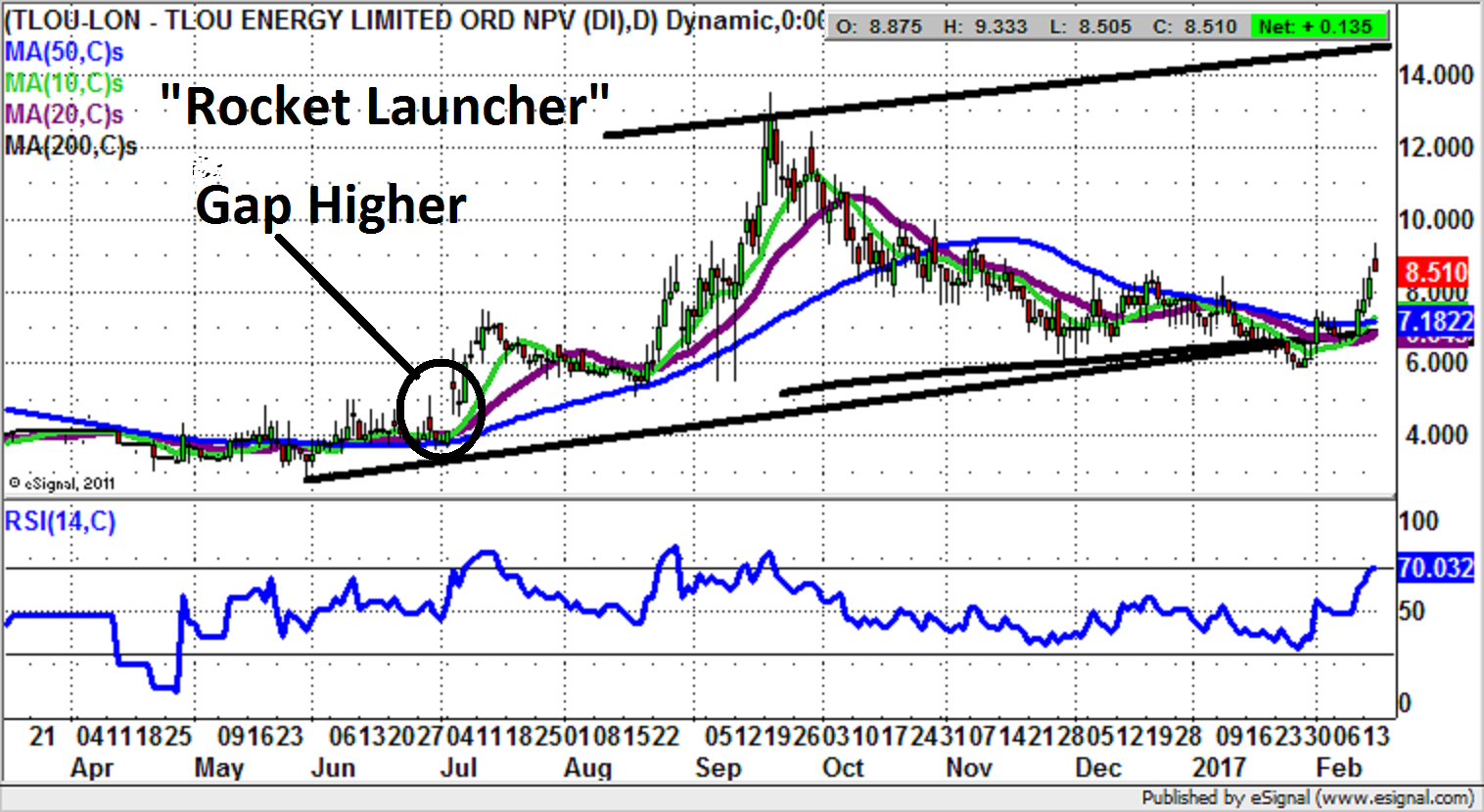

Tlou Energy: “Rocket launcher” set up could lead to 14p

One of the technical setups which I enjoy, especially when it produces the fireworks it is normally associated with, is the gap through the 50 day moving average. Tlou Energy (LON:TLOU) exhibits this from as long ago as July last year.

From a technical perspective it could be said that fans of Tlou Energy have been waiting in the wings a little longer than they might have wished for. This is particularly so in the wake of the shares peaking in September above 13p. Since then they have effectively halved, something which is never pleasant even if you are in a stock from the lower levels.

What may be worth noting in terms of the daily chart is the way the shares have left behind one of the better setups in the technical analysis textbooks: an unfilled gap to the upside through the 50 day moving average. This is a setup which I describe as the rocket launcher, as its presence tends to precede some of the more explosive rallies on the market. Indeed, this setup was in place last summer ahead of the big move higher for another stock market minnow – Edenville (LON:EDL).

What provides grounds for optimism at Tlou Energy currently is the way the latest news underpins the idea of recovery here. This is because it has just announced a material increase in 3P gas reserves for its CBM project in Botswana. Indeed, the run up to the news has already witnessed a decent push higher, taking the shares well above the post-July support zone just below 6p. Indeed, the technical message now is that provided there is no weekly close back below the 50 day moving average at 7.19p the upside here is expected to be as great as 15p over the next 2-3 months.

Comments (0)