Small Stocks: Big Yellow and Walker Crips

Trading is all about probability. If we want a good chance of succeeding then we need to take opportunities that offer as many elements as possible to help us succeed. This is why I tend to trade indices in preference to companies, and big companies in preference to small companies. Liquidity is our friend for the most part. It means we can enter and exit trades quickly, and get filled at the right price, which in turn reduces risk. High volume markets, i.e. indices, are harder to manipulate for any length of time, and if we’re using technicals to trade them we’re not really interested in anything more than price, spread and entry and exit signals.

Of course we can’t trade in a vacuum, so if we know there is any real world information that might affect our trades then we need to factor that in. Anything that will create, or resolve, uncertainty.

So I trade small and particularly AIM stocks quite rarely. But that doesn’t mean they’re not worth trading, particularly if you have some specialist knowledge. I don’t mean illegal insider information: I mean professional knowledge, or that which can be observed by anyone, but which most people might miss or not look for. I call that ‘outsider’ information. And that can include your TA skills in reading a chart, or predicting market trends, for example.

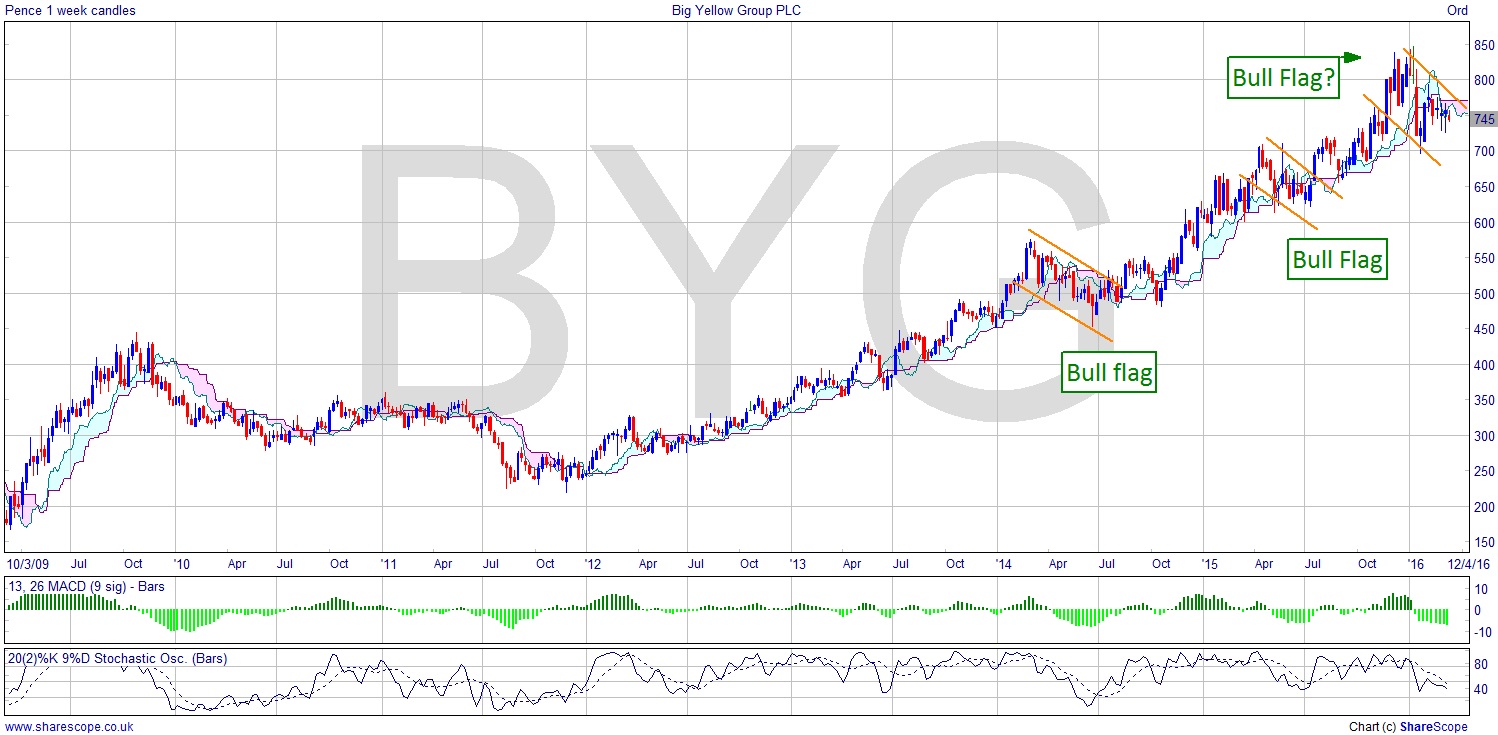

I saw a piece about Big Yellow plc (BYG) the other day on TV. I can see why storage companies might do well in the US. They have more disposable income than us, more space and lots more stuff. But it seems that there is a market here too. I would suggest that Big Yellow is really a property investment company with a business tacked on for cash flow. Either way it’s been something of a stellar performer. We saw a large Bull Flag pattern back in 2014. You can identify more Bull Flags of varying sizes in the price history. The question is are we seeing one now? All a Bull Flag does is make a little pull back producing a pronounced higher low. It’s not rocket science. Rocket science is. If it plays out then the price will again be above the cloud and looking pretty bullish indeed. Definitely a watcher.

