Zak’s Daily Round-Up

Market Position: Below 5,800 on FTSE 100 Risks Towards 5,000

BAE Systems (BA.): Safety in a Sin Stock?

With the geopolitical position appearing to be as precarious as it has at any time in the recent past, one would suspect that our friends in the aerospace/defence sector should enjoying life at the moment. This is particularly so after the latest report of no less than £1bn worth of arms being sold to Saudi Arabia, and backs the idea that so called “sin stocks” can be safe places to be in times of stock market turmoil such as we are in at the moment. Looking at the daily chart of BAE Systems it can be seen how there was indeed a period of outperformance by the stock over the period from the second part of September. This culminated in this month’s spike through the 530p level, to take the shares back up to where they were in April this year. However, it would appear we are looking at a situation which is probably a range situation rather than the potential breakout that we might have been counting on just a couple of weeks ago. The reason for saying this is the way it is possible to draw a rising wedge formation from as long ago as June, with such patterns typically being the forerunner of extended moves to the downside. The idea is backed in the way of the latest gap down through the 50 day moving average, a move which is equal and opposite to the gap higher seen in November through 470p. The implication of all of this is that at least while there is no end of day close back above the 10 day moving average at 513p, one would consider that this situation could fade towards the floor of the November gap running at 466p over the next 2-4 weeks, even if recovery is seen from that point.

Tesco (TSCO): Still off Its Technical Trolley

The usual rule for a stock or market which gaps up off its lows is that one would quite reasonably expect to see at least an intermediate rally. This is said on the basis that the shares have caught out the shorts and in their panic the price heads higher in a vertical fashion. However, as can be seen from the recent trace at Tesco on the daily chart, we have been treated to gaps to the upside off all the major lows within the main falling trend channel in place since as long ago as this time last year. The other point to note is the way that the rallies have largely stretched just above the 50 day moving average now at 158p, with the message being that one would be looking to go short of the shares between 5p and 10p above the 50 day line. This would mean that the notional entry on Tesco over the past few sessions could have been at 168p, fractionally below the actual January peak towards 170p. The position now is that we would be looking to an end of day close back below the 50 day moving average, and back below the RSI 50 level versus 54 at the moment – as the next clues that shares of Tesco are ready to head down again in earnest. Indeed, even at this stage it can be said that as little as an end of day close back below the 50 day line could lead shares of the ailing supermarket back towards the floor of last year’s price channel with the implied target as low as 135p. That said, the hope would be that the next breakdown will underline the way that there is perhaps lasting support for the stock towards 140p on a value basis.

Bull Call:

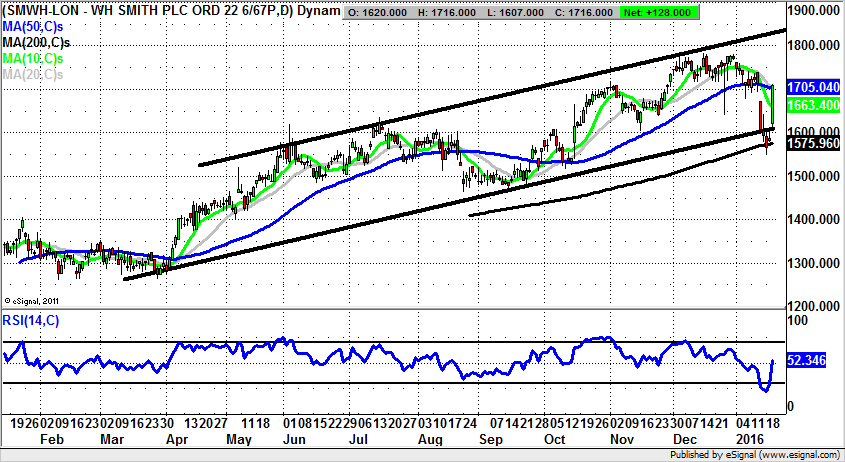

Buy WH Smith (SMWH): Airport VAT Rip-Off Play

One of the best rules about investing in the stock market is “don’t get mad, get even.” This may sound like a rule which comes from other areas of life, but the example of WH Smith will be one that I am sure most will understand. The reason for this is that by rights UK citizens are entitled to buy goods at duty free prices at the airport – as if they were offshore. Unfortunately, the 20% VAT charge is not typically passed on by retailers who simply ask you for your boarding card so that they can claim the money you were supposed to save. This is not so good for the ordinary person in the street, but very good for the likes of WH Smith – where their airport outlets are clearly going to be more profitable than typical High Street locations. Incidentally, if my description of what goes on in the Duty Free setting is not correct, I would be delighted to know what really goes on from the perspective of WH Smith. In the meantime, we have the honour of looking at the daily chart position of the retailer where it can be seen how there has been a sharp bear trap gap reversal from below the 200 day movinng average at 1,575p. The view now is that provided there is no end of day close back below the 10 day moving average at 1,663p one would expect to see a 1 month target as high as 1,850p at the top of a rising trend channel drawn from as long ago as March last year.

Bear Call:

Tullow Oil (TLW): Shocking Sub 100p Technical Target

Tullow Oil was until relatively recently the poster child of the idea where a minnow can join the FTSE 100, and therefore the concept of the multi bagger winner is alive and well for keen private investors. What can be seen here on the daily chart though, is the way that there has been a persistent decline within a descending price channel, one which has been in place since as long ago as May. The floor of the channel currently has its support line projection heading as low as 95p, with the problem by implication being that even after all the losses of the recent past, the stock with its RSI at 31 / 100 is not yet officially into oversold territory. Of course, even if it was oversold, in current momentum based markets, the shares could still keep falling considerably. The best technical call at this point would be that we see a further decline within the falling 2015 chart feature, even though it feels as though the stock has already fallen “too far.” In fact, at this stage one can say that any strength towards the 10 day line to improve the risk / reward ratio could be regarded as a buying opportunity.

Comments (0)