Zak’s Daily Outlook: LLOY, CPI, 88E and PANR

Market Position: Dax above 9,090 Targets 9,790

Lloyds Banking (LLOY): Buttering up Shareholders

I am not sure whether after some seven years in the wilderness, shareholders of Lloyds Banking finally have a warm and fluffy feeling regarding the aftermath of the shotgun wedding between it and HBOS. This was clearly the work of the saviour of the financial world, Gordon Brown, someone who famously sold the UK’s gold reserves at the bottom of the cycle. Had he held on presumably the Gold reserves could have been sold to bailout HBOS without destroying the shareholder value of Lloyds Banking with a draconian People’s Bank of China type intervention. Even after all this time it is amazing that this horror managed to escape the financial media’s attention, and without, say, a class action lawsuit. But of course, financial journalists do not really have much sympathy for shareholders, and lawyers are very much on the side of the banks and the status quo. After all, the banking sector was the only one to be bailed out in the financial crisis, largely because most politicians are lawyers and banks – via mortgages and the housing market, are their principal source of income. You would not see such an intervention these days for the steel industry/manufacturing.

But getting back to the bank that charges you a service charge for an online account that pays no interest, and ratcheted up billions in profits after being given an anti competitive share of the market for taking on HBOS… Former Chairman Sir Victor Blank may have just defended the rip off; the rest of us can only watch in amazement at how he can back a concept which stands against every pillar of the free market. Perhaps the only plus to today was actually the new £2.1bn PPI provision, something which no one has been prosecuted for. In fact, the special dividend announced today looks to be a form of atonement for the sins of the past, and has caused the share price to jump 10%. This was understandable, as will be the prospect of the Government selling down more of its stake in the upper 70ps ahead of a reboot of the shelved public share sale last month. Chart wise, a push back to the 200 day moving average at 76p looks possible while the 50 day moving average at 65p, which has just been crossed, acts as support.

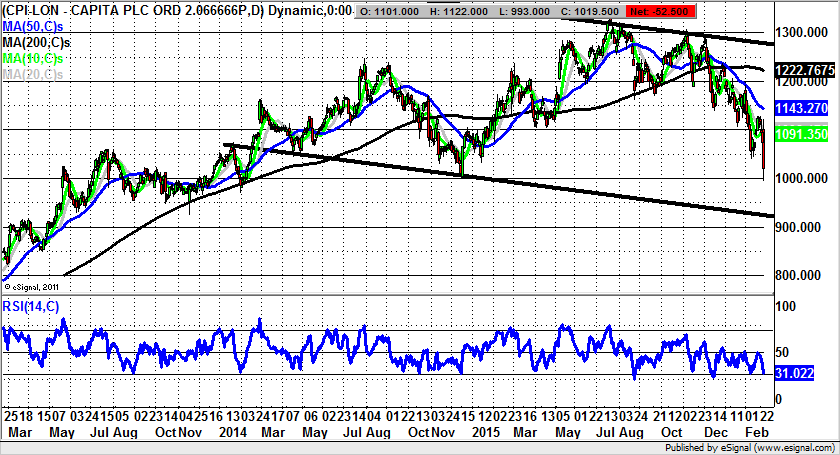

Capita (CPI): All about Margins

It used to be the case in the not too distant past that in times of austerity the services of the outsourcing giant were all the rage. However, this looks to be a case of there being the equivalent of the wrong type of snow, or leaves on the line. In theory, the type of services provided by this company should be very much in demand, but even for this specialist player, it would appear that current market conditions are difficult to play. The stress for the bull argument rests on margins and the bid pipeline. The former is promised to rise, even as the latter could improve. Not surprisingly the stock market is somewhat confused/bemused, a point backed by today’s 5% decline for the share price. But the problem here looking at the daily chart is the way that since the summer we have suffered an extended topping out towards the 1,300p zone. All of this implies a structural change in the fundamentals of the group, as well as a shift in sentiment on the part of investors. The risk now is that sustained price action back below the 1,000p level – post 2014 support – could lead back to the floor of a two-year descending price channel, currently pointing as low as 920p. This is the 1-2 months target in the wake of a weekly close back below 1,000p.

