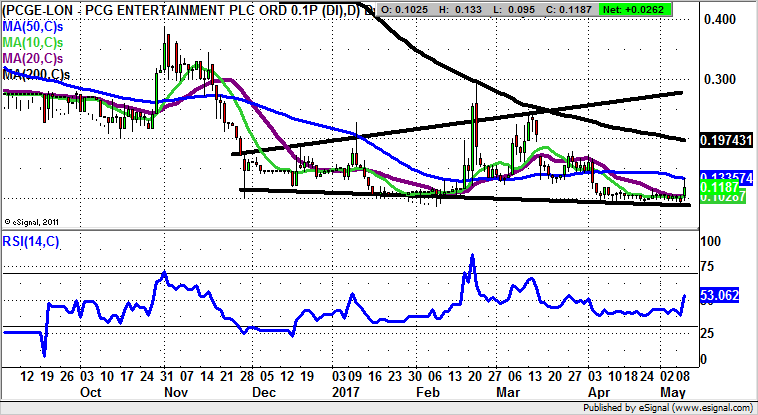

PCG Entertainment: Possible triangle formation recovery

PCG Entertainment (LON:PCGE) is a company which I have had on the passive “watchlist” for quite some time. It would appear that at the very least, there are some signs of the stock bumping along the bottom.

It may just be me, but there would appear to be quite a few triangle formation recovery plays around. Clearly the easiest thing normally is to wait until the stock in question has made some progress within the triangle – especially above the 50 day moving average, before getting too excited. However, in the case of PCG Entertainment we are tempted to bottom fish this situation technically given the way that 0.10p zone looks to have been held well since the end of November. This, combined with the massive volume spike today, does suggest that there may be an opportunity to bottom fish.

Of course, the newsflow of late has been challenging to say the least, with the axing of the CEO’s contract a standout in this respect. But it has not all been negative in the sense that this year to date we have also been treated to a stock overhang clearance, a funding boost and the possibility of a joint venture. But at least from the charting perspective, what we are looking for is a clearance of the 50 day moving average at 0.13p to deliver a 3-6 months target at the February resistance towards 0.30p.

Comments (0)