Zak’s Daily Round-Up: BP., LGEN, PRU, FFWD and MXO

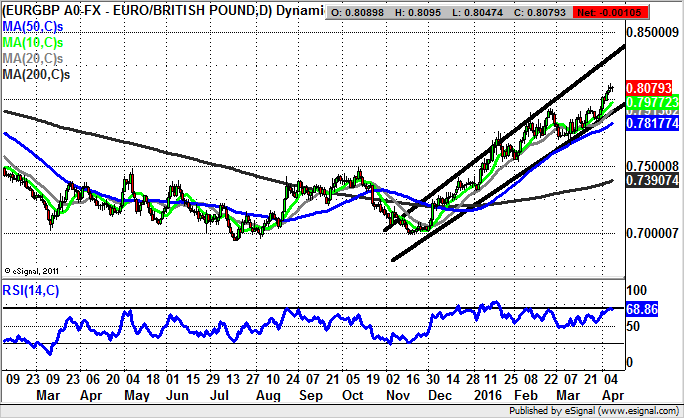

Market Direction: Euro/Sterling above 80p Still Targets 83p

BP (BP.): Possible Return to November Resistance

Now that the Deepwater episode is finally out of the way for BP – at least in terms of the financial liability – it looks as though the oil giant may finally be able to move on. However, we are still in the midst of an oil price collapse, and the ramifications of this may be set to last even longer than the six years the Gulf of Mexico disaster hung over the company. At least from a charting perspective though, it would appear that there is recovery in the air for BP, a point which is backed by the way it is possible to draw a rising trend channel on the daily chart from as long ago as December. The floor of the channel currently runs at 340p, with the implication being that provided there is no weekly close back below this feature, a decent intermediate rebound could be on the cards. The favoured destination at this point is regarded as being the top of the late autumn price channel pointing as high as high as 400p/former November resistance, with the time frame on such a move regarded as being the next 1-2 months. Clearly, if this comes to pass it would be a big plus for the FTSE 100, given the heavy weighting of this stock with the leading UK index.

