Serica Energy: Break of 25p should lead to 35p

It would appear that the newsflow for star small-cap resources prospect Serica Enegy (LON:SQZ) has been rather thin, apart of course from the recent contribution from Donegal Now.

My fundamental excitement as far as Serica Energy shares are concerned stems from the fact that they are trading on a price/earnings ratio of just 5, and an earnings growth rate of 37%. These ratios are not to be sniffed at, and neither is the cash position, last quoted at $13m in September last year.

However, without naming names, the most exciting aspect is the backing from a few canny investors I know who like the company. While this may not guarantee a smooth ride higher for the stock, it should be enough to allow us to look on the bright side of the daily chart.

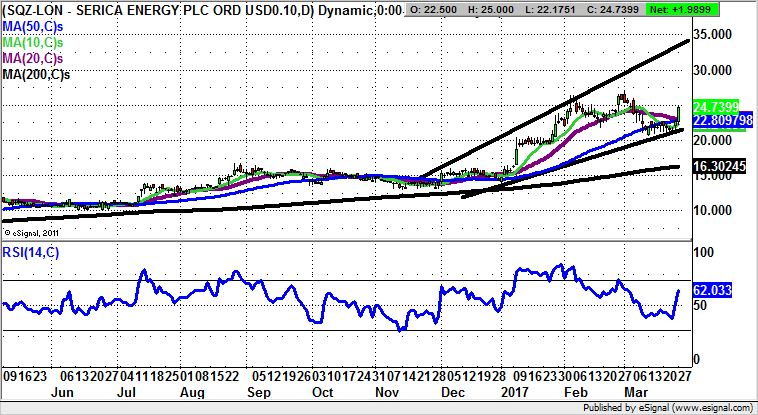

What can be seen here is the way it is possible to draw in a rising trend channel from as long ago as November. Helping the chartists is the so-called “rocket launcher” gap higher at the beginning of this year. These are usually very reliable indicators.

However, in this case we have seen decent progress so far this year. The message at the moment is that with as little as a weekly close above the latest resistance at 25p we should be treated to a top of November price channel target as high as 35p over the following 1-2 months.

Comments (0)