When 100 Tribes Go To War: Defence Darlings

You remember the Frankie Goes to Hollywood song Two Tribes, right? The one with the line “one is all that you can score”? Well war is big business now and many of you will have read my Final Word magazine article back in the August ’15 edition called “War! What Is It Good For? Absolutely Your Pension”. Logically, if you can score only ‘1’ if two tribes go to war, imagine what you can score if you get a hundred to go to war! ‘99’ would be the obvious answer, but it’s probably geometric or even exponential really. The truth is, as I wrote then, that if you don’t have some defence exposure in your portfolio then you don’t have a pension.

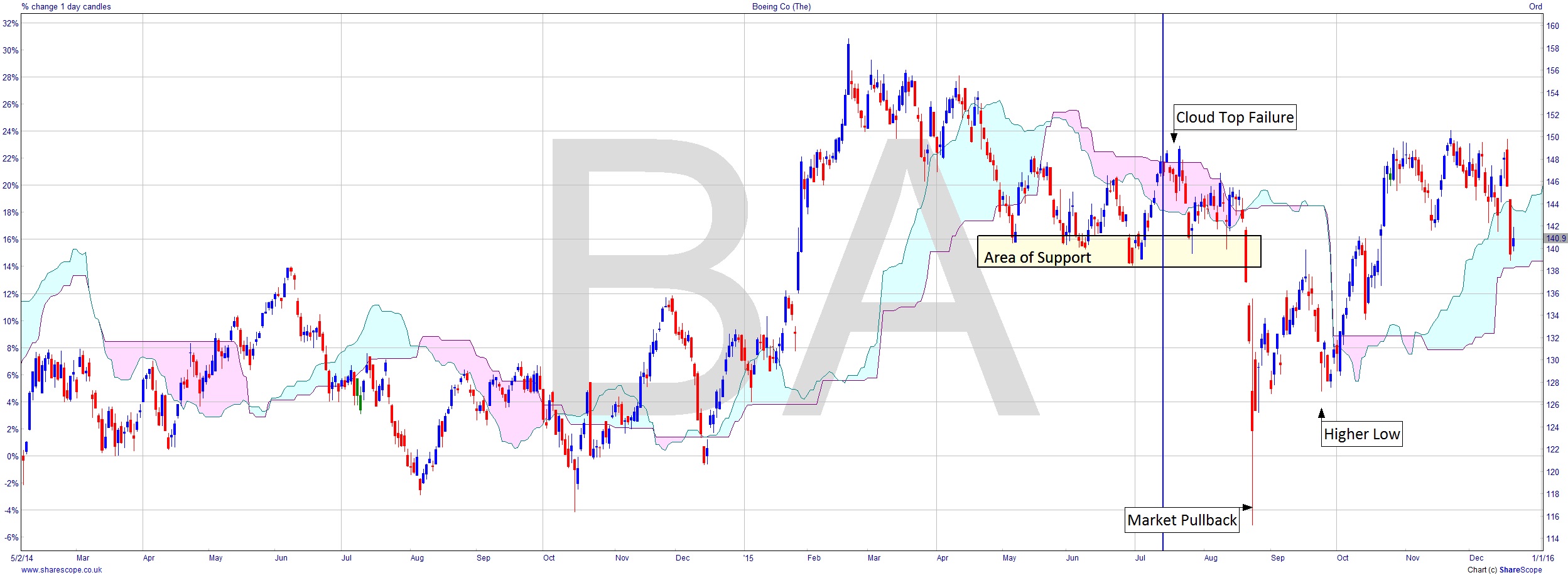

Boeing (NYSE:BA), having the excellent cocktail of Defence with Commercial Aircraft, has indeed proved to be a very good bet. The chart I used in the article was dated 15th July. I’ve marked that date with a vertical line. My main comment in terms of entry was “with the obvious caveat that we’ve just seen six years of rising US markets”. In other words, be wary of a pullback. We have an area of support going back at that point to May and I’ve marked that on the chart.

At the time, I remember this chart was knocking on the door of the Ichimoku cloud top. Had it successfully broken out we would have expected a leg up. However it fails, in fact, it fakes out. Fake outs are usually a good sign of a bigger move in the opposite direction. We see the price fall out of the cloud bottom a few bars later and after a bit of a struggle, where simply going sideways would have put the price above the cloud, it falls sharply into that Support Area. More spectacularly it goes right through it in one day. And we all know markets fall, in general, faster than they rise.

For the happy shorter, that was a great signal to take the leg down. But you might not want to short things for some reason, in which this was still a brilliant outcome. Even taking a very ‘safe’ entry by waiting for the failure to end, waiting for a Higher Low to seal the change in trend and then even for it to pop out of the cloud top, you’re in 10% lower than the price on 15th July. A 25% increase in profits announced in October would have been a nice gift, and with the candle about a week ago piercing the cloud top there’s a little signal that stops need tightening. This was followed by a little rally. A good time to halve a position, and you’d either have a loose stop under the cloud if you wanted to hold long term, or at the cloud top if you’re keener on banking profit.

The point is that the signals were there, and they were clear ones. I keep the charts I post here clear of clutter so you can see the salient points. On screen I have lots of other indicators and you’d probably think it was an on-screen acid trip. You have to use a screen set-up where you can identify what’s going on to suit yourself and your trading style. A tidy desk may be the sign of a sick mind, but an untidy trading platform is the sign of a poor education. Ergo, poor results.

Comments (0)