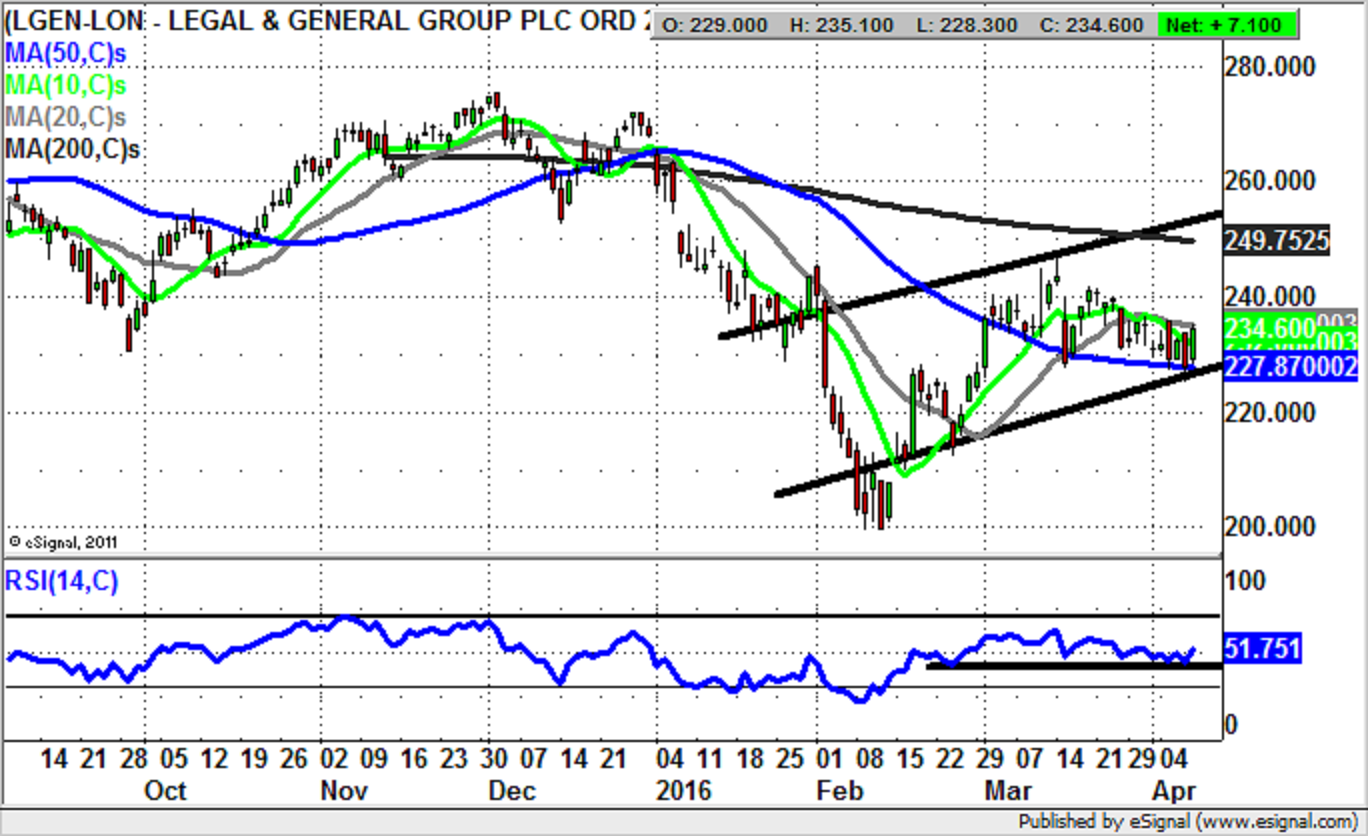

Legal & General (LGEN): January Gap Top Target

What is interesting about the recent history of Legal & General on its daily chart is the way that the key turning points have been punctuated by gaps to the upside and downside. In fact, I would say that the importance of gaps in charting remains relatively understated, especially as one can see how there have been gaps to guide us ahead of the big moves. This was seen at the turn of 2016 with two gaps to the downside which came ahead of a sharp bear move. The bulls, however, were back in business with the early February gap to the upside through the 10 day moving average, then in the 210p zone. Winding forward to where we are now, it can be seen how it is the 50 day moving average at 227.8p which is in play, along with the floor of a rising trend channel from January with its support line at the same level. The idea now is that we are looking at notional double support in the 227p zone, with the implication being that provided there is no end of week close below this, one would be assume decent upside over the near term. Just how high shares of Legal & General could fly is suggested by the 2016 price channel top with its resistance line projection heading as high as 255p, also the area of the second January gap down. Indeed, only cautious traders would wait on an end of day close back above the 20 day moving average at 235p as a momentum trigger before taking the plunge on the upside.

Prudential (PRU): Above 50 Day Line Targets 200 Day Line

There was a deliberate decision as far as today’s daily round up to choose a couple of insurance stocks, and compare/contrast their charting positions. As can be seen from the daily chart of Prudential, one could easily play a game of spot the difference in terms of the relative positions and patterns we see before us. But at least we note how Prudential managed a reversal via an as yet unfilled gap to the upside in early February, and this has led the stock to the positive consolidation we are seeing currently. Much of this consolidation is occurring at and around the 50 day moving average at 1,289p, with the idea over the near term being that while there is no end of day close back below the 50 day line we should be treated to a fresh leg to the upside. The favoured destination above the 50 day line/January uptrend line is back to the area of the 200 day moving average/January price channel top. The timeframe on such a move is regarded as being the next 4-6 weeks.

Small Caps Focus

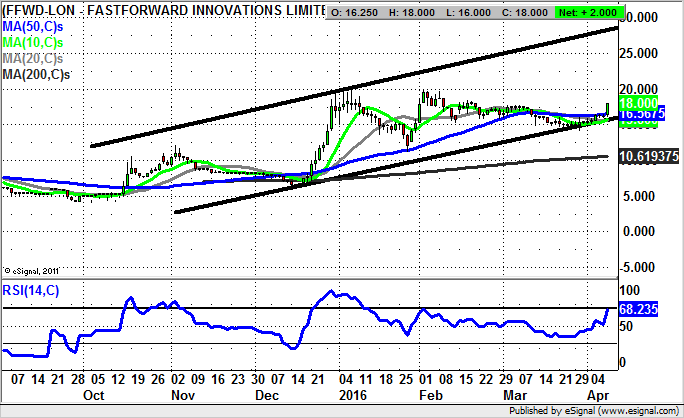

Fastforward Innovations (FFWD): Targeting the Top of the 2015 Price Channel

FastForward Innovations is a stock which happily looked to be a relatively straightforward situation in favour of the bulls, almost from the time that it hit the stock market in its present form. The position now is that we are looking at an extended ricochet off the floor of a wide rising trend channel which can be drawn in from as long ago as October. While it is clear that 20p is the big level to break here, aggressive traders would be buying the latest bounce, and targeting the top of the 2015 price channel at 28p over the next 1-2 months.

MX Oil (MXO): Gap Fill Rebound

It can be said without too much fear of contradiction that the recent journey for bulls of MX Oil, especially since the beginning of the year has not exactly been a pleasant one. But as we race through the month of April it can be suggested from a charting perspective this is genuinely a recovery situation. The main plus point is last month’s gap fill rebound off the floor of the January gap floor at 0.63p, which was anticipated according to technical rules. In addition it would appear that the shares are trading within a post December wedge reversal, with aggressive traders happy to buy the floor of the wedge towards 0.7p. However, the rest of us may wish to wait on an end of day close above the 20 day moving average at 0.8p before targeting the main March resistance at 1.3p plus over the next 4-6 weeks. In the meantime any initial intraday dips back towards the 50 day line at 16.56p can be regarded as buying opportunities. Only well below 15p would even begin to imply a delay in the upside scenario given how well support has come in above the main 200 day moving average now at 10.61p.

Comments (0)