Zak’s Daily Round-Up: BKG, PSN, STAN, DIA, 88E and MOGP

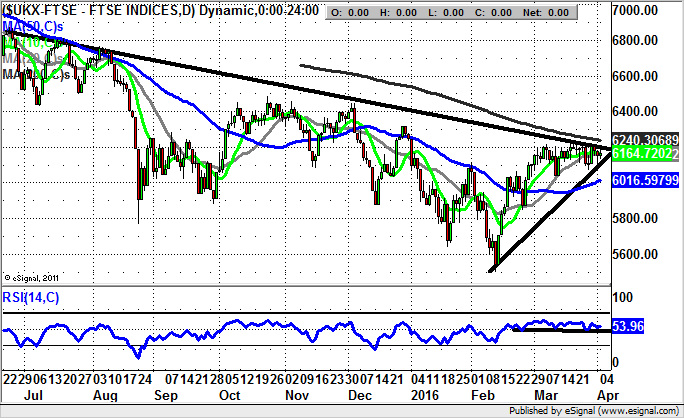

Market Direction: FTSE 100 below 6,100 Risks 5,845

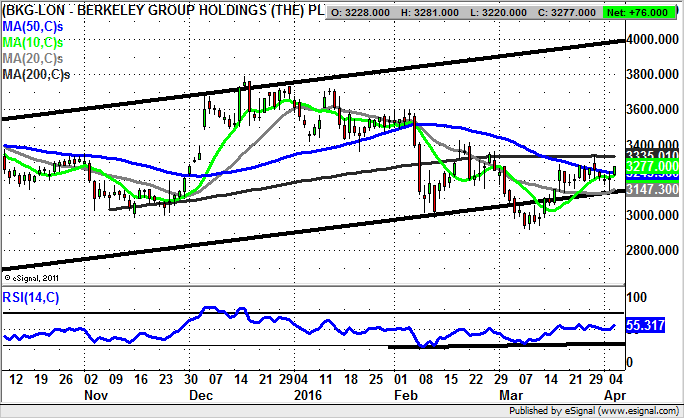

Berkeley Group (BKG): Above 200 Day Line Points to Range Highs

It should very much be the case that shares of Berkeley Group were a safe pair of hands in current stock market conditions. While this has been true to some extent, those on the long side here have not had everything their own way, despite the way that the fundamentals here are very heavily backed.

The overall pattern here on the daily chart since last summer has been a trading range between roughly the 3,000p level and 3,750p. This has clearly been helpful to range traders, but it is surprising that there has been such amplitude in terms of the price action, let alone the lack of a discernible consistent uptrend. Even the 200 day moving average, which can be regarded as the driver of an uptrend in the most robust of situations, has since February shown an inclination to top out, and even decline.

Nevertheless, we can draw a rising trend channel here from as long ago as the end of August, with the assumption to make now being that provided there is no weekly close back below the floor of the channel/20 day moving average at 3,147p, a fresh leg to the upside should be forthcoming. This is particularly the case given extended RSI support at and above the neutral 50 level over the past few weeks to leave it at 58. On this basis we should be justified in looking to a retest of range highs above 3,750p over the next 4 to 6 weeks. The best buy trigger at this stage would be an end of day close back above the 200 day moving average at 3,335p over the next week or so..

Persimmon (PSN): 2,350p Technical Target

As far as the daily chart of Persimmon shares is concerned, in recent months it can be seen that since the November dip below the 200 day moving average, currently at 1,988p, we have seen a decent progression within a rising trend channel from the autumn. The chart position shows how the floor of the channel is also backed by a higher support level since a February bear trap rebound, as well as an uptrend line in the RSI oscillator window with the line currently running through the neutral 50 level.

All of this goes to suggest that there could still be further upside for Persimmon shares despite the 10% plus bounce from the support zone of late last year. The favoured destination at this point is the top of last year trend channel with its resistance line projection currently heading as high as 2,350p. Only a weekly close back below the November uptrend line would even begin to suggest that a delay to the upside scenario was on the cards.

Standard Chartered (STAN): Threat of Sub 400p Again

It has to be admitted that Standard Chartered shares have been a somewhat difficult candidate for technical analysis over the recent past, with the bull trap high through 500p last month being one source of difficulty. After that, the shares started to behave themselves in the sense that there was a gap to the downside and then a failure of the main resistance line from the autumn of last year currently running at the 10 day moving average level of 463p.

What one would expect now in the wake of the latest failure below the February uptrend line/50 day moving average at 448p is a retest of the worst levels of the year to date, well below 400p over the course of the rest of April. In the meantime any strength back towards the 50 day line is regarded as a shorting opportunity, with only a weekly close back above the 2015 resistance line above 460p really questioning the continuation of the bear argument.

