I Didn’t Read The News Today, Oh Boy!

Lots of people trade news. In fact many companies, the ones that make money from the number of trades you place, encourage you to. And why shouldn’t they? It can be demonstrated that there is enough volatility at such times to make money. What is not illustrated is how unpredictable news can make markets, nor how unsuccessful most people are at capitalising on it.

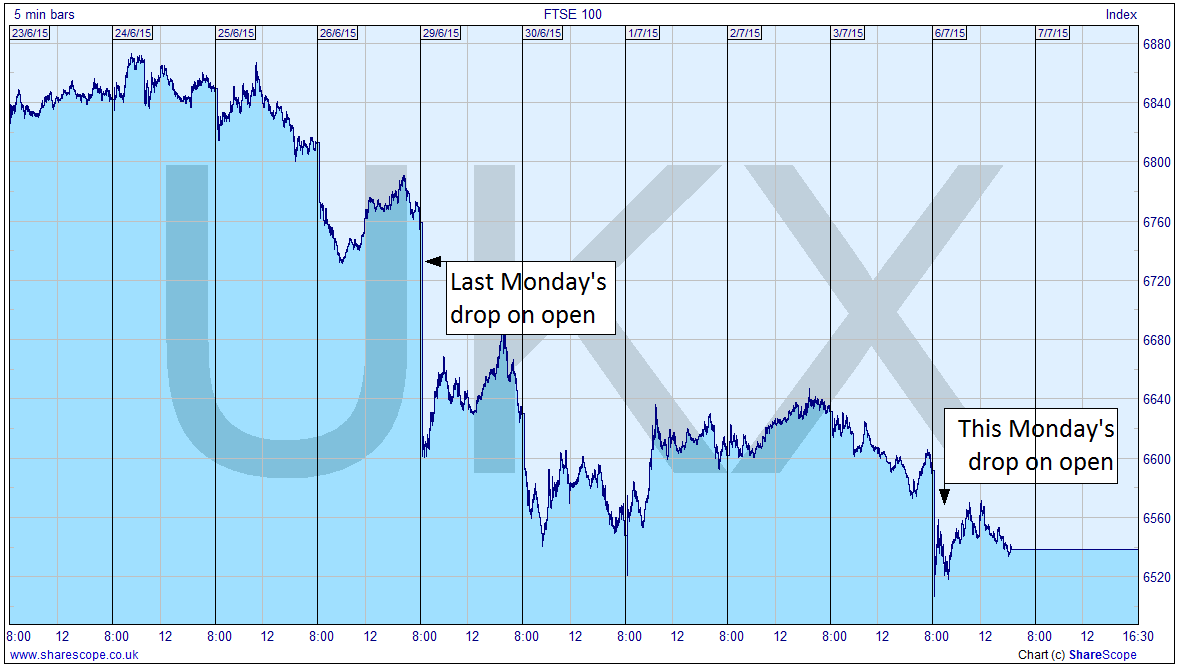

Take today. Greece voted ‘no’ in their referendum on how (not if) they want their lives to be difficult in the future. Spurred on by selling advertising space, filling columns and such like, the whole developed world seems to have been media-led in discussing Greece, and what may or may not happen. Did the markets move all over the place this morning when they open? Not really. The FTSE dropped more last Monday than this morning. This week the FTSE 100 moves in the same direction it’s been moving down: down (see intraday chart). Same with the DAX, and that’s much more exposed to Greek vagaries than the UK markets. Incidentally, there may be value in bond trading, but only if you really know what you are doing, and get it right. Not for the uninitiated.

