Oil at $35

There are lots of platitudes in trading, just as there are in every field of human endeavour. One or two are useful, and probably absolute in practical terms. For example, “no price is too low to fall, or too high to rise”. That’s a useful piece of information. But many of them are just complete and utter rubbish. The one I’m thinking of is “trying to guess a bottom is like catching a falling knife”. No it isn’t. There are often very clear signs about when bottoms are likely and these sorts of investors’ old wives’ tales are unhelpful at best. They discourage people from market participation almost in a superstitious way. There be dragons.

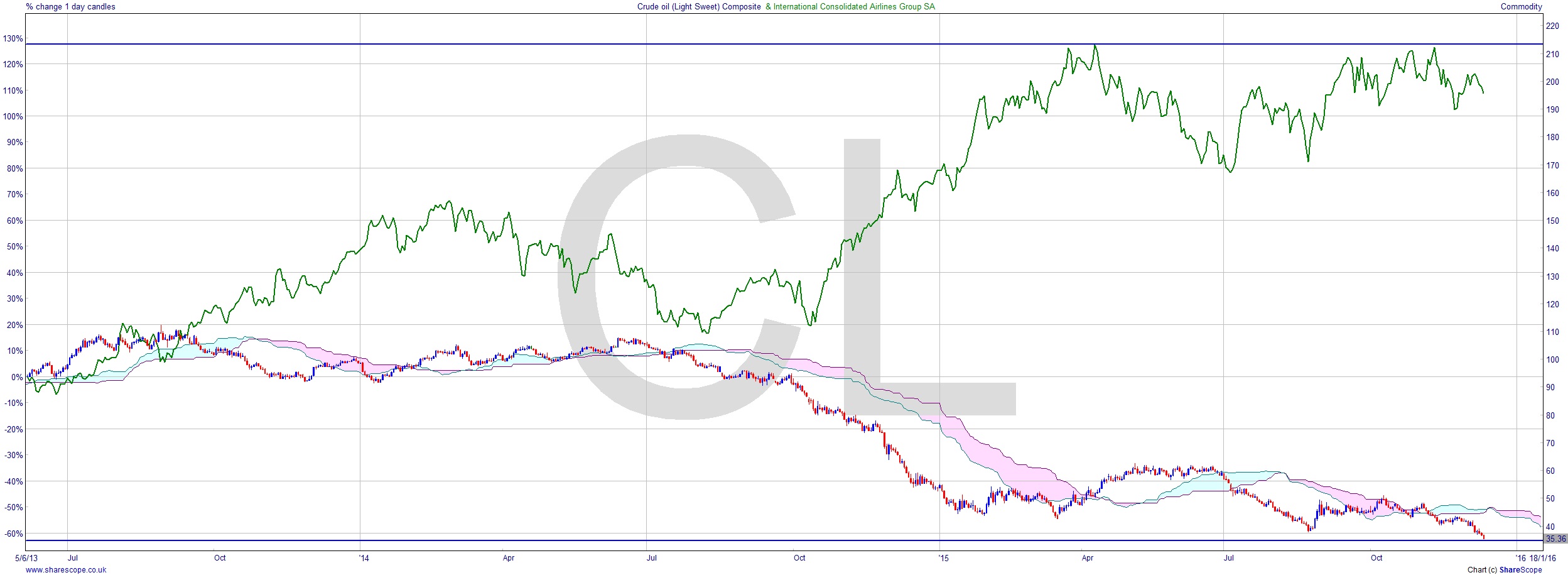

Yesterday, oil hit $35. West Texas Intermediate (NYMEX:CL), that is. It’s a price that relates to an old low from 2009. I guess that gives it a little relevance. Probably not as much as you might think though. It’s not a stock. No one is still holding some oil they bought in 2009, or might feel that they’ve been waiting seven years for $35 and now they might buy some. The really significant lows before that are in the last century, as are some of the ATHs in UK stocks. How relevant even those ATHs are is debatable. But we can’t really expect a price from 1998, or even the early noughties, to have any impact in terms of Support and Resistance today.

So what do we have? We can’t expect a measured move based on the congestion around $50 as that would put the extent of this downward leg of the move to just below zero. I expect either we’ll see an over-shoot to at least $30 or a rally to at least $40, with a poor third place to ‘going sideways’. If you can find the right options, and are happy with the entry signal, then a straddle isn’t a bad way to go. In other words we’re saying it’s more likely WTI will go at least $5 up or down than stay around $35. There are also fixed odds bets for this sort of thing.

I’d be more inclined to look at the knock-on effect. Businesses that rely on oil as a major input are having a bonanza. Airlines, for example. In the short-term they hedge against oil prices. At these prices even if oil halves it won’t have anything like so much of an impact on their business as the last $70-80 off the price has.

I’ve shown the de facto British Airways (IAG) against WTI and it’s certainly meeting resistance. We can also see that oil prices aren’t the only influence on IAG’s price, but a fall such as we’ve seen this year is bound to play into their hands, and is clearly reflected.

We’re looking at two really big elephants in the room now: oil prices bouncing back, and interest rates rising. This double whammy is going to bring down some big companies over the next couple of years. Perhaps even countries.

This current cycle of economic growth has been largely based on printing more money and low interest rates being funnelled into asset bubbles. There is no real demand, otherwise we would have seen consumer spending going through the roof. The good news is it does mean we’re getting very good value on our military operations overseas with these low oil prices, which is sort of ironic.

Comments (0)