Zak’s Daily Round-Up: BRBY, CNA, RBS, CWR, NRRP and POS

Market Direction: Gold Support in the $1,260s Zone

Burberry (BRBY): March Bull Trap Gap Reversal

What still dominates the daily chart picture on Burberry is March’s bull trap gap reversal through the 200 day moving average. This is a relatively rare configuration, but one which can haunt a stock or market for months to follow. Indeed, it can be seen how the shares have drifted since that event, and frankly, do not appear to be very keen to rehabilitate themselves at the moment either. The fear that the longs would have currently is that at least while there is no break back above the 10 day moving average at 1,202p, one would expect to see further downside. This could still be significant, especially given the way that the floor of a wide trend channel from October has its support line projection heading as low as 1,000p. While this appears to be somewhat on the pessimistic side, we should remember how negative the March chart setup was, and of course at the same time be aware that the downside would be that much less if Burberry delivered a recovery of the 10 day line over the next couple of sessions.

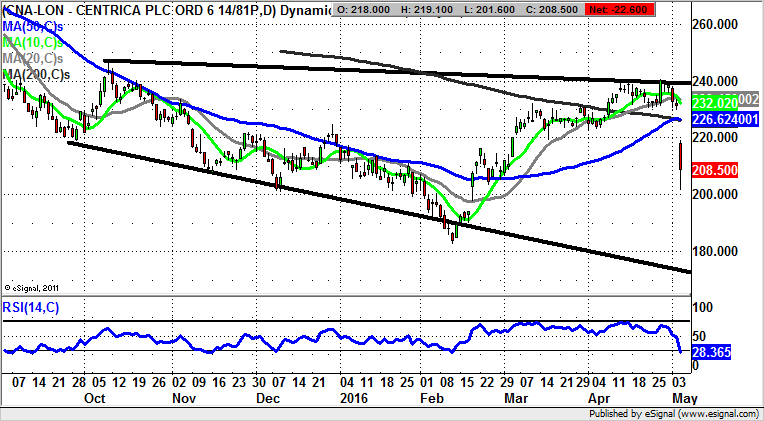

Centrica (CNA): Broadening Triangle Target at 175p

What is clear from the daily chart of Centrica is the way that it has not exactly been a pleasant ride for the bulls in the recent past. The reason for this on a technical basis stems from the April setup on the daily chart which was an island top reversal – a very negative configuration. To make matters worse, the formation was delivered above the 200 day moving average, now running at 226p, and falling along with the 50 day line at the same price. The problem now is that even though the stock is oversold on the RSI scale, at least while there is no end of day close back above the floor of the May gap down at 219p one would fear a further fall, despite all the near term losses we have already seen. The favoured destination in this respect is seen as being the floor of a September broadening triangle with its support line projection pointing as low as 175p. This area is regarded as being a valid target for Centrica over the next 1-2 months, or even sooner if we see a quick break of the initial May support at 201p early next week.

RBS (RBS): January Price Channel Floor at 200p

What has not been answered of late as far as RBS is concerned is why the Government owned bank continues to soldier on, losing some £30m a day? Presumably, the idea is to keep its highly trained and capable operatives off the streets? As far as the charting position is concerned here it can be seen how there has been a decline within a falling trend channel which has been in place since as long ago as the beginning of the year. The support line projection of the channel is currently heading as low as 200p, and given the woes of the stock it would be surprising if it did not drift down to this level over the next 2-4 weeks. At this stage only back above the 215.89p former February floor would even begin to delay the downside scenario.

Small Caps

Ceres Power (CWR): Still as High as 14p

The “breakthrough” that helps in terms of the charting of many small caps and illiquid shares is to encompass them in a triangle pattern. In the case of Ceres Power we can see how there has been progress within a broadening triangle which can be drawn in from as long ago as February last year. The resistance line projection target of the triangle is assumed to be as high as 12p, even after all the gains we have seen in recent days. This is especially the case given the way that we have an RSI reading of 80 plus. The message, therefore, is that while we may wish to see a cooling off for the shares, at least while there is no end of day close back below the former March resistance at 8.5p. The timeframe on the notional 12p target is the next 2-4 weeks.

North River Resources (NRRP): 0.3p Price Channel Target

We have seen a decent breakthrough for shares of North River Resources in the sense that there has been a clearance of the 200 day moving average at 0.125p. The assumption to make now is that provided there is no end of day close back below the 50 day moving average running at 0.10p we could be treated to further decent upside. The likely destination for the stock should be as great as the top of a rising trend channel from August currently heading to 0.3p. This could be achieved as soon as the next 2-3 months.

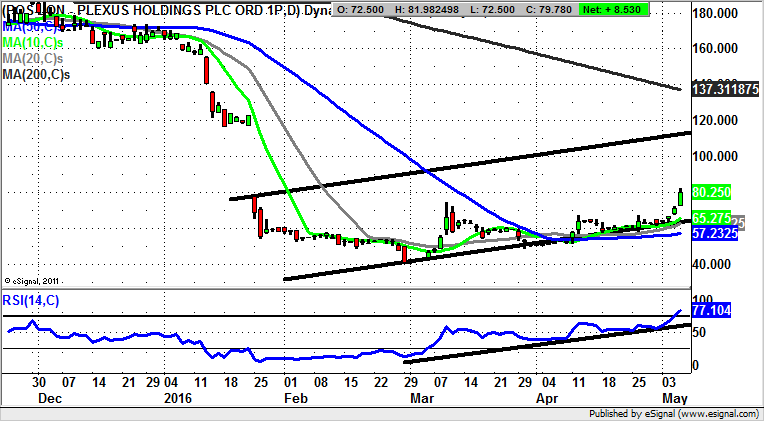

Plexus (POS): 115p Trend Channel Destination

We have been seeing an extended base on the daily chart of Plexus from as long ago as the end of January. Indeed, the overall pattern here is that of a U shaped reversal – one of the strongest in the charting textbooks. However, the big breakthrough for those seeking recovery has been with the April clearance of the 50 day moving average now at 57p. For May to date we have been treated to a near vertical jump with a gap to the upside, something which bodes well for the stock, despite having travelled so far in such a short space of time. The call currently is that provided there is no end of day close back below the 10 day moving average the upside here could be as great as the top of a rising trend channel which can be drawn in from as long ago as January at 115p. In the meantime any dips towards the 10 day line to improve the risk / reward of going long are regarded as buying opportunities. This is even though the momentum here looks to be so strong any pullbacks could be limited.

Comments (0)