Stores of Wealth

During a lifetime there are bound to be times when normal rules don’t apply. We’ve been very lucky in the developed world that our leaders have managed to export war, and, for the most part, civil unrest more or less completely since the war.

However, that is a situation that, should we apply the risk rules of trading, almost certainly can’t persist, and thus one we need to hedge against.

For Brits the main store of wealth is residential property, most likely our own home. But increasingly we are releasing the capital in our homes, for example, to counter dwindling annuity rates – another thing that will come back to bite us on the arse as and when interest rates do rise. Low interest rates have gotten us used to an almost slow-motion economy. The problem is that because as humans we find patterns everywhere, whether they exist or not, this is at once the secret to our success but also the reason we often don’t see the obvious coming, or simply deny it if we do. When things speed up it’s going to be a smack in the face for most.

Governments will always be looking for the next thing to tax. Pensions have been hit and now homes, although they’ve only worked out thus far how to tax at the point of sale (I regard local taxes as inevitable). In France, Italy, Spain, Norway, Switzerland and India they tax their citizens’ wealth, over a certain lower limit, at around the 1% mark. So don’t think it couldn’t happen here. Actually it would have been a smarter move than increasing stamp duty, if they really wanted to keep the housing market alive but more sedate.

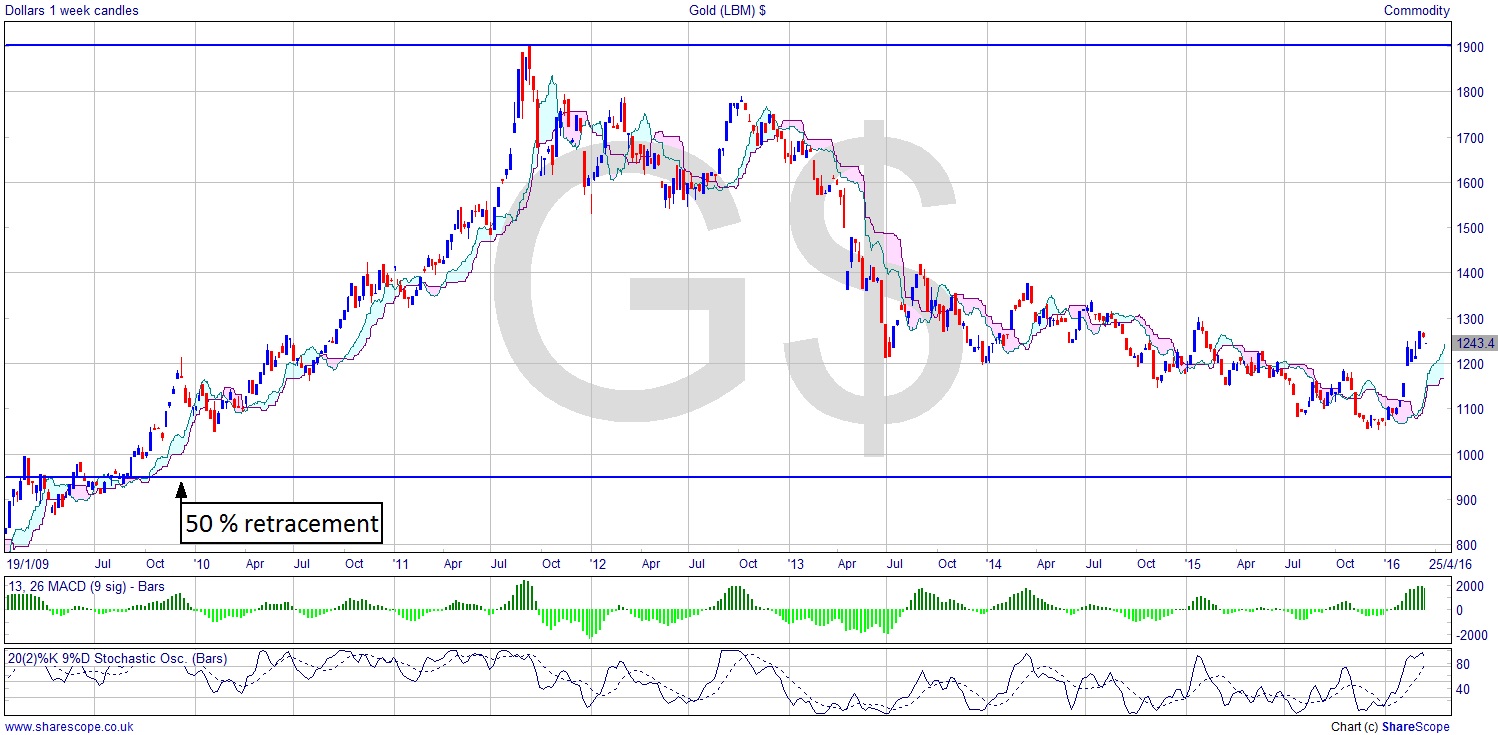

The obvious stores of wealth you can grab in an emergency are traditionally gold and jewellery. Gold (LBM) [G£] is looking quite bullish right now. John Paulson is the man responsible for the biggest trade in history, on which subject there is an excellent book called ‘The Greatest Trade Ever’, by Gregory Zuckerman, if you have an interest in how he did it. Obviously it wasn’t by doing what everyone else did, so it’s a valuable lesson for private investors. Paulson likes gold. Granted not quite as much as he did five years ago, but people should be more ready to follow his example than blindly following Warren Buffett.

