Sleeping Satellites: Eastern European ETFs

When the Soviet Union broke up Ukraine did a deal with Russia, France, the UK and USA, embodied in the Budapest Memorandum of 1994. It gave up its nuclear arsenal in return for assurances from those nations that its borders would be respected. In an address I attended last year, Lord Robertson, former Labour Defence Secretary, said in respect of the Commons voting against attacking Syria in 2013: “It is my strong opinion that it was this demonstration of feebleness which led directly to President Putin acting with such boldness, first in Crimea and then in Eastern Ukraine.”

The EU actively courted the former Soviet Satellites, the Eastern Bloc, presumably to distance them from Moscow. I would be surprised if the governments of the former Eastern Bloc haven’t been meeting to discuss how little promises from the West mean today. Even Poland, for whom the UK went to war with Hitler, might be a little queasy.

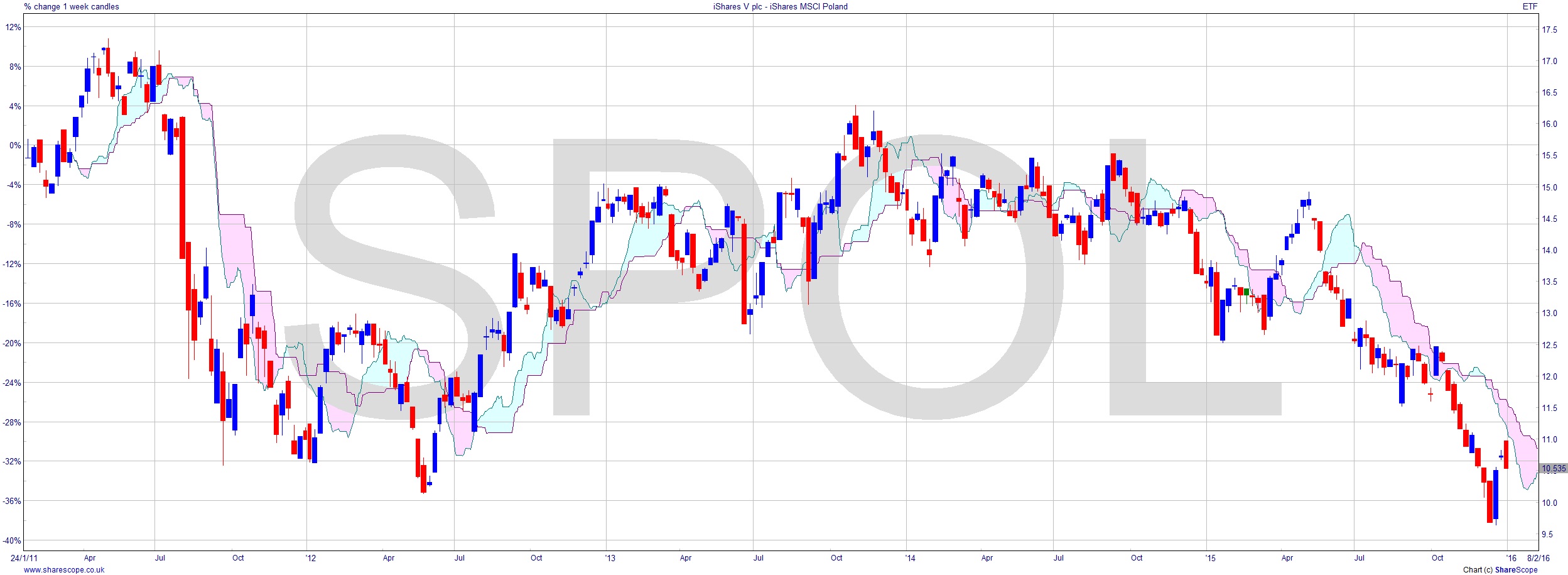

These countries should be doing very well right now, with low commodity costs and money coming back from ex-pats working in richer EU and other countries. But it’s not that easy for us to invest in most of these countries. Poland seems to be the only one with a dedicated ETF. And it doesn’t look too great. As we head into 2016, the iShares MSCI Poland ETF [SPOL] is lower than at any point since it started in 2010.

