The UK Market is Toxic

Lefties are constantly on about how trickle-down economics doesn’t work. You introduce money into the economy and the idea is that it works its way down to the man in the street. Sounds a lot like Keynes’ Multiplier Effect to me. A lefty policy to introduce money into the economy which creates economic activity. You can’t have your cake and eat it though. You first have to actually buy the cake. At least not on the black market. The problem here is we have no economy, only the illusion of one because of all the money that came from PIGS countries to park itself in London after the financial crisis. We have avoided a full blown noticeable recession here in the South East precisely because of trickle-down economics.

Austin Reed followed BHS into administration this week. The retail landscape out there is not bleak. The companies must have been really making a balls-up of things. Completely misreading the market place and committing to a succession of poor decisions (if at all).

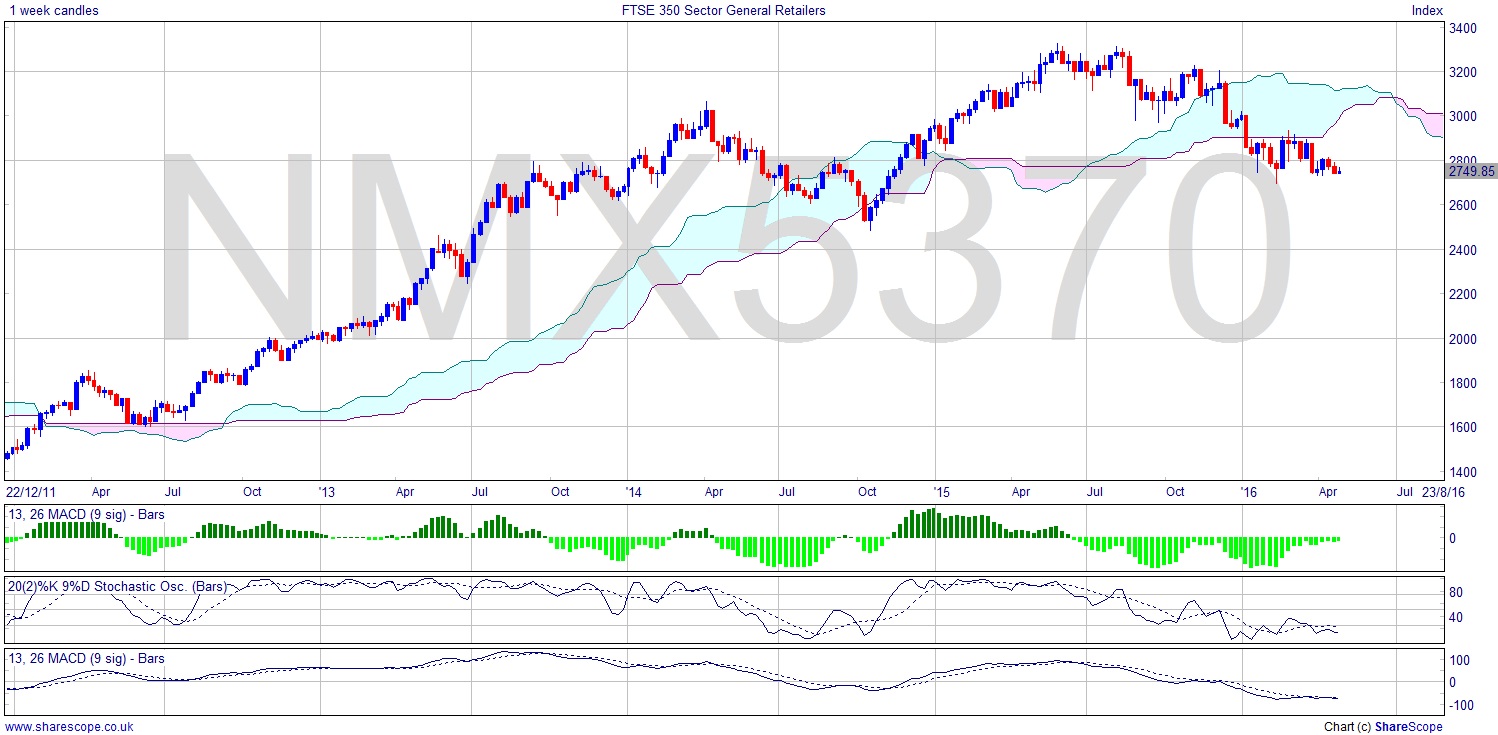