The chart has reached the highest GBP level since 2013. The gap up is a really good sign of strength seen just a couple of months ago. If it was in a trading range before that, then it has confidently broken above it. How does that compare with the USD chart? Not quite so bullish but the gap is there too, and it’s above the previous high from last autumn. It’s the best it’s looked in a few years now, having averted a 50% retracement.

The one thing I hear people asking about though is diamonds. Gold is heavy and bulky, so while you might be able to grab some in an emergency, what you can fit in your pocket won’t last long. Enter the diamonds. While testing gold for authenticity is relatively simple using a little nitric acid, with diamonds you need to be prepared. Or at least anyone who might want to accept them for payment will need to be prepared. I don’t think most people are, and you’d end up ripping yourself off giving away far too much. That said they are quite portable.

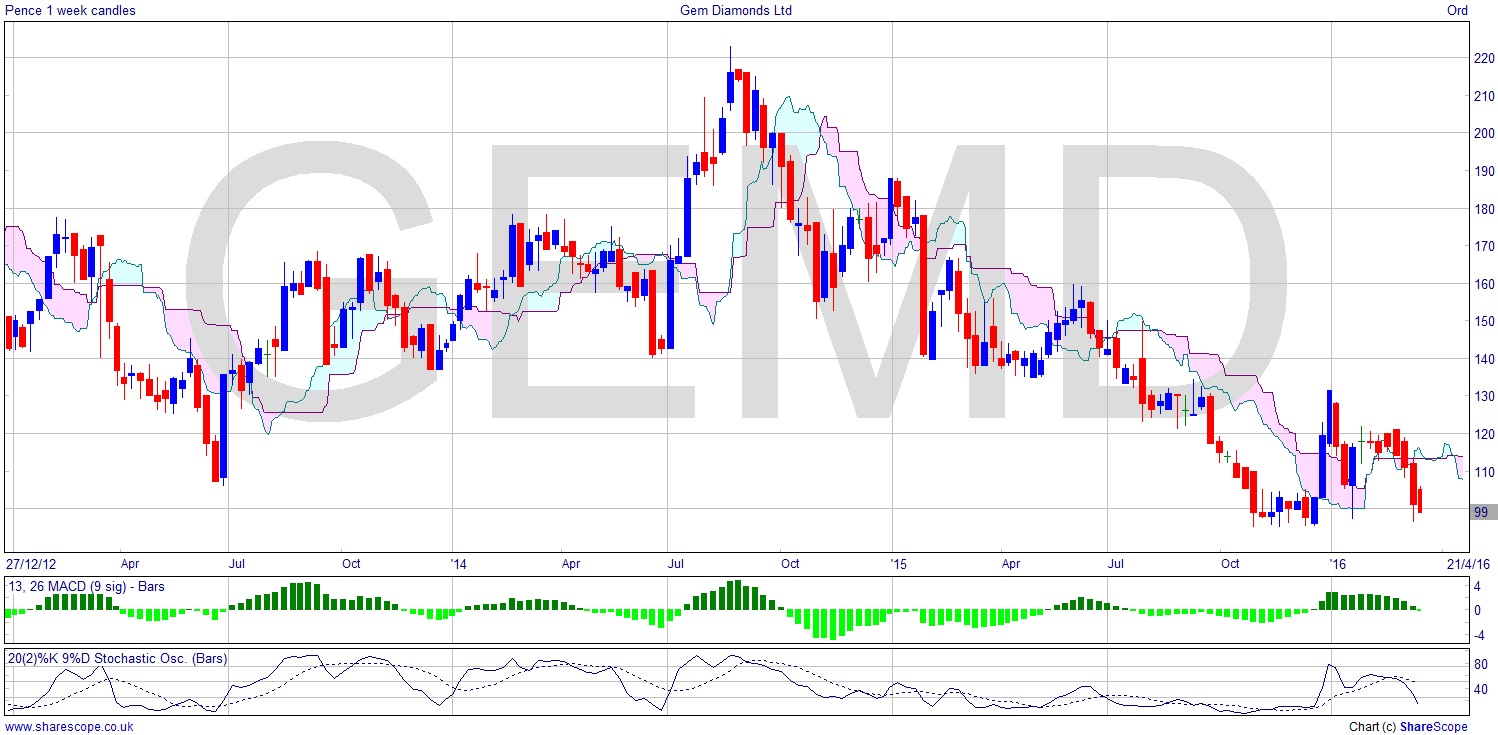

Gem Diamonds Ltd [GEMD], listed right here on the LSE, is an interesting looking stock. Priced at over £10 per share in 2007, it’s been lacklustre since 2009 at around £2 or £3, and it’s more recently fallen to £1. You could almost regard it as a penny share given they are so upbeat. Diamonds have made a steady recovery it seems, and Gem Diamonds are being sensible about expenditure, if company executives are ever to be believed. This could be a snazzy recovery stock with a huge potential upside. There’s a very nice £1 support level, well 95p, and if you allow breathing space 90p for stops, perhaps. Not all the ducks are in a row. The MACD isn’t really ready, but that can change quickly. It’s definitely one for the watchlist. Alternatively, you could just buy some diamonds, and good luck finding a definitive price chart for that! But do make sure you have the skills to tell the real ones from the fake ones.

All in all it’s amazing neither of these convenient stores of wealth have been rocketing up given what’s going on in the world. But we are, as investors, order takers in the sense that we have to play the hand the markets deal us. It might be good to be holding diamonds though.

Comments (0)