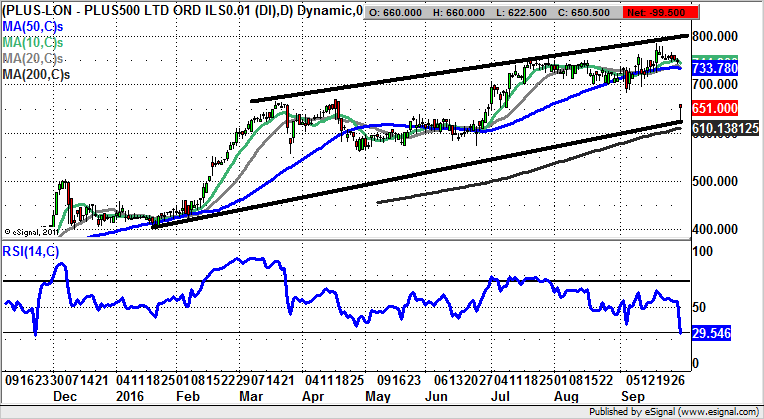

Plus500 finds support at 610p and targets 733p

It is normally the case that director buying or selling is significant as a signal of confidence or woe. We are reminded of this in the aftermath of the latest selling at Plus500.

Plus500 (PLUS): Support above 200 day moving average

There are a couple of major points of interest regarding the recent history of Plus500, the online trading platform provider. The first point to note is that this has been a very active situation where the company’s issues with the regulator have been in contrast to the backdrop of a high growth market segment. This means there have been sharp swings in the share price, which underpins the idea that this is not a company for widows or orphans. The other aspect which is in play here is the significance of director share selling/buying. Normally, this is regarded as being “smart money” or even “insider” knowledge driving the fundamentals. However, it may be that sometimes those in the know actually know too much and do not have the correct judgement. This idea is backed up by the way that support has been found above the present position of the 200 day moving average at 610p, although shares of Plus500 have plunged in the wake of news of founders selling out. The implication from a technical perspective is that at least while there is no end-of-week close back below this feature, brave traders may be looking to bottom fish the shares and target at least an intermediate bounce back towards the 50 day moving average zone at 733p over the next month.

Comments (0)