Zak’s Daily Round-Up

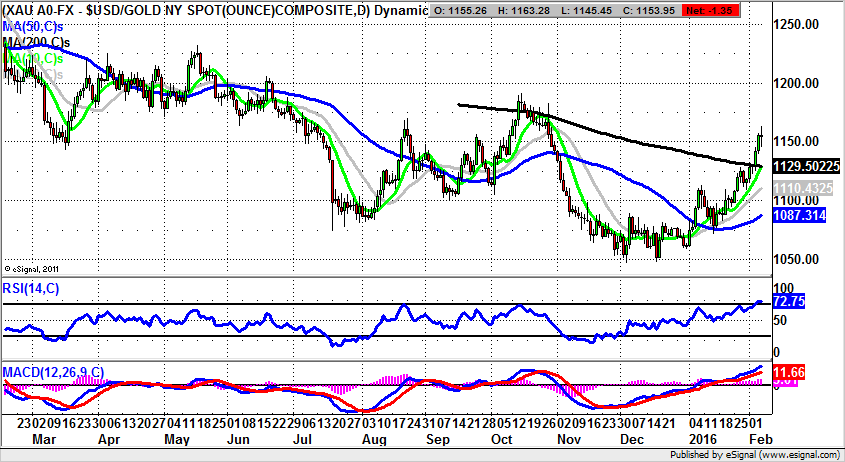

Market Position: Gold Targets $1,200 above 200 Day Line

BP (BP.): $60 a Barrel Forecast Saves the Day

Although I have to admit that I do not think there is a snowball’s chance in hell of the price of Crude Oil getting back to $60 as BP has suggested, the market seems to believe that this could be on the cards. Evidence for this comes from the way that the shares have rebounded from the worst levels of this week and this year towards 322p. Of course, the market has had plenty of time to absorb gloom and doom with regard to BP, especially given the way that the company has been on the receiving end of an extended financial slap in the wake of the Deepwater Horizon disaster in the Gulf of Mexico in 2010. This event clearly forced the company to look at its assets and liabilities and presumably decide what was best and worst about its strategy and portfolio. This may have had the benefit of delivering a rejig of its operations to leave it less exposed to the current severe downturn in the sector. Or at least this is what the bulls will be hoping for. That said, the negative argument would suggest that the only reason BP does not appear to be a total sell now, and is perhaps a dead cat bounce situation, is because there is a delay in what the company is reporting now – over a period when Crude Oil averaged, say $50 a barrel – whereas a real time update would have the company in an even worse state than the worst profits performance for 20 years. Nevertheless, it may be said from a charting perspective that, provided there is no weekly close back below the 320p zone, we could at least see a retest of the main post November resistance at 400p plus. Indeed, it would appear that the top of the November gap at 401p could make for a reasonable target.

Rolls-Royce (RR.): Profits Warnings and Fund Raisings

It would appear that after no less than five profits warnings in the recent past, jet engine group Rolls-Royce has become more famous for issuing negative RNSs, rather than producing anything which might enable aircraft to fly. This is said particularly in the aftermath of the latest $2.7bn jet engine order from Norwegian Aerospace Technology, which by rights really should have turned the tables in terms of sentiment towards this company. Unfortunately, it seems to be the case that the market holds this company in such low regard that even this delicious sounding order has not really turned the price action around. This is not too surprising as the financial press look to be rather more interested in speculation regarding a possible rights issue of £1bn being in the offing, instead of any great bonus from new business. However, even if the rights issue is sorely needed, it seems that from where we are now, with the shares having more than halved from their 2015 peaks above 1,000p, the treatment of the company has been rather harsh. This is because on the face of it, with crude oil prices at multi year lows, and the aviation / defence areas both very much in demand at the moment, one would venture to suggest – albeit cautiously – that the balance of risk at this point is back in favour of the bulls. This is even if there is a cash call. Indeed, it would probably be the case, even if the FTSE 100 was not also at its recent lows, and threatening at least an intermediate recovery. The fact that the index is so near to the floor of the range suggests that, at least while the 500p zone is held, a return to post November resistance at 600p plus could be on the cards over the next 1-2 months, even if the dreaded profits warnings are not finally out of the picture.

Small Caps Focus

Plethora Solutions (PLE): Above 2p Zone Targets 4p

Before I start off with the charting angle on Plethora Solutions, it may be worth disclosing that the fundamental business of the pharma group is something that is beyond me – and given the subject matter, I am happy for this to be the case. That said, looking at the daily chart of the premature ejaculation treatment group, it can be said that the price action of late has been relatively brutal, if you are a bull of the stock. In particular, there was the agony of the temporary break of the former November 2.65p support. The fact that the shares have just been able to break back above this level on a weekly close basis does provide a decent assurance in terms of the chances of at least an intermediate recovery. Therefore from a technical perspective one is able to suggest that, provided there is no break back below the 2.06p February support, the upside here should be towards the area of the 50 day / 200 day moving averages in the 4p zone over the next 1-2 months.

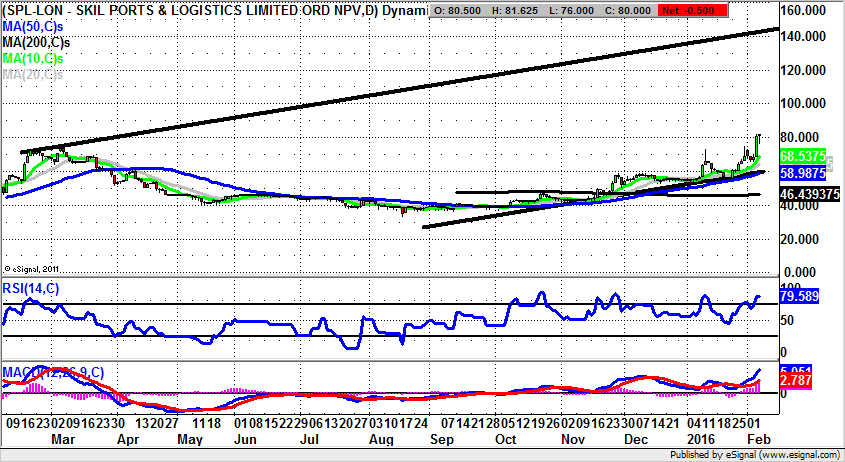

Skil Ports & Logistics (SPL): Extended Saucer Reversal

Skil Ports & Logistics does not perhaps quite sound like a company which could be in the FTSE 100, but at least from a technical perspective one can say that this is a situation which has very positive credentials. Indeed, one would say that given the backdrop of the stock market, and the way these shares have outperformed, one would expect great things, if not the full blue chip status one day. The reason for the relative optimism is the way that we have been treated to an extended saucer shaped reversal on the daily chart from as long ago as March last year. The stock is currently threatening to consolidate above the former 2015 resistance at 75p. The message at the moment is that, provided there is no end of day close back below this level over the next few sessions, one would be looking for a best case scenario target as high as the 2015 price channel top at 140p over the next 2-3 months.

Comments (0)