Zak’s Daily Round-Up: BARC, IHG, NXT, 88E, KOOV and PANR

Market Direction: Nasdaq 100 Above 50 Day Line Targets 4,800

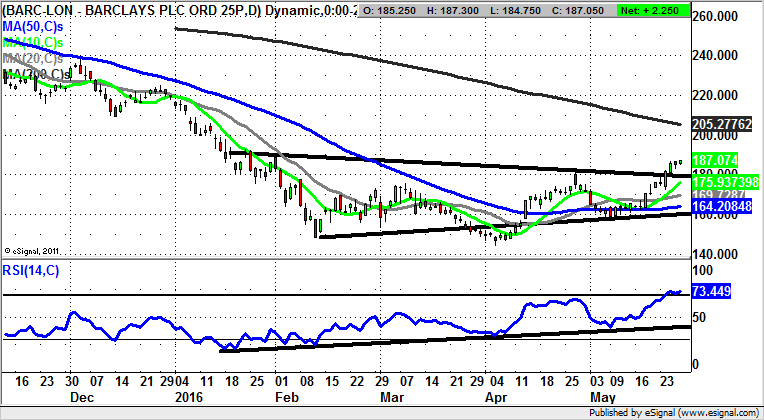

Barclays (BARC): Converging Triangle Breakout

Barclays has been a surprisingly, but nevertheless satisfying recovery situation over recent weeks. This is said despite the way that this particular commentator has an irrational aversion to banks, especially their “service” charges. I also have a problem in terms of working out exactly what the business model of the future may be, without investment banking, and with the advent of the so-called challenger banks. These organisations seem to have sprung up only to join the gravy train in retail banking, rather than work in the interests of the customer. But of course, that is the world of business. As far as the charting position of Barclays is concerned, it can be seen how we have been treated to a decent break of the post January consolidation pattern, a converging triangle breakout which could still serve up some decent upside. Just how much is on offer initially is suggested by the present level of the 200 day moving average at 205p. This is a valid destination over the next 2-3 weeks, especially while there is no end of day close back below the former April peak at 182p. At this stage only back below the 10 day moving average at 175p would even begin to question the idea that further upside is on its way. However, given the way that the situation is backed by such an extended uptrend line in the RSI window running through 40 / 100, it would be unusual for this bull setup to fail.

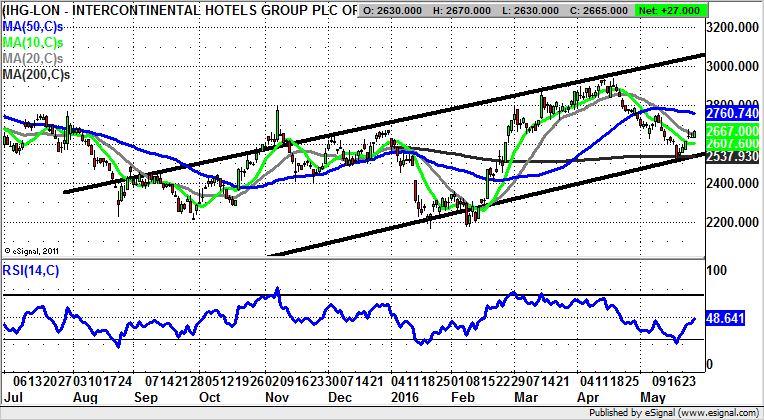

Intercontinental Hotels Group (IHG): Rising 2015 Price Channel

Although Intercontinental Hotels Group is perhaps regarded as more of an investing type of stock than a day trading situation, it can be seen from the daily chart of recent months that there have been decent swings in the price action. The latest event of note is the way that there has been a near perfect rebound off the 200 day moving average at 2,537p. This offers us up a decent technical trade on the basis that the 200 day line is a convenient end of day close stop loss, especially given that the floor of the main trend channel from August last year runs through this zone, and in the wake of the latest gap to the upside for the stock above the 10 day moving average at 2,607p. Therefore, the ideal scenario is that provided there is no end of day close back below the 200 day line we should be treated to a 2015 resistance line projection target as high as 3,050p over the next 1-2 months. Only cautious traders would wait on a clearance of the 50 day moving average now at 2,760p as a momentum buy trigger before taking the plunge on the upside.

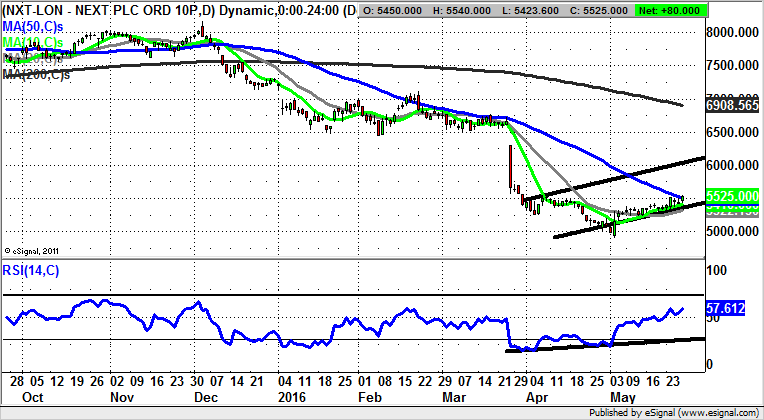

Next (NXT): 6,000p April Price Channel Target

Next has been as intriguing from a technical perspective as it has been on a fundamental basis. The problem here from a fundamental basis is the way that we have gone from a company which was a solid stock market darling, to being one where the rug was pulled rather unceremoniously. I would venture to suggest that in such circumstances it is only the charting side which can successfully warn us something is awry. This is because major technical sell signals can appear in a short space of time, all backing the idea that this is a situation which has turned from bull to bear. For instance, gaps to the downside, and the loss of the 200 day moving average, now at 6,908p, ahead of a dead cross between the 50 and 200 day lines in January. The position now is that we are in a rising trend channel from April, with a 6,000p target on offer if the shares can remain above the price channel floor at 5,410p over the next week.

