Low Cost Airlines: RyanAir versus EasyJet

My cousin works for EasyJet, and although he’s been in love with airlines since he was a kid, I don’t think that’s really the dream job. He wanted to be a pilot, but that didn’t work out and he went through various high end airlines which led to fate conspiring for him to end up working on a low cost airline. The thing that shocked me is that the cabin crew on low-cost airlines actually clean the aircraft during turnaround. This is how they keep the costs down, and it also makes them able to do the quick turnaround which is the low cost business model. So from aspirations of being a pilot, essentially he’s now an international executive cleaner.

Meanwhile, over at Ryanair plc (RYA), they are bullish about the future. It’s not a big surprise. Ryanair expect to be carrying 180m passengers per year within ten years. They currently carry around 105m. After profits announced this week at the high end of expectations they… oh no, I was going to say ‘are flying high’, but that’s crap journalism, so I won’t. They are riding the crest of the wave (phew!).

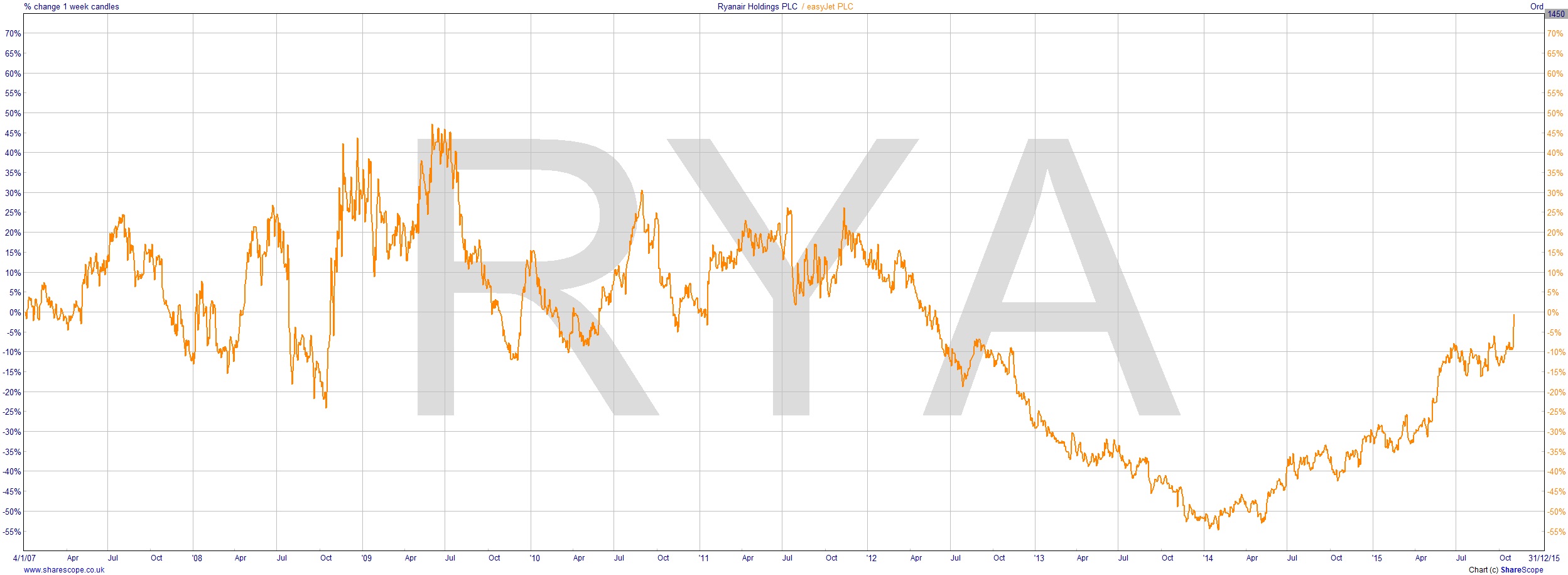

What’s not to like about their chart? Well, nothing if you’re already holding the stock. If not it’s a bit more complicated. A golden rule of the markets is that nothing is ever too cheap, or ever too expensive. I’d be looking for a signal to be getting in here but it’s clear that their business model really suits the economic climate just now, and I can’t see that changing. Even if we do see interest rate rises, and people have less disposable, that only plays into their hands. Same goes for cruise companies, incidentally. They offer value, and one of the last things people will give up is the chance to get away from it all. For Brits it’s therapy. Our chance to go somewhere and stay in denial for a week or two when things could be better, ergo, pretty much always. And of course in this case denial might well be a river in Africa, as EasyJet do fly to Egypt! [Not any more they don’t. Ed.]

