Zak’s Daily Round-Up: MRW, TLW, LEG and AERO

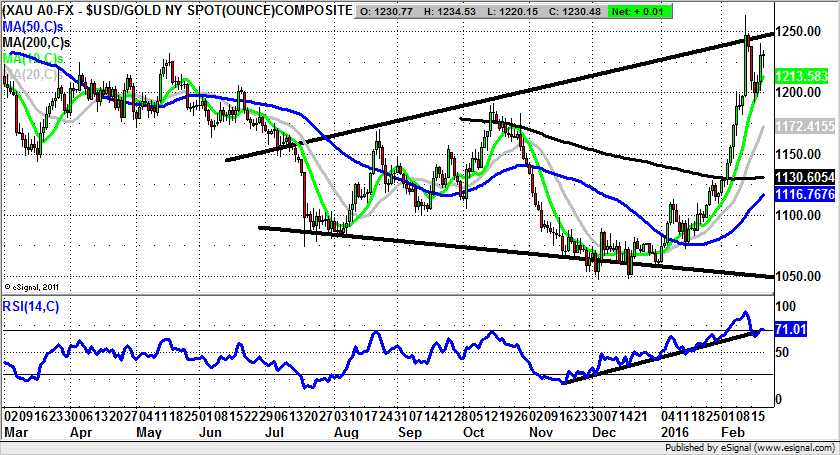

Market Position: Gold above $1,190 Targets $1,260 Initially

Morrisons (MRW): Broadening Triangle Targets 220p

It can be said that it is bad enough that the FTSE 100 has gone nowhere for the best part of 20 years; but perhaps the worst aspect for investors, both long and short term, is the way that not only have share prices drifted, but the level of M&A has been pitiful. This is particularly the case since the Global Financial Crisis, where one gets the feeling that very often the management may be more keen to remain in employment than necessarily act in the interests of their shareholders by accepting a takeover for their company. Happily, Argos owner Home Retail Group (HOME) did play ball with supermarket Sainsbury (SBRY) and value should be unlocked. Now as a possible follow on we have a situation where there are rumours that both troubled Tesco (TSCO) and equally pressured Morrisons, might be about to tie the knot.

Interestingly enough, it could be the case that the recent recovery in the share prices of both groups could be a sign that a deal is in the offing. At the very least it may be that sentiment towards both companies has turned more positive at the idea of possible M&A. As far as the charting position of Morrisons is concerned, it can be seen how there has been a solid enough looking break of the 200 day moving average, now at 168p, from the end of January. Indeed, the break has been reinforced by two successful tests of the 200 day line this month as support, followed by the double unfilled gaps to the upside since. All of this would go to suggest that provided there is no end of day close back below the initial February peak at 177p, we should be treated to further upside. The favoured destination at this point is seen as being towards the top of a broadening triangle which can be drawn on the daily chart from as long ago as June last year. This has its resistance line projection currently running at 220p, a target which could be achieved as soon as the next 1-2 months.

