It’s AIM that should get skewered, not private investors!

AsiaMet Resources (AIM:ARS)

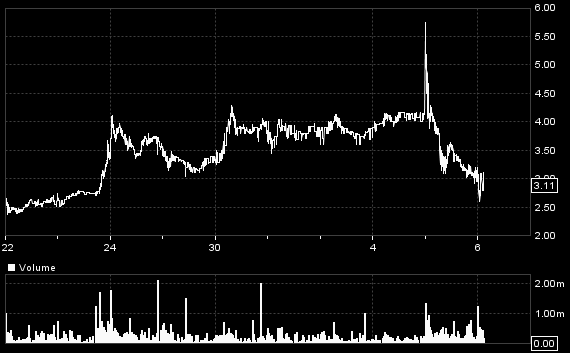

Well that was a spike if ever I saw one! And plenty of innocent lambs got skewered. Maybe it’s time for those responsible (an AIM market that doesn’t police misleading information and ‘research’) to get skewered themselves.

I said I’d revisit ARS when its long trumpeted (by the CEO) PEA arrived. And although he had promised a truly magnificent one, it turns out (surprise, surprise) that once various optimistic assumptions in the latest PEA were corrected for, the economics are not much different than the estimate that the company broker published back in September, when the shares briefly touched 1.5p against the 5.9p some poor, over-optimistic and misled souls paid a few minutes after the market opened on Tuesday.

Those who followed him, however, didn’t manage to stem the fall, and by the end of the day most of those early turkeys paying over 5p had lost 1/2 to 1/3rd of their money. But you can’t persuade a turkey to lie low and avoid the inevitable turkey-shoot, so the desperate optimists on the boards kept ignoring the (very few) warnings – pressing on with blame for the market makers and traders less intelligent than themselves before the renewed bounce towards the glorious new highs they expect. But I’m afraid they’re unlikely to see that 5p, or even 4p, again.

Unless, that is, the copper price, against all evidence, suddenly spikes in the same way as did ARS’s shares (what an apt mnemonic).

There seems little doubt that ARS’s projected BKM copper mine in Kalimantan looks relatively attractive and may well eventually go ahead – provided the copper price recovers from its current depressed $4,800/tonne ($2.15/lb), as most observers expect that it will one day. But the PEA (it’s only ‘Preliminary’ after all – and even a Definitive study doesn’t claim better than 20% accuracy) assumed a near 20% higher price than now, and a lower discount rate than did the broker estimate, to arrive at its apparently magnificent $204m NPV against the broker’s $79m. Once adjusted, the NPV is much the same (even though the PEA goes for a 25% higher rate of output) while the capex is actually a bit higher at 10 times ARS’s market value after yesterday’s fall.

It is, of course, that high capex that might have spurred the company’s CEO to try to get the share price up, even though the excellent IRR (at current prices more like 26% than the 39% trumpeted, but still OK) will help much, but not all, of the necessary financing eventually. But more likely is the need for financing in the short term, for which all the best IRRs in the world won’t help at this early stage. At the last balance sheet date in November, £306,251 cash remained after raising $3m since January, and the company warned it will need to raise more in the near future.

So it is a pity that it has, through the misleading (and unnecessary) hype about its coming PEA, really now shot (skewered) itself in the foot by stimulating that enormous share spike which from now on will deter all but the most gung-ho private investor. And it can’t help AIM’s reputation that many of its shares are now so volatile that sensible companies will think such a market just won’t value them properly and therefore isn’t for them. By ‘properly’ I mean of course that investors should be given the correct information to do so. And, sorry to belabour the point, readers know my opinion of the bogus share price ‘targets’ that is all most ‘retail’ brokers seem willing to offer. I don’t think you see such artificially stimulated ‘spikes’ on the Canadian exchanges.

I must admit, however, that I get the impression that even company CEOs are taken in by these ‘targets’ for their own shares. They must know that as their projects progress through their various spending stages, it is impossible to forecast what the eventual value will be to its shareholders without full knowledge of the funding steps required and at what price. A competent broker or analyst should at the least be able to make some such projections and show his assumptions, and by doing so show the investor that he is being as open and as honest as it is possible to be even if the full cost can’t yet be known. I have seen a few such more professional research reports from some institutional brokers in my time – but not much that is ever available to private investors. I believe that if more such higher quality research were to be made available to them, companies and their shareholders will get a much better value in the long run. But, then, I suppose I’m ignoring the temptation the brokers have to flog as many shares at as high a price as they can get away with today, in case they go bust tomorrow – not to mention the stupidity of the FSA in assuming that private investors are so dim as to not be able to understand proper research.

Comments (0)