The sector charts are a good place to check the pulse of British Retail. General Retailers (NMX5370) is no longer bullish, but if we’ve already seen two failures this week then there are lots more to come. I understand Philip Green is to be hauled before MPs to answer questions as to why MPs didn’t see this coming. One simple reason: they evidently don’t read my articles. The biggest threat to us all is not these businesses going under. That’s just a bit of inevitable unemployment, which is inevitably on an incline anyway. It’s the fact that these pensions black holes are being underwritten by us, and they exist in part because companies have been allowed to borrow against them and can get their greasy little hands on the money.

General Retailers (NMX5370) is clearly bearish, and that augurs more retailers going into administration. But it’s only just turned over, which shows how weak and pathetic the High St Retailer is in terms of balance sheet to be failing already. Perhaps thanks to flamboyant borrowing at low interest rates, or simply because they haven’t been making margin. In many cases due to a failed online policy, if any.

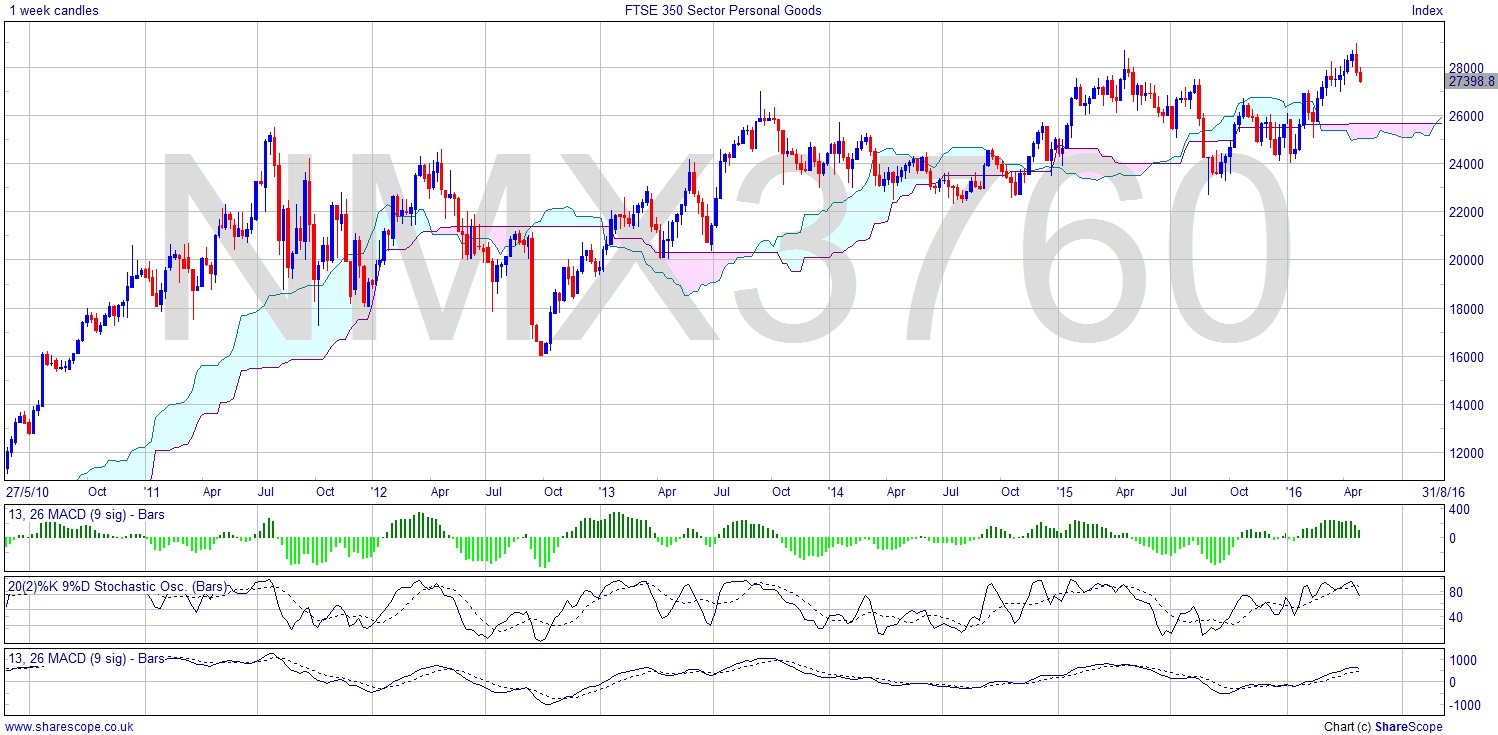

The other sector I’m looking at is the Personal Goods Sector (NMX3760). Well this sector isn’t even weak. So all the more pathetic to fail in this climate then. That’s another ATH there last week on the Personal Goods Sector.

