Something for the Weekend – Resistance to Support

You know when something happens and then later you think of something you wish you’d said at the time? Well, sometimes it happens that you do think of the right thing at the right moment. I was talking with some friends and one of them had seen an article about some contraption that men can wear to breast feed their babies. It’s like a pair of boobs they strap on with milk inside. “And this is commercially available?” I asked. “Oh yes”, they replied. “So I suppose it’s called ‘I can’t believe it’s not mutter’”, I quipped.

It reminded me of the time at school when I’d arrived back from lunch late (I lived very close to the school) wearing cowboy boots and the head of the English department, apparently unconcerned that I was clearly late, chuckled to himself and said “where’s your horse?” “Traded it for a kingdom, sir”, replied the 15-year-old me. Probably my finest hour that. All downhill since, except that was and will be the last time I ever called someone ‘sir’.

So, support and resistance. Breakouts I’ve talked about before being a bit ‘amateur hour’ as a trading strategy in my Breakouts Are for Dummies article from last August. Support and Resistance are easy to see and, for those who don’t have the risk appetite for early entry before the breakout, are useful in order to enter at a good price and safely after the breakout, but not during the main rush when fills are poor and you’ll likely be chasing a price (something you should basically never do).

Let’s think about the psychology of the people in the market as the breakout happens. Obviously we’re moving up through resistance or it wouldn’t be a breakout.

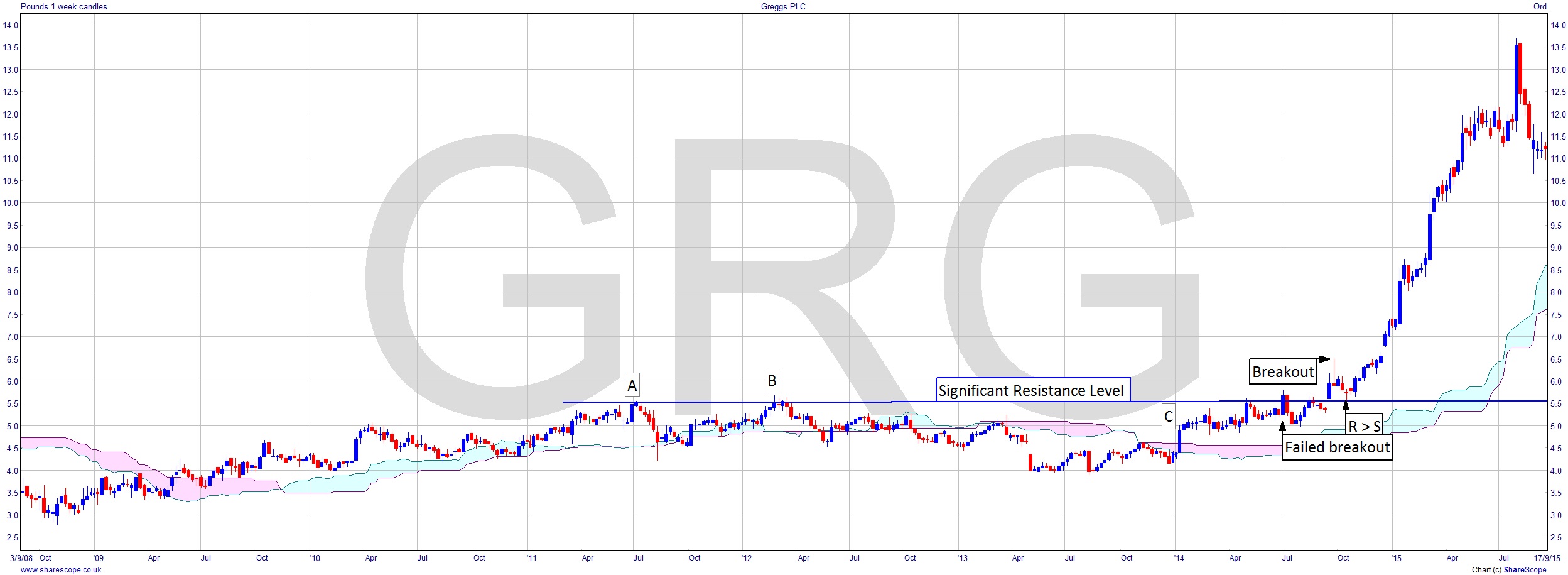

Here’s an example. I’ve used Greggs, but because the psychology of these moves will remain constant it could be an example from yesterday or even 100 years ago. A significant resistance level develops over time. This one started in 2011 (A) and broke up in 2014. It made an attempt to break though in 2012 (B), then again in 2014 (failed breakout), failing just above the level. Finally it breaks upwards in September 2014 (Breakout). An early entry with low risk for me would have been at the beginning of ’14 (C) and to be fair that was probably too early in this case. So for those really risk averse after it gaps up to breakout it’s the pullback (R > S) that offers the late entry well below the high of the initial breakout. It went to 6.50 and you could have been comfortably in a few weeks later at under 6. The price then rallies up offering over 200% in less than a year.

The psychology here is that if people are worried that a price is going to trade off again they will sell when the resistance level is reached. Which is what happened the first few times. The move up at (C) is very bullish as it’s getting back to a level where people will want to hold in the hope that it reaches the 5.5 resistance level again. They might sell there and the failed breakout is there because that’s exactly what some did. Having shaken out these people the price then gaps up, which is probably why people didn’t sell into that breakout. At 6.50 though some are thinking “this is a nice profit and I’m out”. As some start profit-taking the buyers wait to see if they can buy cheaper. Pullback and people who missed the breakout are once again tempted by the chance to buy at 5.50, along with ones who missed getting in in the rush. They do and at the then ATH of 6.50 the price gaps up a little again. This is very bullish too. It encourages people to hold onto the stock and the rally then goes on to 13.50.

So that’s how you trade a breakout on a pullback as resistance becomes support because no one much wishes to sell at that price any longer.

Comments (0)