House of (Credit) Cards

I’ve said before that the only reason we’ve appeared not to have a recession in London and the South is because foreign money has parked itself here as a safe haven. I mentioned property in particular before, but in case you didn’t know more than half the stocks listed here in London are owned overseas. Many markets are now becoming so obscure and disconnected from what drives them that it is harder and harder to analyse them. No wonder economists don’t have a clue what’s going on! New markets appear almost like quantum events, and that’s ignoring black markets and shadow markets (which economists usually do).

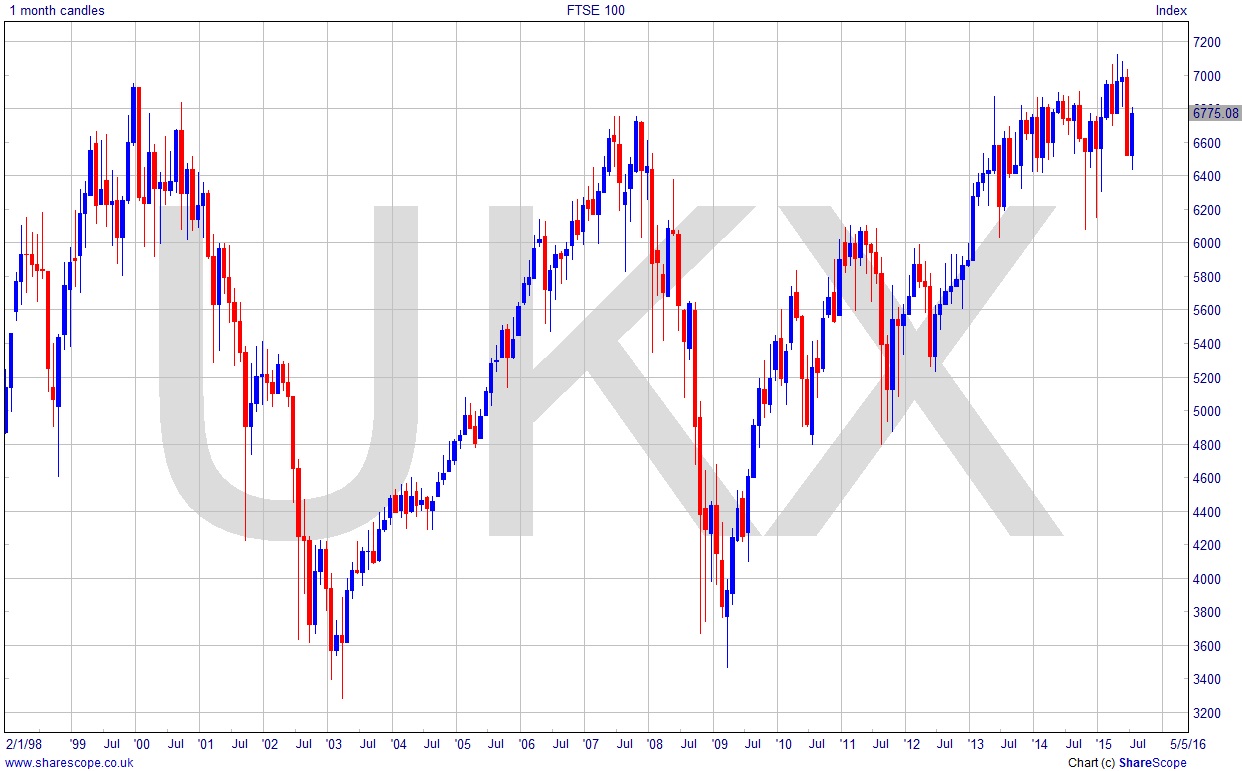

So if it weren’t for the failure of the Eurozone in the PIGS countries, and general devaluation of the Euro, then it’s doubtful all this money would have been driven into the UK at all. I’ve shown here what the FTSE 100 would look like adjusted for foreign investment, which has gone from around 30% in ’98 to over 50% by the end of 2012 – with half of that change taking place between 2010 and 2012, incidentally. As you can see, it’s quite weak and generally unremarkable. It looks more like a stock that is capital heavy and probably past its best-before date! I’ve based the chart on figures from the NSO’s Statistical bulletin: Ownership of UK Quoted Shares (2010/2012) and extrapolated conservatively.

