Can Brazilian stocks continue to rally?

After three years of subdued performance, there are once again signs of life for Emerging Market equities, including Brazil. By the end of 2015, the main Brazilian stock market, the Bovespa, had seen five years of annual negative performance – the longest in dollar terms since 1983 – as the index became a lightning rod for myriad economic and political stress factors in the country, including impeachment, recession and downward pressure in global commodity prices.

By the middle of last year, the index was ranked as one of the most volatile in the world. However by the end of 2016, the Bovespa followed broader emerging assets in dialling back their negative streaks, closing out the year as the third best global equity market performer, with an 80% year on year uptick in dollar terms (+39% in local currency terms). The MSCI Brazil Index also rose 66.6% in value (BRL).

It’s all macro

An improving macro outlook has driven expectations that the Bovespa has bottomed. A broad range of economic indicators point to an upward swing in momentum. Market consensus forecasts expect the economy to grow by around 0.5% in 2017 before expanding 2.2% the following year. However, the positive trajectory also depends on the progress of fiscal reforms.

Inflationary pressure in Brazil moderated through 2016. The expectation is that the Brazil Central Bank continues to accelerate the pace of monetary easing in 2017, potentially positively impacting equity markets.

The Bovespa index is so far up 12% in the year to date (as of 24th February). A big contributor has been the continued strength of the Brazilian Real after already closing out 2016 around 20% stronger against the dollar. Marcelo Mariano from Treviso Forex Brokers expects the forex rate to hover around 3.20 until year-end but that it is “path dependent on potential tail risks materialising, not to mention the pace of Federal Reserve tightening.”

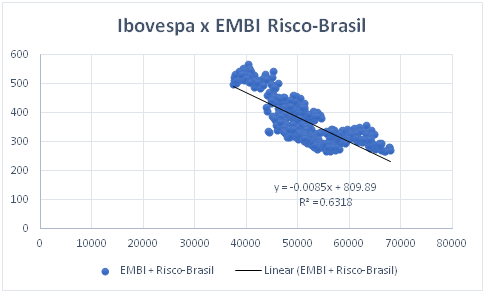

As a result of the improved outlook, country risk, as measured by JPM EMBI, is also seeing downward pressure. The relative bond spread of a basket of emerging market sovereigns is down 47% year-on-year and 14% year-to-date. The graph below suggests a significant relationship between Brazil risk and Bovespa strength (correlation of -0.79, and R2 of 0.68 over the last 24 months). Country risk is at its lowest level since 2015, which positively impacts equity valuations.

Recent IMF research also suggests that in 2017, emerging markets should provide greater growth opportunities than the advanced economies, with 4.6% and 3.4% GDP growth respectively. Moreover, with many leading commentators such as the World Bank and Moody´s forecasting strong gains for industrial commodities such as energy and metals as well as agricultural assets in 2017, this could positively impact Brazilian equities with around 60% of Brazil´s exports and 20% of the Bovespa commodity based. Petrobras (BVMF:PETR4) is up 8.59% year-to-date and Vale Rio Doce (BVMF:VALE5) an incredible 49.89% (as of 21st February). Over the last 12 months, investors have been steadily increasing their positions in Brazilian equity.

The earnings outlook of the Bovespa Index this year rose over the month of January, with estimated earnings for 2017 and 2018 revised upwards (FundSupermart). Most strategists see a year-end target of over 70,000 points, a slight upside of around 5% from its current level (as of 22nd February). The average target for year-end 2017 was 70,000 points.

In this “neutral scenario”, upside could be limited by the long awaited Fed tapering, a strengthening dollar and the prospect of a challenging political milieu for much needed financial and social security reforms.

However, as we can see from the above table, there is a school of thought that expects a much more robust outlook, with a target range of 72-75,000 points (+8%-12%) driven by aggressive interest cuts, a stronger than expected rebound in economic performance and an improved earnings environment (especially as a lot of debt financing is linked to the SELIC rate).