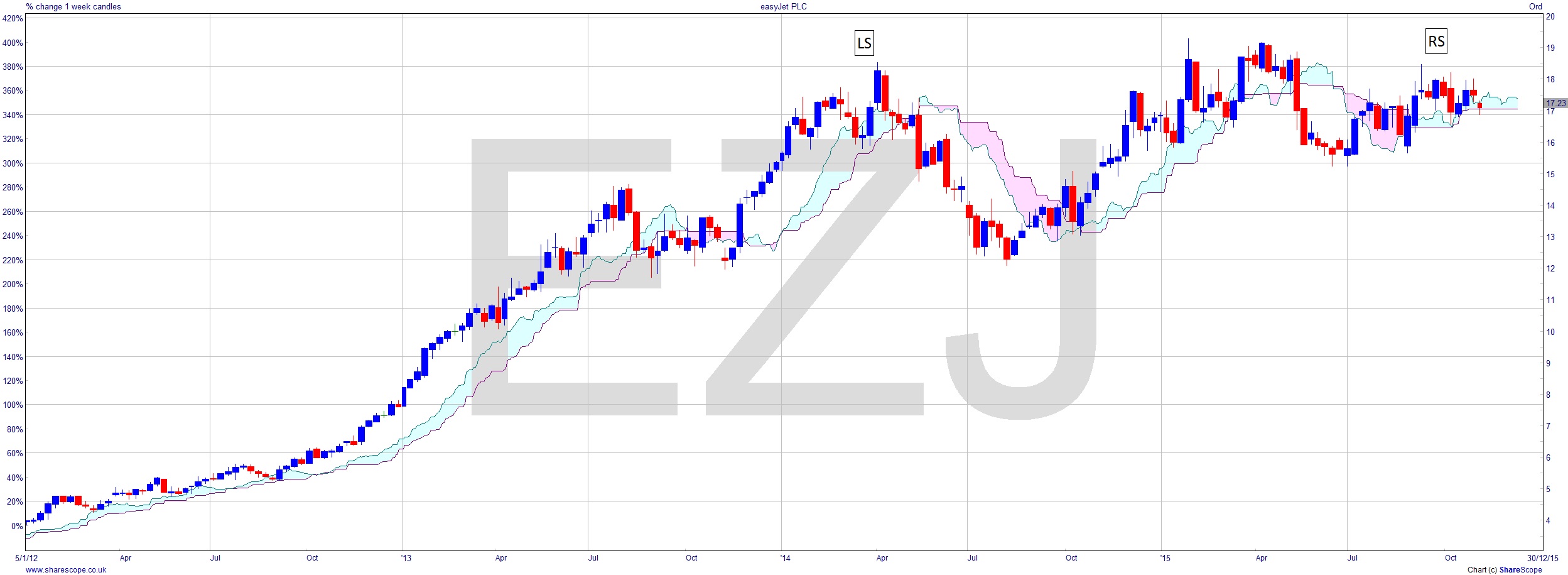

And so onto EasyJet (EZJ). By comparison, the chart has a shallow head and shoulders forming. Following the stellar performance around 2013, when it went from £4 to over £18, they’ve been going sideways. And now a sign of some weakness.

It could be an interesting trade to hedge the one against the other. Ryanair has certainly been outperforming EasyJet since the beginning of last year and has now reached the typical sort of relative price that persisted throughout the years before and after the credit crisis. If you’re short EZJ and long RYA this is your price chart: Ryanair relative to EasyJet.

For those that prefer the old school buy and hold stance, low cost airlines are secular in my view – they can perform irrespective of economic conditions. ‘Secular’ is now the word for the opposite of cyclical. I don’t think they are generally classified as secular, but they are.

Finally, to misquote the old showbiz joke: low-cost airlines started at the bottom and they like it there! You might too.

Comments (0)