Small Caps

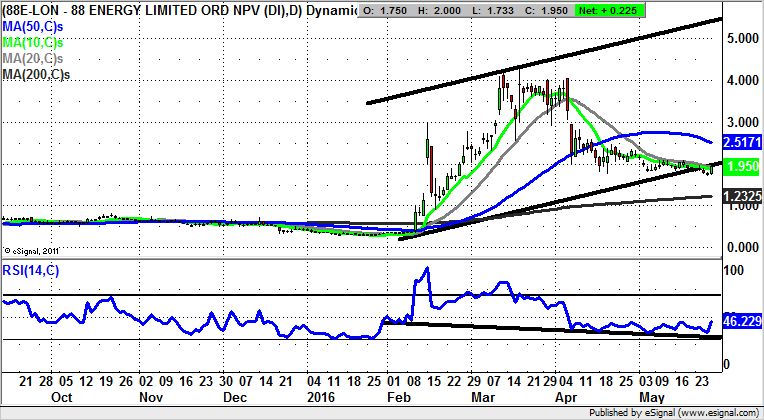

88 Energy (88E): Rising February Price Channel

There is little question that 88 Energy has been one of the small cap stocks of the year, and that this is said on both a technical and fundamental basis. For instance, the February climb included a vertical move to the upside via a gap higher, and was swiftly followed by a golden cross buy signal between the 50 day and 200 day moving averages. The position after that was that March actually served up a very negative pattern, coming in the form of an island reversal which led to the loss of the 50 day moving average, now at 2.51p. The ideal scenario in the wake of the latest weekly close back above the April floor of 1.76p is that we see a relatively swift move up to the 50 day line. But it will be an end of day close back above this feature which opens up the prospect of a top of 2016 price channel target at 5.5p, something the bulls would no doubt cheer whole heartedly.

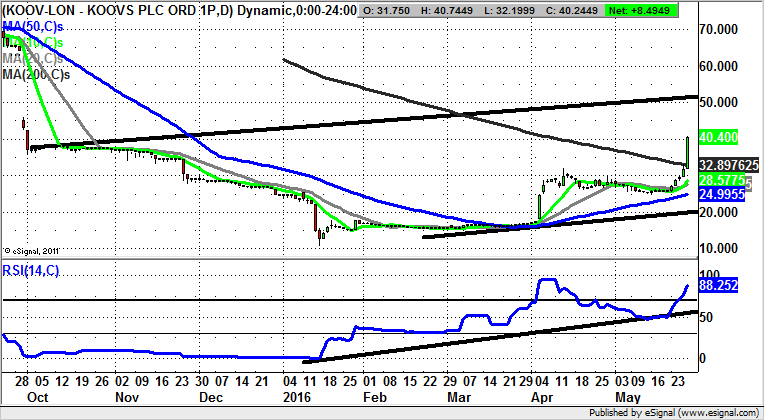

Koovs (KOOV): October Price Channel to 50p

It would appear that with Koovs, the promise of decent follow through to the upside in the wake of the vertical push through the 50 day moving average, then below 20p, at the beginning of April is starting to deliver. This is said in the wake of a second push higher, up to the top of a rising October price channel pointing at 50p. This is seen as the technical target over the next couple of weeks, although given how impulsive the price action here appears, there could be much more to come. Only a weekly close back below the 30p April resistance really questions the ultra bull argument.

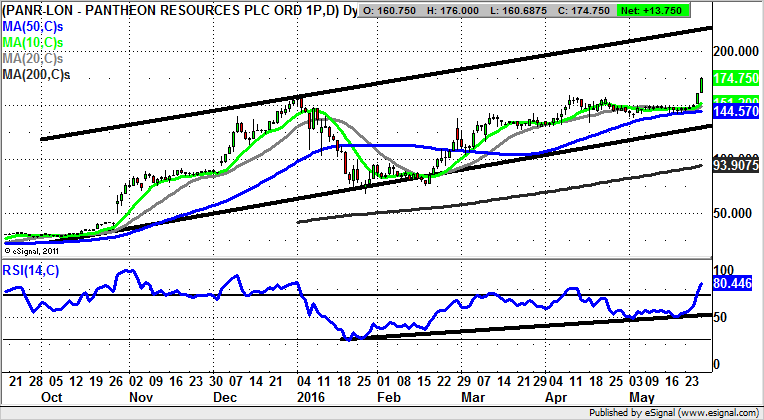

Pantheon Resources (PANR): New 220p Technical Target

Shares of Pantheon Resources have been and continue to be something of a lap of honour for the bulls. The latest development here is the weekly close via a near vertical move through the former April peak at 158p. The message now is that provided there is no break back below the April high, we could be treated to a top of October rising trend channel target, now pointing as high as 220p over the next month.

Comments (0)