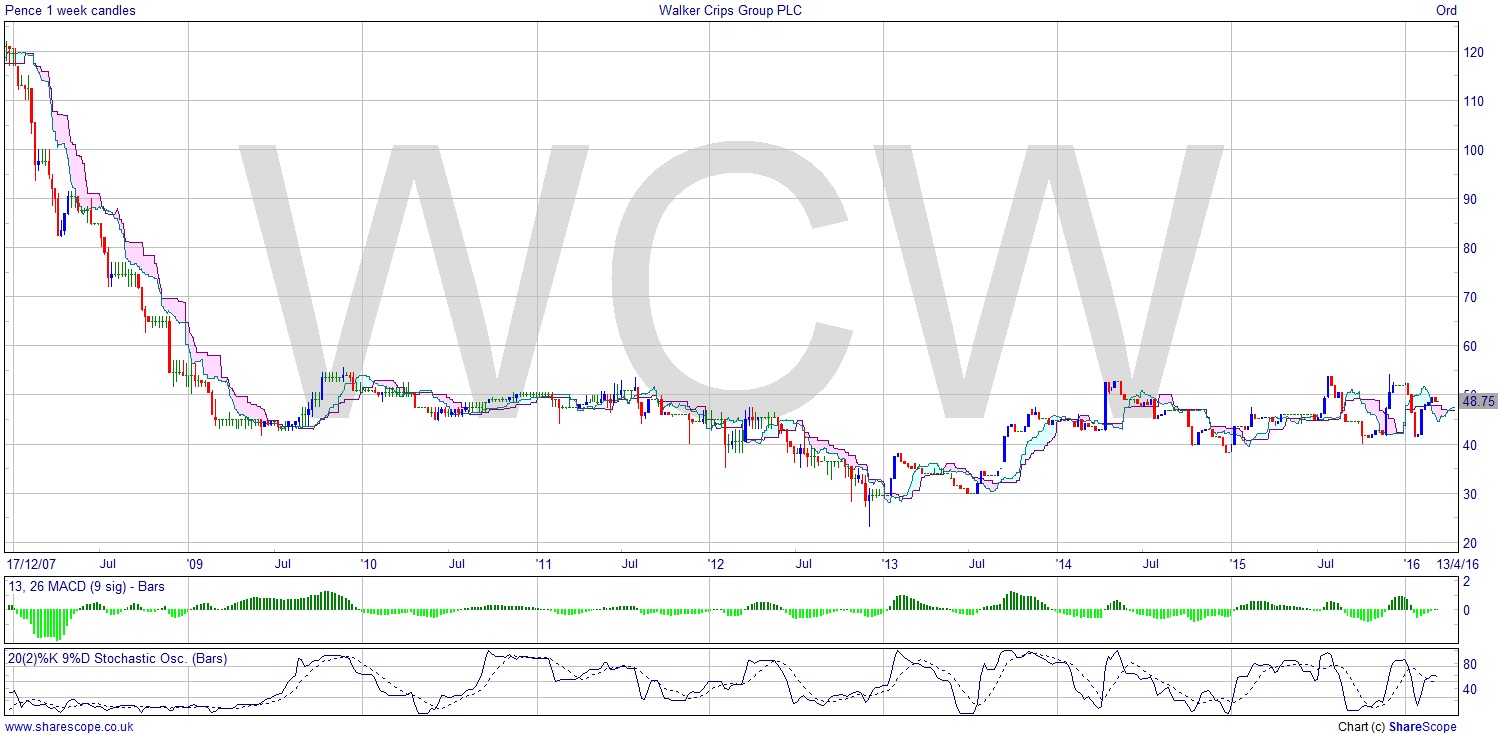

I thought this next company was the Walkers Crisps people. Not least as Crips is what we used to call crisps at school and I thought it was a typo! Oh well. It seems they’re in finance services. But of course with our chartist hats on we don’t care that much.

Here’s an interesting one: Walker Crips Group plc (WCW). It’s a rather messy chart but the key thing here is that we’ve got a H+S. Well an upside-down one, where my suggestion of cock and balls as the description doesn’t seem to have caught on at all. So a C+B. A drawn out left ‘shoulder’ from ’09 to ’11 and then the ‘head’ at the end of ’12 and a developing right ‘shoulder’ as I write. A break upwards from here could signal an impressive rally. There’s an awful lot of upside. Probably a slow burner though unless you can get the timing just right.

Comments (0)