The Getaway That Got Away

I wrote a blog post called ‘Cruising Home’ (July 3rd 2015) about cruise lines and how they are likely to remain pretty much bullet proof over the coming years. By contrast the more traditional bucket shops are not faring quite so well.

A lot of the go-to cheap, hot places have got problems now. You, like me, may have had more than one invitation to go on a 2-week holiday to Turkey, including flights and pretty much everything for around £200. The angle is that it’s a thank you for being a good customer of some company or other. The reality is that no one wants to go to places that border with Syria, and that’s just the tip of the ISIS-berg (sorry).

Thanks to poor communication, from what I gathered watching the Panorama programme about it, the holiday-makers in Tunisia were exposed to a risk they were unaware existed.

Is it a real worry though? Not just people being over-careful? Like in 1991 when the Americans stayed away from Europe in their droves because they didn’t know where Iraq and Kuwait were. There is a precedent here.

My mum went on holiday, much to my surprise, to Libya a few years ago. She’d already been to Egypt a short while before the Arab Strap, or Arab Spring, or whatever it was, sprung. This time it was a little too close for comfort though, as she had to be evacuated along with hundreds of others. The British Embassy evacuation effort was appalling apparently, and she actually left courtesy of the United States. Even so it wasn’t a picnic. After being in a hotel within earshot of gunshot, it was a few days on a boat waiting for the weather to improve so they could get to Malta. The weather didn’t really calm down and in the end they had to head off anyway.

TUI and Thomas Cook are the main FTSE travel agents. I presume they’ll both be extending more into places like Bulgaria to replace destinations like Tunisia and Turkey. The point of budget holidays is you’re basically paying for a flight in order to take advantage of buying power massively skewed in your favour, whilst avoiding risks to one’s life. It’s the corollary of being an economic migrant: economic tourist. Lefties should be aware that their holidays are in essence ‘off-shore’ next time they criticise someone for storing cash perfectly legally somewhere tax advantageous. Cheap holidays don’t exist in a world of minimum wages and the sort of economy we live in. Oh, and Duty Frees are tax planning. It’s like the old adage, in this case: “we’ve established what kind of left-wing tax-avoiding hypocrite you are Lefty, we’re now merely haggling over the price.”