Small Caps Focus

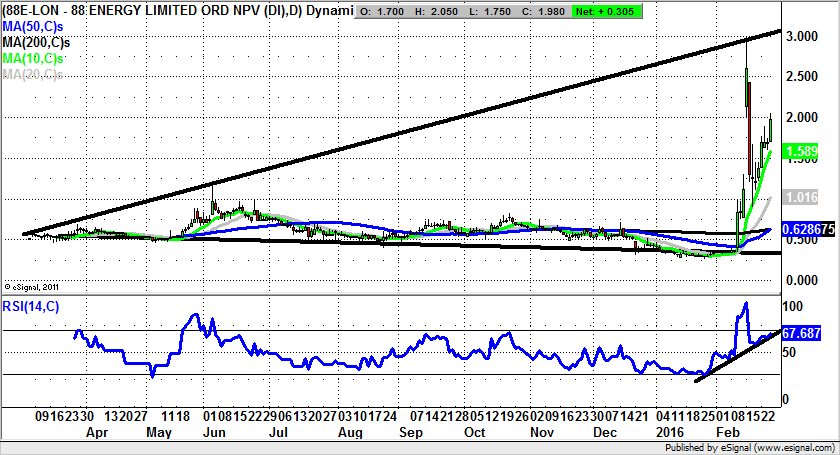

88 Energy (88E): 3p Retest Possible

I have to say that from a technical perspective I was one of the biggest fans of 88 Energy towards the end of last year, especially given the enthusiasm there appeared to be on the part of private investors who are normally well informed on Twitter. However, last month I rather foolishly listened to an alleged negative fundamental comment on the stock, and while I was still calling it higher, did not fully get the glory of having done the dirty work of identifying a base building opportunity. Of course, for February the shares have rocketed to a resistance line target at 3p, and then cooled off. But the position now is that we are in the run up to a golden cross buy signal between the 50 day and 200 day moving averages, something that could easily lead the shares back up to the 3p zone all over again. The stop loss on the buy argument, and the best trailing feature for the longs is the 10 day moving average at 1.53p. At least while above this dynamic indicator, we can back the idea of further recovery.

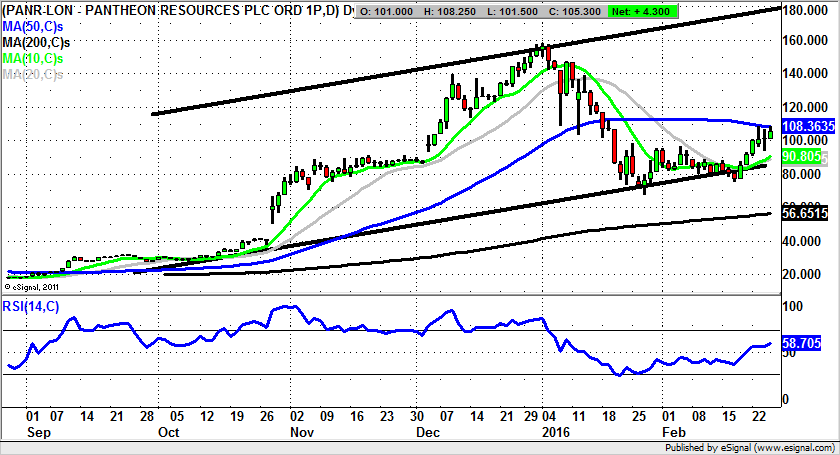

Pantheon Resources (PANR): A Return to Form?

It has been quite a ride at Pantheon Resources, and it could very well be the case that this state of affairs continues, given how much hot money will have gathered here over the recent past. The brace position for the bulls probably came and went with the January dip below the former November support at 70p. Since then the technical position has looked rather more robust, especially given the significantly higher February support at 75p versus January’s 67p. All that is needed now to trigger a return to the good old days of the autumn, during which the share price quadrupled, is likely to be an end of day close back above the 50 day moving average at 108.4p. This will hopefully be served up as soon as the end of this week. The good news with that is we would then be open to a journey towards the top of a rising trend channel from September as high as 160p. The timeframe on such a move is seen as being the next 2-3 months. The ultimate stop loss at this point is back below 75p.

Comments (0)