Sovereign Mines of Africa: Wedge breakout to target 0.8p again

It would appear that in Sovereign Mines of Africa (LON:SMA) we have a company with a little more personality than many of its sector peers.

Although there has been little by the way of newsflow from this cash shell, the recent past has been noteworthy. This is because the farm-out of its key 75% owned Mandiana Gold Project last year was Ebola related given that this resource lies in Guinea.

The other focus of the group in the recent past has been its personnel, coming in the guise of former Chairman of the English Cricket Board, Giles Clarke. No slouch in business, he is the founder of Majestic Wines.

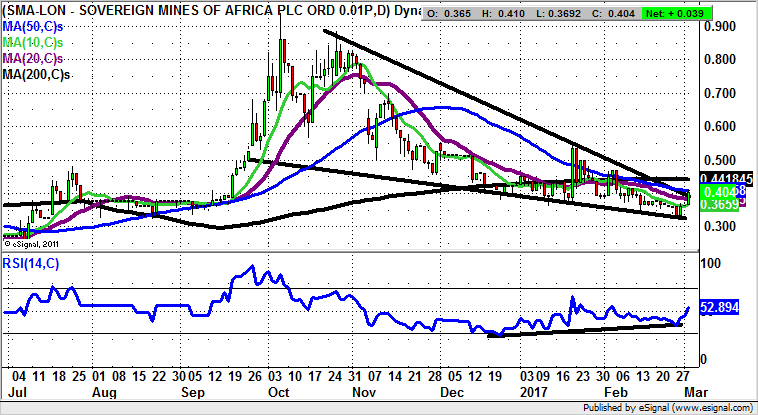

Of course, the key to the Sovereign Mines story now is what happens next, both on the fundamental and the technical front. Perhaps it may be argued that it is easier to focus on the latter given that the shares appear about to break out of a clear wedge formation which has dominated the daily chart since last September.

Indeed, the best way forward for traders may be to focus on the 200 day moving average at 0.44p, just above the top of the wedge. A weekly close above this feature should be enough to trigger follow-on momentum towards the 2016 resistance zone through 0.8p over the following 1-2 months. Only back below the post-August 0.3p support really upsets the recovery scenario here.

Comments (0)