Most of the world has been strategically buying and deploying ordnance. According to Defence Minister Tomasz Szatkowski, Poland is even considering asking NATO for permission to get some nukes to counter the perceived threat from Russia. And given how lily-livered we’ve been about Crimea, is it any surprise? Something that rarely gets mentioned is the justification (or lack thereof) for Russia’s sabre rattling in the Caucuses a few years back, and more recently in the Black Sea. The answer: a show of strength to ward off Chinese attack in the East. Specifically, Irkutsk where Lake Baikal holds 20% of the world’s drinking water, a commodity of which China is desperately short. My prediction, made back in 2007, is that China will battle Russia in the East, and likely win due to sheer force of numbers, making them Palin’s new neighbour.

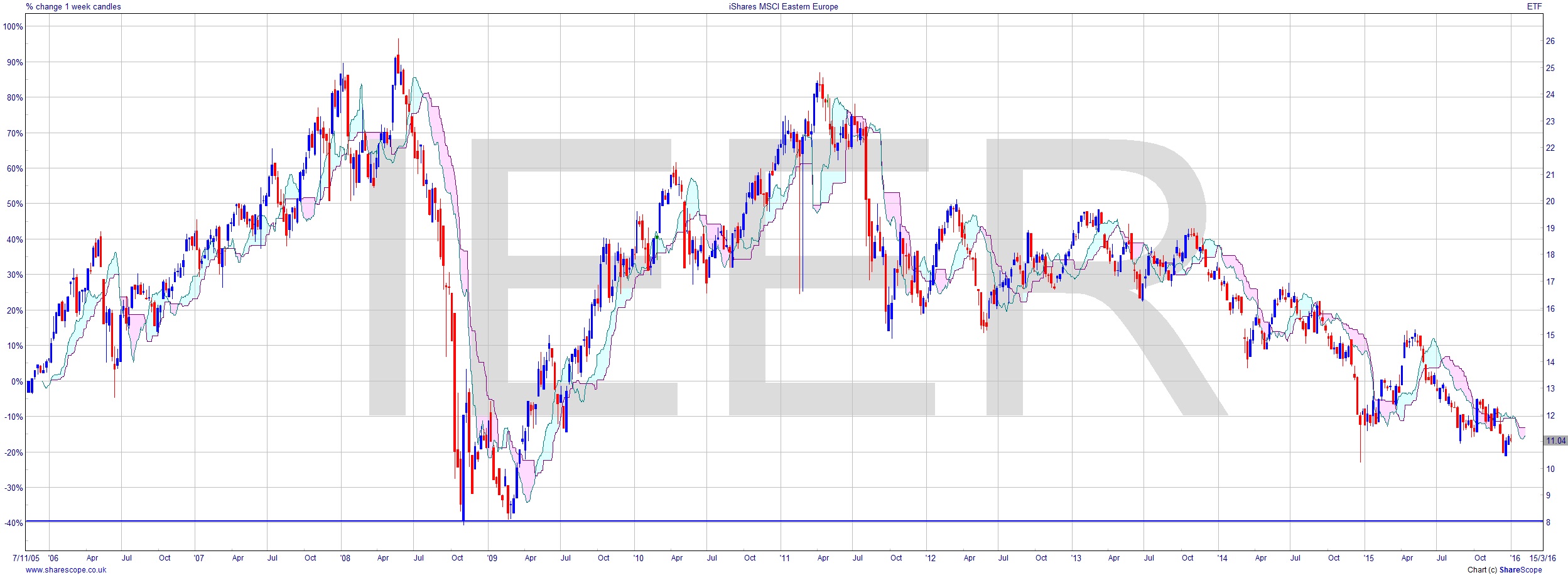

Further south from Poland, countries from the Czech Republic – whose president says the migrants are able bodied men who should stay home and fight ISIS – down to Macedonia, have been harshly critical of the EU’s handling of migrants. They may start to see Russia as a stronger ally against what they perceive as an ‘invasion’. There is an iShares MSCI Eastern Europe ETF [IEER]. It doesn’t make much better reading than the Polish one. There is significant support around £8 on this one, presently around £11. It’s firmly in a downward trend though, and has been for five years now. Not quite the debacle that is the PIGS countries but not too good either. A lot of older people will be thinking “it was better under the Soviets. At least we could afford to go to the opera.”

Back to Poland though, it is no surprise that the newly elected government there is overtly Euroskeptic and certainly right of centre. It’s likely all European elections will see a swing to the right at the next opportunity. The only reason Le Pen didn’t clean up in the local elections in France was that some candidates stood down to give their votes to another anti-Pen candidate.

Comments (0)