Kodal Minerals: Gap higher towards 0.35p

One of the perennial issues facing small caps is to effectively garner the positive attention of private investors. As far as Kodal Minerals (LON:KOD) has been concerned, this looks like it is finally coming to pass.

One of the problems that many private investors can have is seeing the wood for the trees in terms of the small caps area in general, and mining minnows in particular. Given that historically this space has not exactly distinguished itself, it requires a great deal of due diligence for a private investor to get on the correct side of this particular speculative curve.

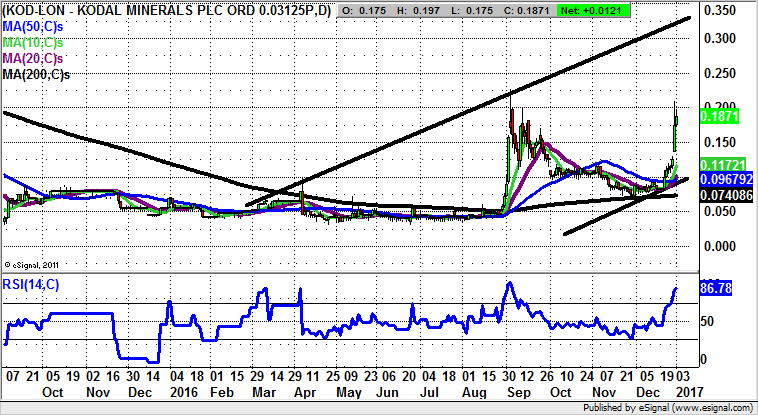

Part of how this can work is provided by the positive example of Kodal Minerals. Here the latest spurt of bullishness in the wake of positive drilling test results comes off the back of an extended basing in the shares on the daily chart for the best part of a year and a half.

The key breakthrough from a technical perspective was last August’s vertical spike through the 200 day moving average, now at 0.07p. Interestingly enough, since the break the shares have remained wholly above this positive trend feature, albeit after a period of consolidation from August to the end of last year.

The view now is that provided there is no weekly close back below the latest swing low at 0.15p, we should be treated to a journey towards the top of last March’s trend channel at 0.35p on a 1-2 months timeframe.

Comments (0)