Analysts at UBS calculate that for every 100 base point reduction, the Ibovespa index increases by around 7%. Although they also point out that, much of the economic improvement has already been priced in. JP Morgan maintains a “buy” rating and sees the Ibovespa at almost 75,000 at year-end buoyed by GDP growth of 0.8%, interest rates at 11.25% (by year-end) and an uptick of 15% in corporate profits (double the consensus). Moreover, in a “bullish” scenario they even modelled the index at 84,500 points (+26% as of 24th February).

There is potential upside but investors should be selective on stock picks. A rising tide may therefore not lift all boats. Analysis by Credit Suisse (2016) suggests that “there has historically been a low correlation between monetary loosening and Bovespa performance,” whereby ”country risk and inflation rates are more relevant variables than policy rates”. Nevertheless, they point to a bullish equity scenario, similar to 2005-07, when rate cuts were “accompanied by a drop in country risk and inflation eased below the centre of the Central Bank’s target”. In such a scenario, shopping mall operators, infrastructure (toll roads) and utilities are three of the main sectors that tend to perform well in a falling interest rate environment.

In line with such insight, André Carvalho, Head of Brazilian Equity Research at Bradesco Home Broker expands this sectoral view and suggests that for utilities CTEEP (BVMF:TRPL4), CESP (BVMF:CESP6) and COPEL (BVMF:CPLE6) could be top performers whilst strategists from Banco Votoratin also predict potential upside in energy, retail and mall operators, and infrastructure due to their historic correlation with lower interest rates.

Valuations

In a recent note, Blackrock advise that:

“The macro outlook continues to show encouraging signs in Brazil. A pickup in leading indicators, combined with falling interest rates and a stable currency, all contributes to a brighter picture. Expectations for the delivery on structural reforms, in particular with regard to social security, are further fuelling investor appetite. But already lofty valuations keep us neutral.”

Looking at the Forward P/E of 12.1, Brazil is around two standard deviations above its 18-year average. Compared to fellow BRIC Forward P/Es, only India has a higher valuation metric.

Nevertheless, with a 2018 estimated P/E of 10.9x (Fundsupermart) when compared to its “fair” PE ratio of 11.5x this represents a future discount in pricing. Looking at Shiller’s Cyclically Adjusted Price Earning (CAPE) and the Price/Sales metric, Brazil also looks relatively cheap when compared to the rest of the Americas region.

Moreover, using one of Warren Buffett’s favourite snapshot value metrics – total market cap (TMC) relative to country GDP – the Bovespa, at 43%, is below its average level of 53%, and closer to its historical minimum of 26% than to its maximum of 106%, showing that on this macro measure there is potential room for further upside.

According to analysis from Guru Focus, the index is expected to return 14.9% a year for the coming years based on the contribution of economic growth in local current prices (8.9%), dividend yield (2.78%) and valuation reverse to the TMC/GDP ratio mean (3.25%).

With global stock markets set for modest gains in 2017 according to a Reuters poll, and elevated interest rate risk inherent in fixed income, a diversified play on global markets could add investment value relative to other asset classes. Indeed, after three years of subdued performance, there are once again signs of life for EM equities, including Brazil.

However, there is a broader distribution of possible outcomes. According to Lazard Asset Management, “Despite clear improvements in emerging markets economic data, not all investors are convinced that the structural bear market in emerging markets is over”. Strategists at Morgan Stanley recommend selling U.S. and EM equities for Japanese and European stocks (the opposite view from last year).

A key question to keep on the radar is where are the additional catalysts coming from to sustain last year´s rally? Central to Brazilian valuations, then, will be the fundamental performance path at the micro level and the resilience of the country to global and local shocks at the macro level. We should not expect a V-shaped recovery in either GDP growth or earnings in 2017. Taken against the last few years of continuous negative performance and last year’s extensive uptick, the Bovespa currently appears relatively steady. However, we would do well to remember a Nicola Taleb axiom:

“Never think that lack of variability is stability. Don’t confuse lack of volatility with stability, ever.”

Comments (0)