The Greek Crisis Is Far from Over

The main news flow this week has been related to the apparent capitulation of Greek PM Tsipras to extremely harsh EU demands. This triggered a vote via the Greek parliament to approve the plan, leaving the Greek population angry and confused – after all had they not just voted to reject the previous bailout conditions just the weekend before?

The fact is that the recent referendum appears to have been largely symbolic, or to put a blunt interpretation on it – a waste of time. European officials sadly have a habit of finding loopholes to suit their needs – such as when claiming their previous agreement with Britain that no new funds would be spent on Greece was merely a ‘political’ agreement and not written in law.

On the issue of law and mandates, the Tsipras government survived a rebellion, with ‘just’ 32 defectors opposed to the new legislation. This was seen as a minor triumph for the government, as a figure over 40 could have seen a reorganisation and possibly new elections.

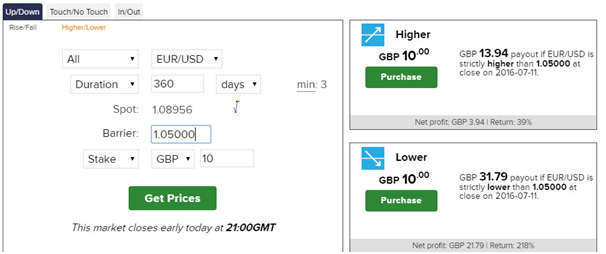

The euro has hardly been running laps on the back of the news, with the EUR/USD dropping steadily throughout the week. There are some macro-economic reasons for this, primarily the advance of the US dollar. Fed Chair Janet Yellen hinted that US rates would rise sooner rather than later, boosting the dollar and sending most dollar pairs on a negative trajectory this week.

EUR/USD

Still, it is not as though we have seen the euro stage a serious rally as you might expect on the surface. The fact is that investors know that this latest deal may change very little for Greece and Europe. There are already doubts about the Greek ability to deliver the required reforms when it has so far either refused or been unable to deliver on previous privatisation plans.

Prior to the latest deal, many analysts were pointing out that Greek debt levels were unsustainable and that fiscal authority on the scale required is hardly going to spur growth. No-one denies that Greece needs to get its house in order, but even assuming a best case implementation of the current and past bailout requirements, the imbalance is too large. The IMF pointed this out this week in a leaked document that appeared to state that the organisation would have no part of the latest bailout unless debt haircuts were considered.

There have been vague promises of this in the EU agreement, but politically this is a hot issue. Although likely self defeating, many of the creditor nations needed punishing bailout conditions in order to justify fresh funds to their own electorate.

The saddest point of this self serving perspective is that all this has been predictable. We’ve known for months, nay, years that Greece cannot support it self and that dramatic action was required. Instead we have another round of ‘extend and pretend’. The Greek crisis is not over and that is why there could be further downside from here for the EUR/USD.

Disclaimer: This financial market report is intended for educational and information purposes only. It should not be construed as investment or financial advice, and you should not rely on any of its content to make or refrain from making any investment decisions. Binary.com accepts no liability whatsoever for any losses incurred by users in their trading. Fixed odds trading may incur losses as well as gains.

Comments (0)