Zak’s Daily Round-Up

Market Position: FTSE 100 Targets 5,600 While Below 5,800

ARM Holding (ARM): A UK “FANG”?

One of the bigger disappointments for the UK stock market in recent years is that our technology plays have never matched up to what has been seen in the U.S., with no equivalent of the so called FANGS companies. This is even while we are told how hot the FinTech space in London currently is. To underline this, today witnessed a profits warning from ARM Holdings’s smaller counterpart Imagination Technologies (IMG). The event has dragged down ARM shares, too, with the risk now being that the FTSE 100 company gets tarred with the same brush as its smaller rival. From a charting perspective we are looking at a triple RSI failure over the past couple of weeks, as well as a dead cross sell signal between the 50 day and 200 day moving averages. All of this points towards a test for support at the June price channel floor at 800p, especially while there is no end of day close back above the 10 day moving average at 985p.

Small Caps Focus

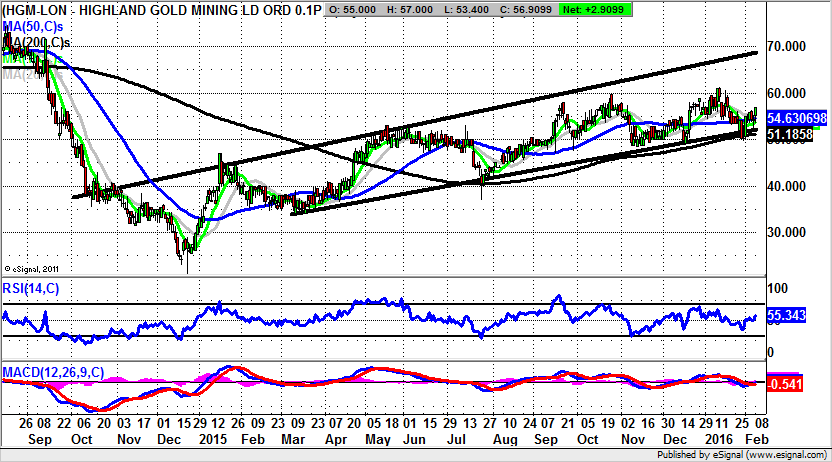

Highland Gold Mining (HGM): 70p Target within 2014 Price Channel

Of course, it may be the case that even though Gold is currently looking as solid as one might imagine, not all gold stocks are going to flourish in the flight to safety we are seeing amongst investors at the moment. But at the very least, one night expect there to be a reasonable recovery, provided the fundamentals are stable at the companies in question. It is to be hoped that Highland Gold Mining is one such stock which fits the bill for bargain hunters in this area. The reason for the relative optimism is the way that there has been a late January bear trap rebound from below the 200 day moving average at 51.18p. The implication is that provided there is no end of week close back below the 200 day line we should be treated to an October 2014 price channel top target at 70p over the next 2-3 months.

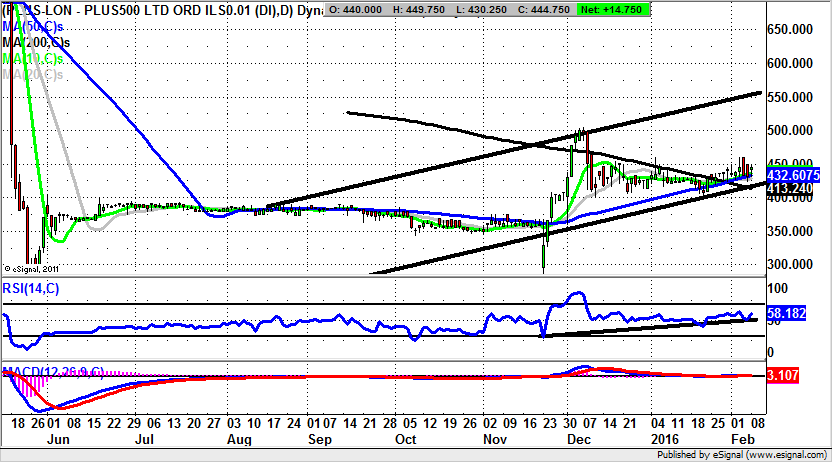

Plus500 (PLUS): 550p Achievable, Even After May Collapse

Although it could be said that a stock market sell off does not do anything in this particular asset class any good, the theory, to paraphrase Warren Buffett, is that when the bullish tide goes out, you can see which companies are robust and which are not. This is not only on a fundamental perspective, but also on the technical. All of which brings us to… er… Plus500. This is the company which had a few issues regarding its business in the online broking space, which can be seen on the daily chart from May last year with the decline from 750p plus to below 200p in just a few sessions. Cynics like myself initially got the impression that this was the start of a death spiral for the company. Instead, we have the cliché “What doesn’t kill you makes you stronger” apparently in operation here. That said, from a technical perspective we could still be involved in a dead cat bounce, rather than a fully fledged recovery. However, given my fundamental caution on the company, it may be surprising to confess in light of how weak the stock market is as a whole at the moment, that we could very well be witnessing a sustainable recovery here. This is especially the case while there is no end of day close back below the floor of a rising trend channel from August / 200 day moving average at 413p. At least while this is the case we could see a 550p target over the next 1- 2 months at the 2015 resistance line projection.

Comments (0)