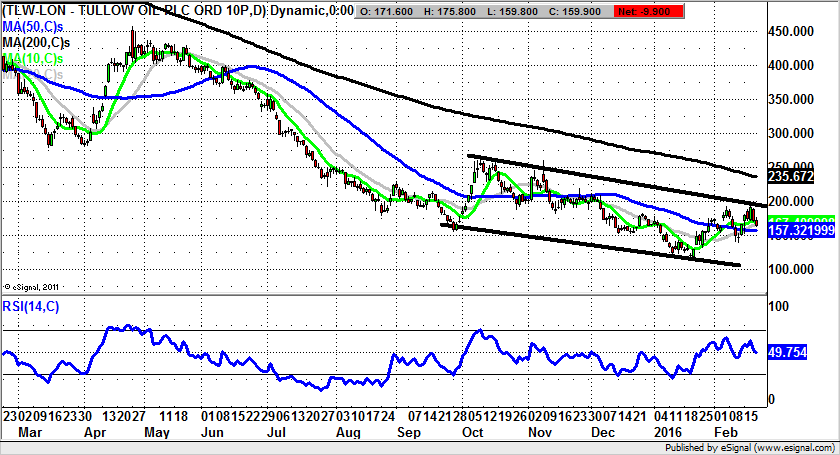

Tullow Oil (TLW): Break of 50 Day Line Risks 100p Zone

It was noticeable that Tullow Oil delivered an operational update regarding its activities in Ghana; but of course it really is the case that in the present climate, explorers such as this company would appear to be at the mercy of macro factors, such as OPEC, Russia and the latest power player, Iran. However, it is the case that the decline for Crude Oil has turned some major oil players back into mid caps, and mid caps into small caps – much as happened in the mining sector. Looking at the daily chart perspective here it can be seen that we are looking at a mature downtrend, with the latest leg to the downside stemming around a break of the March/April 2015 support at 278p. What is worth noting is the way that there has been a persistent failure by the stock to get back up to test former support as new resistance. Indeed, even the 200 day moving average now at 235p has eluded the bulls. On this basis one would suggest that as little as an end of day close back below the 50 day moving average at 157p could lead to a retest of the worst levels of the year at 116p intraday. The worst case scenario target at this stage is seen as being as low as the floor of a falling trend channel from September at 100p. Those hoping for recovery here should really look to a clearance of the September price channel top at 200p on a weekly close basis before considering a sustainable base having been put in place – with the initial target then the 200 day line over the following 4-6 weeks. But it should be stressed that for the time being the bear argument is favoured.

Small Caps Focus

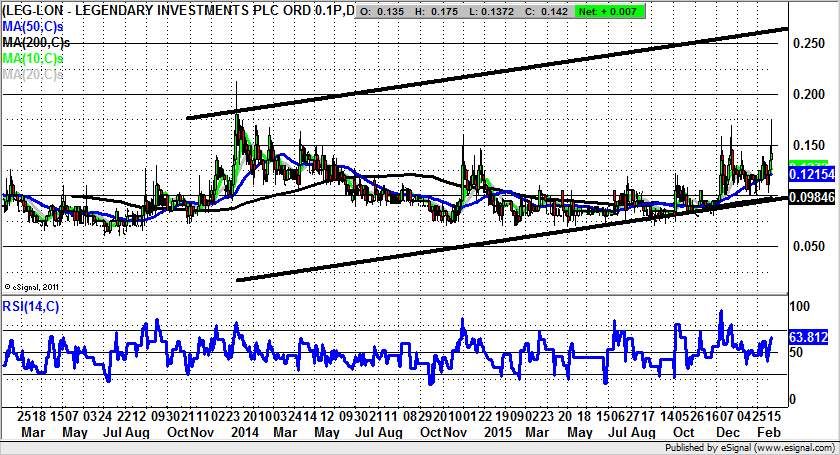

Legendary Investments (LEG): Above 0.15p Targets 0.25p

Legendary Investments has all the characteristics of a penny stock which could be set to offer a decent return in difficult markets; but of course it is always the case that the exact timing in terms of getting on board here at the ideal moment is problematic. However, my suggestion is that it would appear that the time could be ripe from a technical perspective as it finally looks as though the shares are ready to break out after an extended period of consolidation. The reason for the relative optimism at this time is the company’s Virtualstock, something in which Legendary Investments has a stake. This supply chain management software could offer large organisations such as the NHS significant cost savings, and therefore offers decent upside potential, once the market cottons on to what is going on here. In the meantime from a technical perspective it can be seen how we have a slow burn recovery, one which has been in place for well over a year, and largely consists of a dance/basing process either side of the 200 day moving average now at 0.09p. The charting issue is that we are waiting on a weekly close above the main 2014/15 resistance at 0.15p. This may still take a while to materialise. But once the log jam of resistance has been cleared…

Strat Aero (AERO): Above 3.5p Could Lead Back Towards 6.55p

In theory it can be said that as far as drones specialist Strat Aero is concerned, its time has certainly come on a fundamental basis. The issue is how long it will take for the penny to drop as far as the stock market is concerned, and then in turn how to exploit the opportunity. At least from the daily chart it can be seen how there has been an initial positive reaction off the floor of a price channel drawn from May last year, running down to 3.5p. At least while there is no weekly close back below the 2015 support line the upside here could be towards the 200 day moving average at 6.55p over the next 2-3 months.

Comments (0)