Unemployment here in the UK is an outlier on the Unemployment bell curve. It should be around 10% which is the new normal. So these jobs are being paid for by a sacrifice elsewhere in the economy. Variance normalises over time and the number will rise to reach equilibrium.

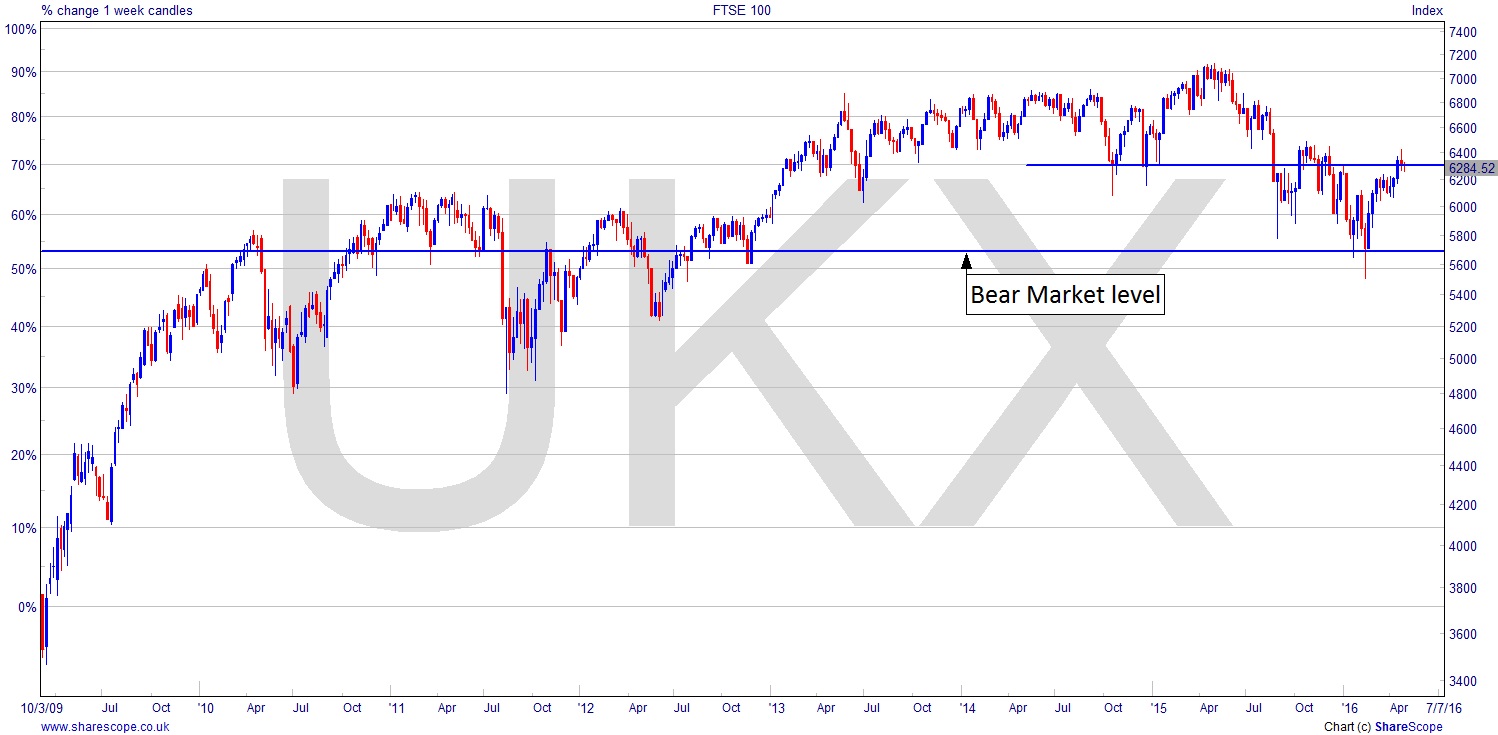

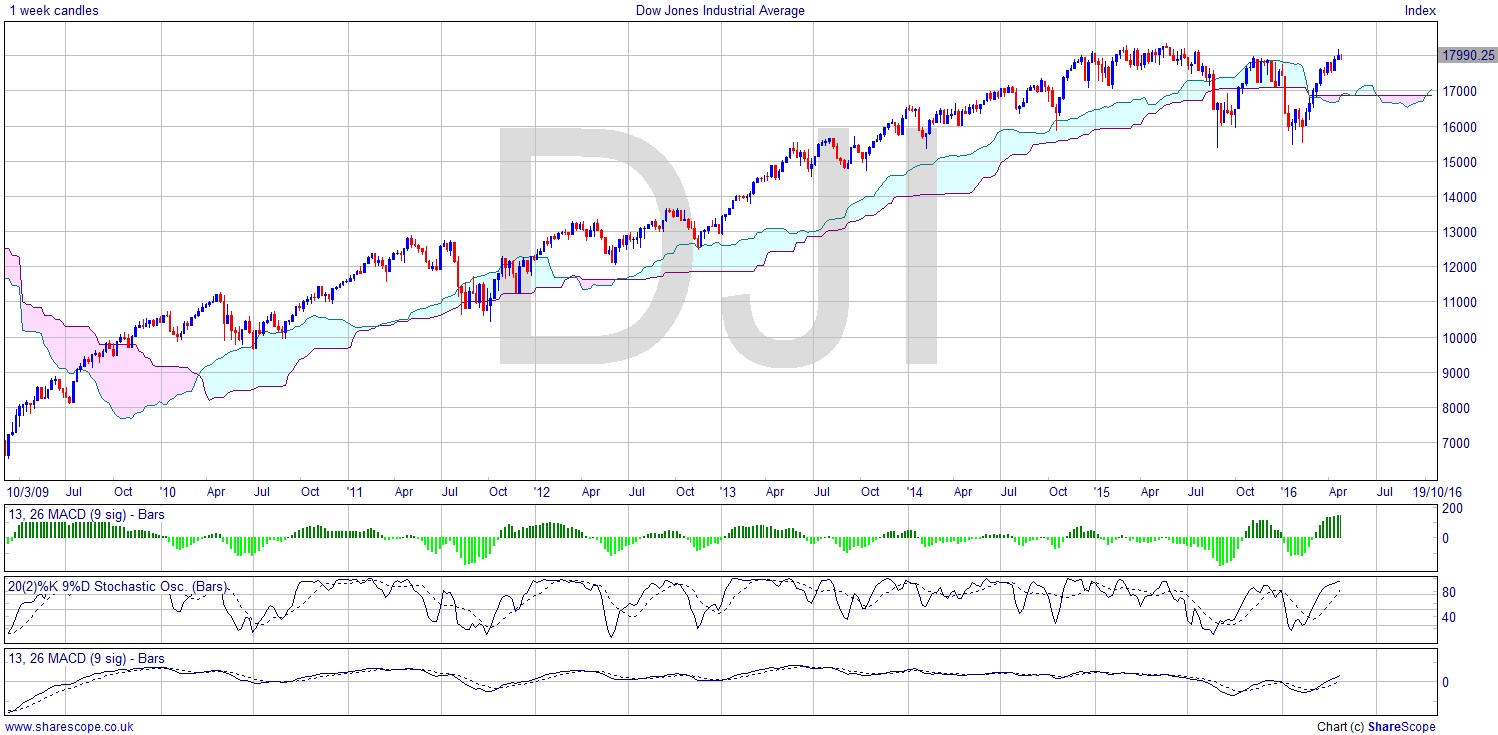

So how does my least favourite index the FTSE100 (UKX) look? Well the support level at 6,300 has now offered resistance to the present rally attempt. It’s not over yet but bear in mind how the US markets have been performing lately, nudging the ATH on the Dow, for example. And it’s not the Brexit effect. In the US they’re dealing with the Trump effect in a Presidential election year. So don’t lull yourself into a false sense of security. The UK market is toxic.

Comments (0)