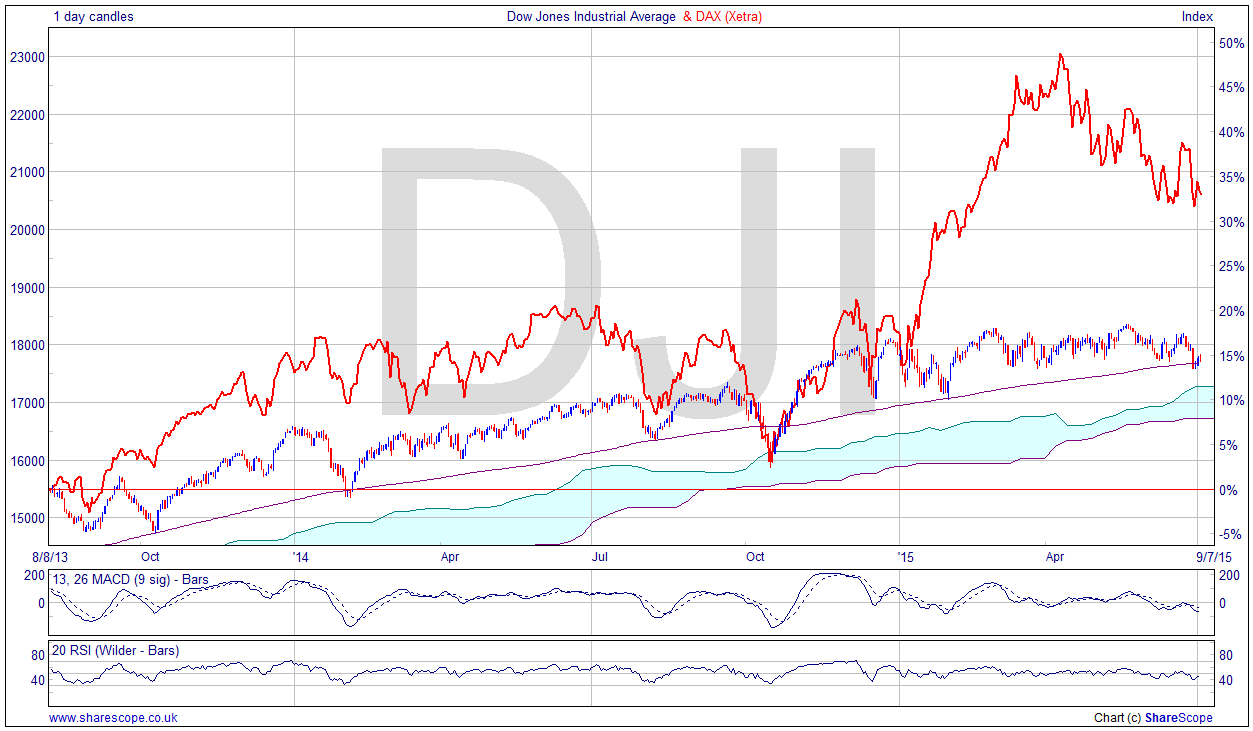

As I wrote last week, Greece is not a big deal except to Greeks. What I shall be watching is the Dow:DAX chart for a recalibration between them. Presently, the DAX is normalising having outperformed the Dow quite significantly this year, as you can see on the chart.

Just a final word on boring, boring, boring, largely irrelevant Greece: What happens now? If they do leave the Euro, or simply create a de facto currency through fiscal means, then it will be like a mate of yours who has been made bankrupt after years of irresponsible behaviour financially asking you to accept an IOU. Good luck with that. They are living in a dream world if they think they’ve really ended ‘austerity’. It’s just deepened. I imagine the middle class Greeks will have to pay the price as the middle classes always do. Well that’s if there are any left in Greece. The only way Greece gets interesting for now is if ISIS stump up on the beach…

Other news is worth avoiding in my view too. Really anything that attracts public participation. The public are your worst enemy in terms of timing trades, but they are also the people you generally make your money from when you get it right. After all 95% of them lose. And that’s how it is. There is no way to make money in the markets without taking it off someone else. But news isn’t the way to do it.

Take Non-farm Payrolls. The investment banks are all lining up with enough cash to influence the markets in the relevant time-frame. The starting gun is about to go off. They have a saying: “the first move is the wrong move”, so they’ll be looking for a reversal when all the bozos are already in. They often get the data before you do, and they have high speed automated trading algorithms that can act way faster than you. And don’t tell me you’ve got high speed automated algo-trading through your retail broker, or some so-called trading training guru’s black box. You haven’t. Economic and company figures are often revised shortly after release. Candy from a baby- you’re being played.

If you want to trade news then I suggest a slightly more sophisticated approach involving some sort of option, or fixed odds bet, straddle or a pair of binary bets. Frankly, it’s rarely worth the effort in my experience. Something to ponce around with in your gap year from Uni. You can find trends intra-day, so why do looking for volatility that is, to you, no different than trying to run across the M25 in slippers.

Comments (0)