Patagonia Gold: Technical target points towards 5p

We have seen an interesting divergence between the initial strength of gold in the wake of the Trump victory, and the mark-up maintained by many of the leading gold proxies like Patagonia Gold (LON:PGD).

It would appear that there has been an embarrassment of riches in terms of the recent news flow served up by the South America focused miner. For instance, on October 31 the first gold appeared at Cap Oeste in Argentina. As if this was not enough, the start of this week witnessed the start of drilling at the Chamizo prospect in Uruguay. Given the way that the history of most small cap mining stocks is dominated by the search for funding as well as the vagaries of actually trying to find anything under the ground, the present position for Patagonia Gold can very much be regarded as a fundamental sweet spot having been hit.

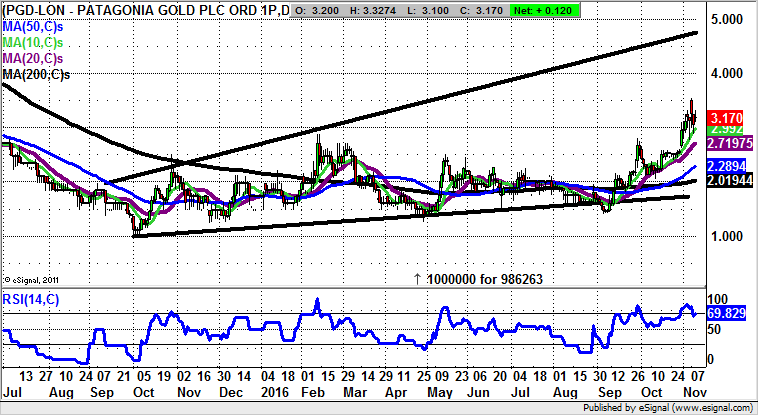

Looking at the technicals on the daily chart it can be seen how there has been an extended base since this time last year towards 1p. The big breakthrough in the recent past was the golden cross buy signal between the 50 day and 200 day moving averages last month, followed by an as yet unfilled gap to the upside. All of this suggests that while there is no weekly close back below the 20 day moving average now at 2.71p the upside here could be as great as the 2015 resistance line projection at 5p. The timeframe is as soon as the next 1-2 months.

Comments (0)