I’m expecting a lot of the foreign money to spill right back out again the moment we see an end, or the perception of an end, to the Eurozone crisis. And that may not be far off. Just using basic Dow Theory the cracks are easy to see. There are lower highs on this adjusted chart, and I’m expecting foreign money to drift out and leave the FTSE in bear mode within the next 6-9 months. Our main index is incredibly weak. Not quite the picture painted by the still unremarkable FTSE 100 chart that shows a new ATH in recent months. The adjusted chart shows even the last domestic ATH was around the turn of the century. Good job I haven’t allowed for inflation then, eh?

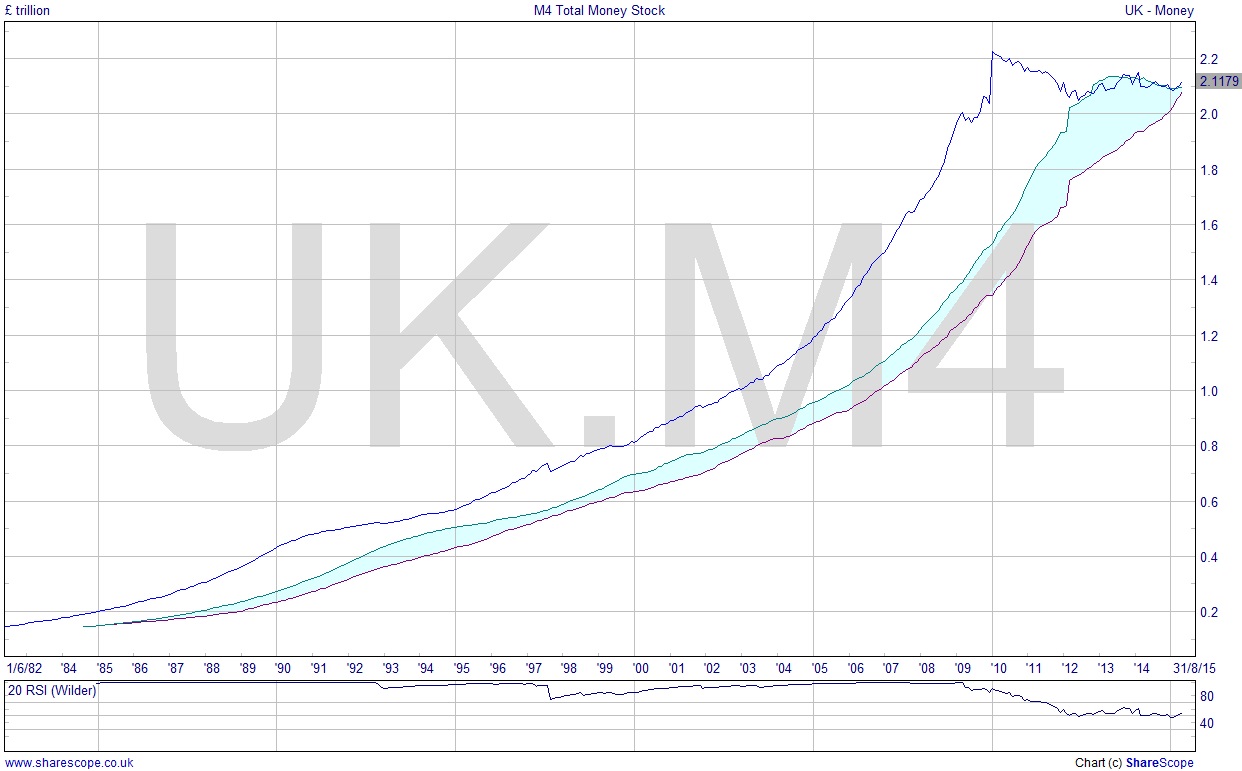

If this is a genuine reflection of the UK economy, and I think it is, then the M4 broad money supply chart supports the narrative. Here we can see a collapse in the creation of value. Is it any wonder that when you chastise banks and tell them to strengthen their balance sheets, they do so before lending the QE money? Not rocket science I would have thought. I’ve put the Ichimoku cloud on the M4 chart. There is a fair chance it will fall through it as it thins and rises to the price action. If it does fall below it then we are looking at some very hard times ahead.

So, are we going to see a fall in the stock market? Well it has nothing to do with domestic UK demand or the economy here (because there barely is one). The FTSE is dependent on the willingness of foreign investors not to pull out. It’s probably already started though, and the next NSO Statistical Bulletin on the subject may take quite some time to come out. Tread carefully. And if you’re worried about your pension (and yes you definitely should be) then I’ll suggest the only place that’s a must if you want any hope for the future in my Final Word column in next month’s Master Investor Magazine.

Comments (0)