Something for the Weekend – the 8th Wonder of the World

The other day a friend of mine posted on Facebook how it would have been her grandmother’s 96th birthday. Of course what she meant was not anything to do with age, but how she missed her grandmother. It got me thinking about how I must have a male ancestor from 1066 and it would inevitably have been his birthday this year too, and he’d have been something like 996 years old, and how utterly irrelevant that is. Each of us has/had, even if we never met them, two male grandparents, four male great grandparents and so on. 1066 is roughly 32 generations ago, which means I would have quite a few male ancestors. To be precise, 536,870,912. So around half a billion. In 1066 there were an estimated 285 million people around. Given there weren’t enough men and women alive to be all my male ancestors, some of them must have been job sharing and occupying more than one branch of my family tree. We are all descended from cuckoos perhaps (discuss).

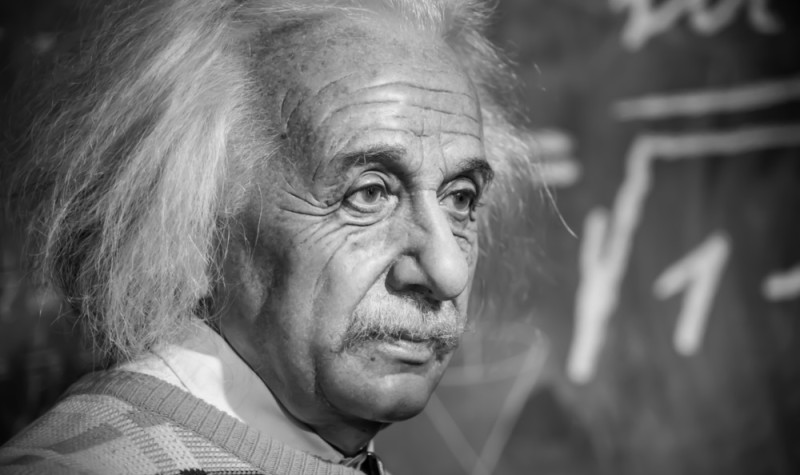

Einstein considered this phenomenon to be something quite profound. “Compound interest is the eighth wonder of the world. He who understands it, earns it… He who doesn’t… pays it”, he said. It’s so true. It’s the reason it’s far harder to make back money lost on investments.

With interest rates as low as they are, this contrast is more stark than ever. It underpins the problems facing companies that have leveraged during recent years. It explains why annuities are not worth buying at the moment. Einstein basically describes the carry trade in that one sentence. It shows why a small edge is all we need to make trading successful and worthwhile, both in the odds of success of our trades, but also in terms of the costs of trading and good trade management. It’s why letting profits run and cutting losses works.

I can’t emphasise enough how important it is to keep a lid on costs. Knowing exactly what the costs are is the first step. They used to say there’s no such thing as a poor farmer, but there’s certainly no such thing as a poor spread betting CEO. Know what they’re charging to hold positions overnight: it’s not free and almost no one can tell you what they’re paying. Know what your exposure is. To calculate it simply multiply the stake by the price. For example, if you have a £10/point spread bet on the Dow, presently at 17579, then your total exposure is £175,790. Practically speaking it’s less than that as the market isn’t going to zero – but remember that markets have fallen 10% in a day more than once. Certain catastrophes could result in your not being able to get out in time (for example, over a weekend), and without a stop loss (and sometimes even with one) you’d be liable. Investing on the stock market may look more and more like playing a fruit machine, but there are more risks involved than simply losing your stake. Your obligations may exceed that.

Your trades involve your money. No one else is contributing. Lots of people want a piece of the action along the way. It all comes out of your money.

For some additional reading on Einstein, check out Hawkwind’s song ‘Quark Strangeness and Charm’ from the late ‘70s, easily found on YouTube. It’s a pop song about Einstein, science and relativity. Robert Calvert’s excellent lyrics include one of my favourite lines in a song: “but all that doesn’t not anti-matter now”.

Don’t not have a really good weekend.

Comments (0)