Small Caps Focus

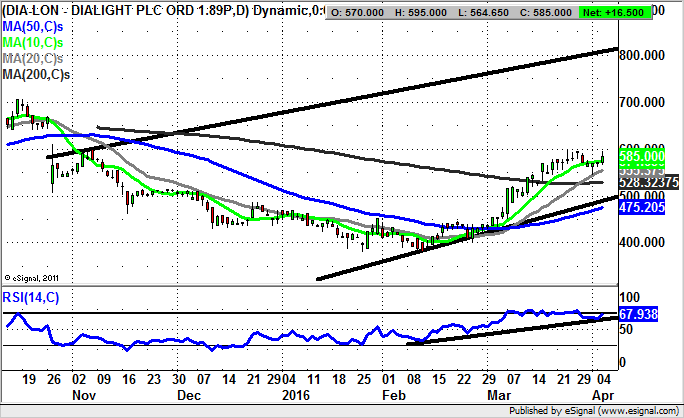

Dialight (DIA): 800p in Focus

It is normally the case that the best turnaround situations are the slowest ones, and in Dialight it would appear we have just one such contender. This is in the wake of the recovery of the 50 day moving average at the beginning of last month at 474p, and then the 200 day line currently at 528p a couple of weeks back. The hope now would be that the shares will be able to find support at and above the 200 day line, and especially above the 20 day moving average at 554p. If this is the case for the rest of the week, one would be reasonably confident of an eventual best case scenario target here over the next couple of months as high as the top of a rising November price channel at 800p. Only cautious traders would wait on a clearance of last month’s resistance towards 600p before taking the plunge on the upside.

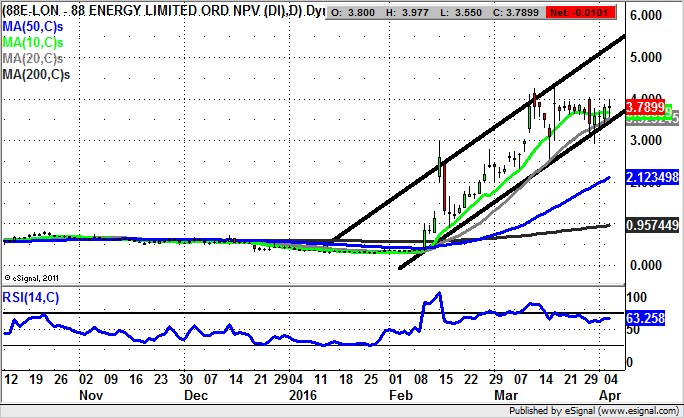

88 Energy (88E): Above 3.5p Targets 5.5p

88 Energy has been one of the small cap heroes of the year to date, and it would appear that even though there has been something of a slowdown in recent weeks, the shares could still deliver for the Bulls in a significant way. The idea here is that there will be further progress within a rising trend channel from January, with the floor of the channel currently running towards the 3.5p level. While there is no weekly close back below this number, one would be looking for a best case scenario target here over the next month as high as 5.5p, at the January resistance line projection. That said, given the way that we have been stalling for the last month, it may be that cautious traders wish to see at least an end of day close above the recent 4p resistance before deciding to go long/add to their positions.

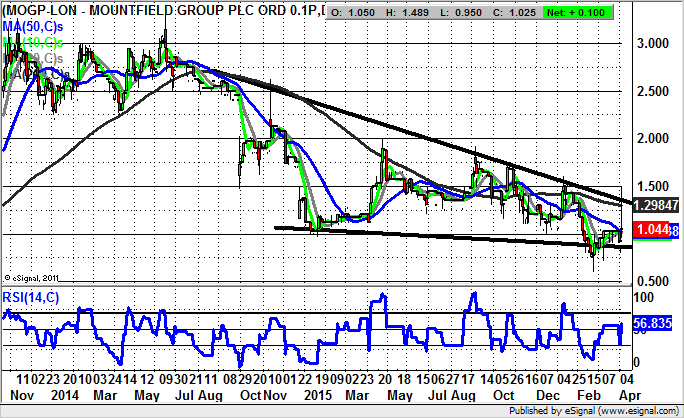

Mountfield (MOGP): Waiting on a 200 Day Line Break

Shares of Mountfield have been bubbling under as a potential recovery situation for quite some time, but so far have not lived up to the expectations of the optimists. At least it does not appear that there will be any fresh break to the downside and sustained price action below say the 0.8p level. However, the easiest way forward here would be to wait for a break of the main 2014 resistance line/20 day moving average of 1.29p, before taking this situation as a serious bottom fishing opportunity.

Comments (0)