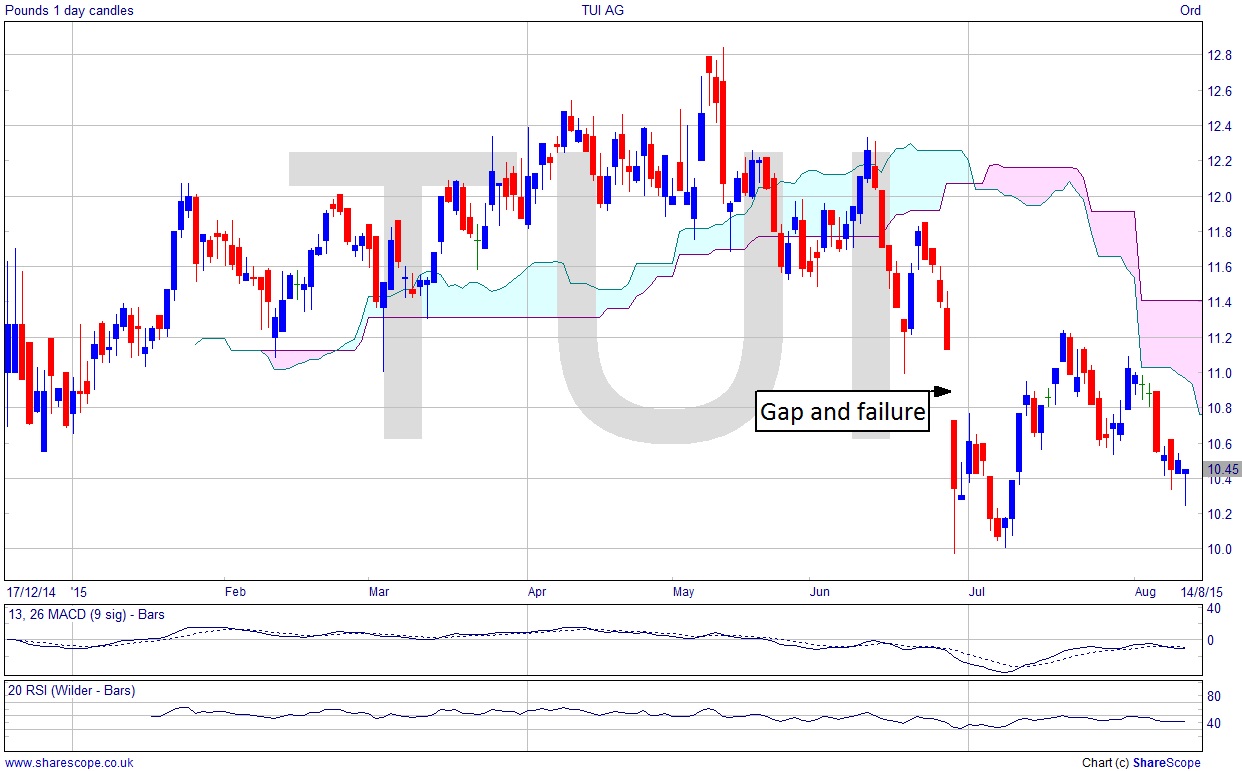

TUI is a fairly short chart with less than a year of data. We can see that it gapped down though in June and has struggled to recover. OK it filled the gap. So what? What has it done then? Failed. It’s below the cloud and is falling to its ATL. Could be worth putting on your watchlist for shorts. Plus it’s German if you’re still bent out of shape over WW2, or the royals, or snide comments about the 1966 World Cup.

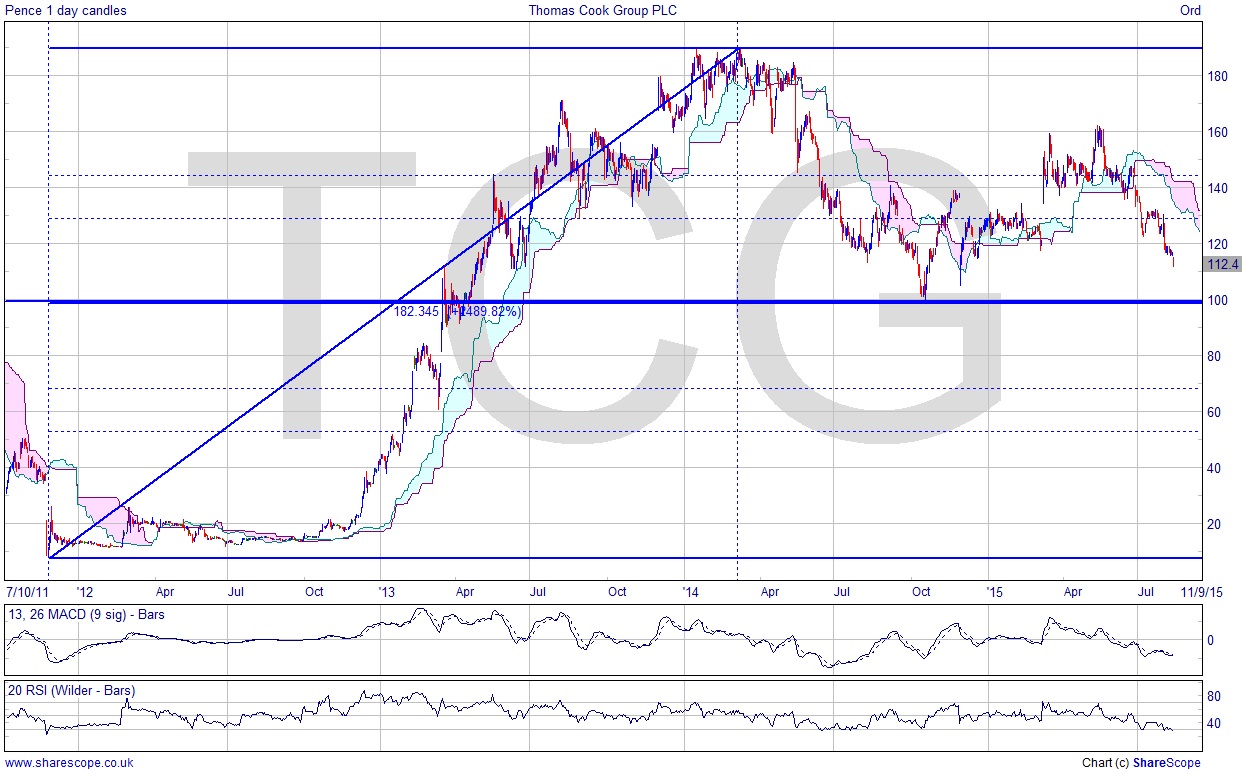

Thomas Cook is an interesting one. The share price failed miserably in 2011, dropping to pennies, never having justified its ATH on the first bar of this chart, a shade over 300p. I’m guessing it’s been revalued at some point since the price is a decimal. It then recovered to almost 200p before falling back to the 50% retracement from the 2014 high. It has gapped a couple of times since then, but like TUI has failed and is now looking fairly miserable. Could there be a take-over in the offing? That’s the thing you always worry about with well-known brands and short positions. I’d be thinking of protecting a short like this against such an outcome. The support level at 100 is interesting. That’s the flash-point on the short side.

Comments (0)