTSE 100 above 5,950 Back to 6,115

Persimmon (PSN): Bear Trap Targets 2,270p

Given the way that the housing market is one of the pillars of prosperity for the Cameron / Osborne administration, it is hardly surprising that housebuilder Persimmon has been going from strength to strength. This has been backed by such bubble inducing ploys as ultra low interest rates, the Help to Buy scheme and periodic deadlines for buy-to-letters to scramble into buying yet more real estate. Perhaps the best part of the bubble plan has been the migrant intake, which presumably with or without the EU would continue to run at 300,000 a year. Easy migrant importation is presumably one of the main reasons David Cameron and Number 10 are keen for us to remain in the EU – as real estate wealth and freshly laundered Third World money, from which a decent part of central London properties are paid for, is the cornerstone of our economy. As far as Persimmon is concerned we have been treated to good, clean fun on the fundamental front, with a 34% jump in full year profits, off a 13% rise in sales. This was partly achieved thanks to the Government’s Help to Buy scheme, a great innovation for the Bank of Mum and Dad to help public school kids get a decent start in life. Cynics such as myself would suggest that Persimmon would appear to be on a cushy number for at least the lifetime of this parliament, which is a long enough investment window. Looking at the technical position here, it can be seen how there has been a wide rising trend channel in place on the daily chart since as long ago as August. The floor of the channel currently runs at 1,870p, with the highlights so far this month being the way that we have been treated to a bear trap gap reversal from below the former January 1,864p intraday low. The likelihood at this point is that provided there is no end of day close back below the 50 day moving average at 1,969p, the upside here over the next 1-2 months could be as great as the 2015 price channel top of 2,270p. Only cautious traders should wait on an end of day close above the 2,102p initial February resistance before taking the plunge on the upside.

Standard Chartered (STAN): Hammer Price Action Could Lead Back to 485p

Well, we have all heard of “too big to fail”, but if the story of many leading UK companies reporting in 2016 to date is anything to go by, “too big to get it wrong” seems to be the concept which is dominating. The problem with the corporate Goliaths would appear to be that they regard themselves as so invincible that by the time the ceiling caves in it is too late to react. Prize winners as far as the being in denial stakes are concerned have stemmed largely from the mining and banking sectors. Ironically, for both sectors the get out of jail card has been China – an economy which delayed the day of reckoning, but then planted firmly at the start of this year. For Standard Chartered we have already been warned via press coverage in the national newspapers that hedge funds have been shorting the shares aggressively. Normally, such an “inside track” may be too late for the average trader, but given that we are trading in the aftermath of a 10% decline at first for this stock, it could be that the heads up is actually quite useful. Nevertheless, as is often the case, we have a situation here where the rebound since the day low of 383.85p is as revealing as the original decline. Indeed, the view now given the hammer daily candle for Tuesday is that provided there is no end of day close back below the intraday low of the day, we could be treated to a 50 day moving average target at 485p over the next 2-4 weeks, even if the downtrend for the shares resumes after that.

Small Caps Focus

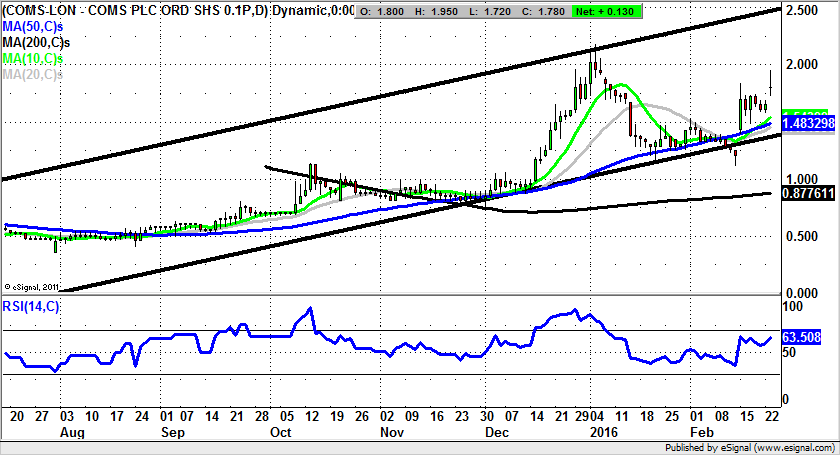

Coms (COMS): 2.5p Price Channel Target

To say that the recovery here at Coms has been something of a slow burn would be the understatement of the year. The most difficult aspect of the recent past has effectively been the decline from the January peak to the February floor just below the support line of a rising trend channel in place since June last year. The floor of the channel currently runs at 1.4p, with the big plus here being the way that following the bear trap below the 2015 support line there was a gap back through the 50 day moving average at 1.48p. The position now is that one would not expect to see sustained price action back below the 50 day line ahead of a 1-2 month price channel target as high as the June resistance line projection at 2.5p. In the meantime, any dips towards the 50 day line can be regarded as buying opportunities, if only to improve the risk/reward of going long of what has been a difficult speculative situation over much of the recent past.

North River Resources (NRRP): Above 50 Day Line Targets 0.25p

It is usually the case that the end of a bear trap is marked by a strong attempt to conquer the 50 day moving average – something which can be the pivotal event in terms of taking a stock from being perceived negatively or positively. In the case of North River Resources we had the break of the 50 day line at 0.07p and essentially the shares have managed to hold onto this feature ever since. They have been helped along by the way that the floor of a rising trend channel from September is level with the 50 day line. The assumption to make now is that provided there is no end of day close back below the January 0.125p intraday peak, we could be treated to a top of 2015 price channel target at 0.25p over the next 1-2 months.

Comments (0)