Zak’s Daily Round-Up: AAL, VOD, AGQ and NAHL

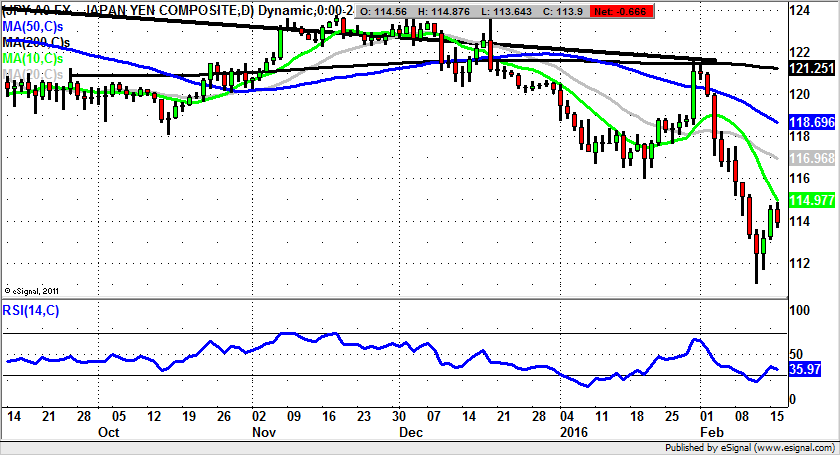

Market Position: Dollar / Yen below 115 Targets 111

Anglo American (AAL): A Denial Situation

It is just as well that I have absolutely no belief in the Credit Agencies, such as Moody’s and S&P, or I would probably have an even more negative view of Anglo American than I do currently. The problem here is that both the company and the market has failed to appreciate how dire the position is for the mining sector. It has faced the issues of overcapacity, diving metals prices and the hard landing in China, on a “too little, too late” basis. Only now are we looking at this company taking any serious action. But just like the rout in the oil & gas sector, the main problem is if there is no rising demand and/or prices, companies like Anglo American are going to go from being FTSE 100 entities to FTSE 250 plays – or as we have seen in the case of such companies as Petropavlovsk (POG), back to small cap territory. What can also be seen from the daily chart action here over the recent past is the way that we have gone from being down in the dumps towards the 215p level, to nearly double this figure at 423p this morning. In many ways this is the issue, given the way that one would not consider that the prospects for Anglo American have doubled. All that we can see as a best case scenario is a shuffling of the pack as far as the myriad businesses the group has, and of course, a massive cull in the head count. Considering the most likely scenario is that the bounce from 215p is the result of short covering, now that the latest trading update is out, we have the temptation for the bears to get into position again. At this stage only an end of day close back above the 423p February peak to date is likely to be enough to be a strong enough momentum signal to provide confidence to the longs to enter again. The target then would be the top of a rising trend channel from November at 550p, 1 to 2 months after 423p is cleared.

Vodafone (VOD): Price Channel Rebound Points Back to 230p

One of the better speculative situations of 2015 was the hope that Liberty Global might takeover/merge with Vodafone, in a story which ran for some time and then faded rather unceremoniously. However, it would appear that Vodafone seems keen to remind the stock market of its previous disappointment; forking out €1bn for a Dutch joint venture with Liberty in Holland will not have helped the fans of the UK mobile telecoms giant forget. But at least as far as the charting position is concerned, we are looking at a February bear trap gap reversal from below the October 201p floor. The message at the moment is that, provided there is no end of day close back below 201p, the upside here on a technical should be back towards a June resistance line at 230p over the next 4-6 weeks.

Small Caps Focus

Arian Silver (AGQ): Above 1p Could Lead as High as 4p Plus

As far as the charting position of Arian Silver is concerned, it can be seen how the recent history has not exactly been for widows or orphans. Indeed, the decline for the end of November was painful enough to have created a widow or orphan or two. The present charting interest stems from the way that it is possible to draw in a broadening triangle on the daily chart, with the floor of the channel running at the 1p level. This is expected to come in as support over the next few sessions, with the longer a base can be held here, the greater the expectation that we shall be on the receiving end of at least an intermediate recovery. Provided there is no end of day close back below the 10 day moving average / 1p zone, the upside here is expected to be as great as the December resistance line projection, currently running at 4p. The timeframe on such a move is regarded as being as soon as the next 1-2 months. An end of day close back above the 20 day moving average at 1.28p later today is regarded as being the first momentum buy trigger, while the second would be a clearance of RSI 50 – the neutral level, versus 42 currently.

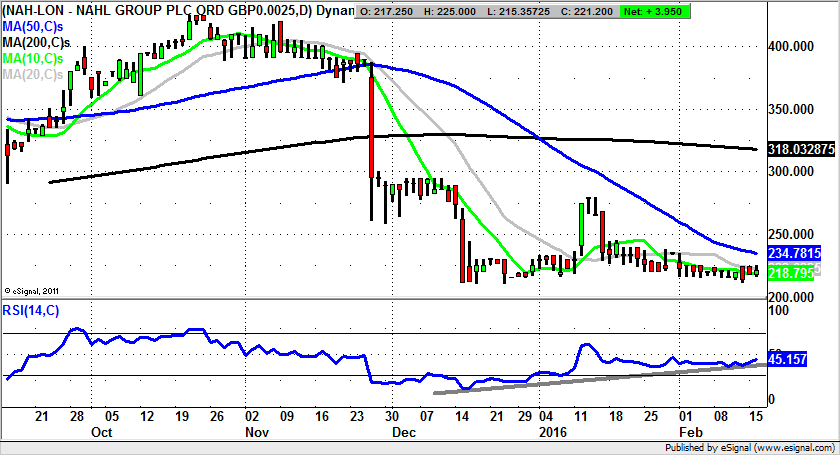

NAHL Group (NAHL): Extended Basing Targets 280p

I have decided in my old age (49), that the greatest service I can provide to private investors is to call a recovery in beaten down stocks, or as in the case of UK Oil & Gas (UKOG), suggest that it was a technical buy ahead of the fundamental revelations today. Hopefully, some people were facing the right direction ahead of the latest news from Horse Hill. In the case of NAHL Group it can be seen how there has been at least a limited basing in place since the middle of December, following the painful two stage breakdown in November. The present position is of course a delicate one for the bulls, with the ever present risk of a new leg to the downside. However, there is the plus point of a rising trend line in the RSI window from December, a significant leading indicator on a possible rebound. This would particularly be the case if we were treated to an end of day close back above the 50 day moving average at 234p. Such a momentum trigger would be expected to take the shares back for at least a retest of the January resistance at 280p over the following 4-6 weeks. At this stage only sustained price action back below recent support under 200p would really call the recovery argument into question.

Comments (0)